- VeChain is rallying alongside the broader crypto market, posting double-digit gains across short time frames.

- Bitcoin’s recovery and improving sentiment are helping lift altcoins like VET.

- Analysts remain cautious, with some expecting a pullback instead of a move to $0.015.

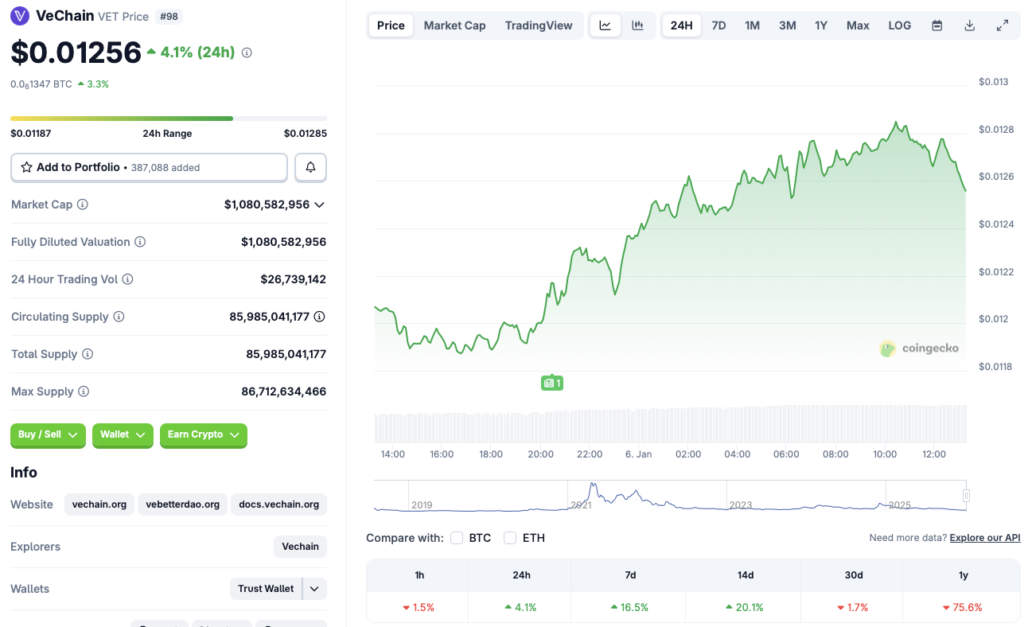

VeChain is starting to show signs of life again as the broader crypto market pushes higher to open the year. CoinGecko data shows VET is up 4.1% over the last 24 hours, 16.5% on the week, and just over 20% across the past 14 days. Still, the bigger picture remains mixed. VeChain is slightly down on the monthly chart and remains deep in recovery mode, sitting nearly 76% below its January 2025 levels. That contrast makes the current rally interesting, but also fragile.

Market Momentum Is Doing the Heavy Lifting

VET’s rebound is closely tied to the wider market resurgence. Bitcoin reclaiming the $93,000 level — and flirting with $94,000 — has restored some confidence across risk assets. As usual, altcoins are responding with outsized moves, especially those that were heavily discounted. VeChain’s bounce fits that pattern, rather than being driven by a single catalyst unique to the project itself.

Sentiment Shifts Add Fuel, but Risks Remain

Improving sentiment may also be playing a role. Bank of America recently allowing advisors to discuss crypto allocations with clients likely helped normalize risk-taking, at least on the margins. At the same time, expectations around economic stability following US actions tied to Venezuelan oil reserves may have eased broader macro fears. That said, investors remain cautious. VeChain was hit hard during October 2025’s selloff, and memories of that drawdown haven’t faded just yet.

Can VET Reach $0.015 or Is This a Dead-Cat Bounce?

If positive momentum holds, VeChain could attempt a push toward the $0.015 level in the days ahead. However, the market is far from fully healed, and renewed volatility could easily stall the move.

CoinCodex analysts remain unconvinced, projecting a potential drop toward $0.010 by early February. That would imply roughly a 20% pullback from current levels and suggests this rally may still be more corrective than structural.