- VIRTUAL price surged by over 23,000% in 2024, becoming the best-performing altcoin in the crypto industry

- VIRTUAL’s price rally was driven by the rising hype surrounding artificial intelligence (AI) agents

- While VIRTUAL has potential catalysts in 2025, it also faces risks such as mean reversion, the Wyckoff Method pattern, and potential slowdown in the AI industry hype

In the whirlwind of 2024, the cryptocurrency market witnessed a significant surge in VIRTUAL price, a leading AI-based cryptocurrency. However, the dawn of 2025 comes with an array of potential risks that may challenge its progressive trajectory.

A Year of Success for VIRTUAL

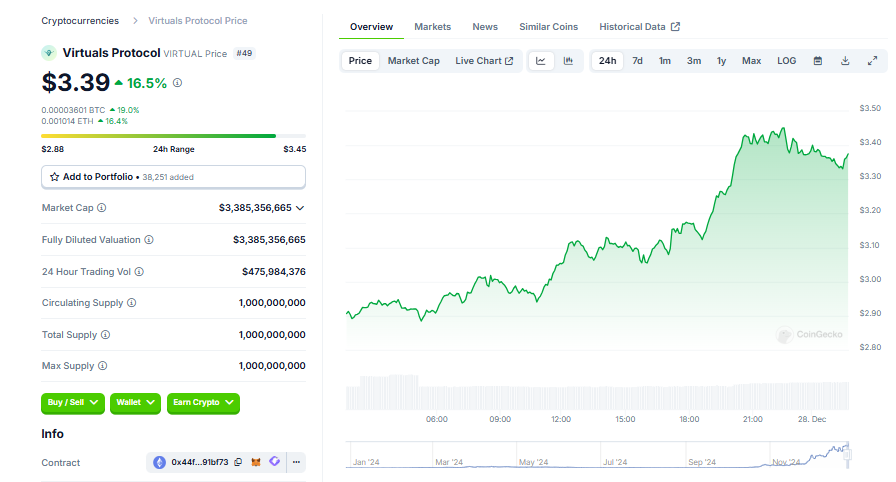

The price of Virtuals Protocol, commonly known as VIRTUAL, soared by an impressive 23000% in 2024, earning it the title of the best-performing altcoin in the crypto industry. The currency rose from a year-to-date low of 0.02234 in August to a significant 34 on Dec 27. The unprecedented rally can be attributed to the escalating hype surrounding artificial intelligence agents (AI agents) – software tools employing AI to perform user tasks.

VIRTUAL’s Ambitious Plan and Potential Catalysts

Virtuals Protocol aspires to dominate the crypto industry as the largest decentralized AI agent network, enabling users to create these agents. Some of its top agents have already attained a multi-million market cap. The Protocol’s price action parallels that of other AI giants like NVIDIA, Palantir, and Broadcom, who have become industry leaders by concentrating on AI solutions.

Entering 2025, VIRTUAL’s growth could be propelled further by a few potential catalysts. The most significant one is the growth of AI agents, which may allure more investors to its network. Additionally, its potential listing on more exchanges like Binance and Coinbase could provide another boost.

Potential Risks Ahead for VIRTUAL

While the future looks promising, several risks loom over VIRTUAL. The hype around the AI industry could potentially slow down in 2025, which might affect most assets. Also, concerns are rising that most AI assets, including VIRTUAL, could be highly overvalued.

Technical Risks for VIRTUAL Price

The VIRTUAL token faces potential technical risks, including mean reversion and Wyckoff Method risks. The token’s price has moved 90% above the 50-day moving average, suggesting that an asset often retreats back to the historical average, which might cause a sharp drop in VIRTUAL’s price. Moreover, the Wyckoff Method indicates that after the accumulation and mark-up phases, the token may move to the distribution phase, followed by the markdown, potentially causing the coin to drop further.

Conclusion

2024 was undoubtedly a successful year for VIRTUAL, with its price surging to new heights. However, potential risks in 2025, both from the market and technical perspectives, could pose challenges to its continued growth. It remains to be seen how VIRTUAL navigates these challenges to maintain its upward momentum in the coming year.