- VeChain surged during the 2021 bull run but has struggled to recover since.

- Price forecasts suggest VET could remain below $0.01 even by 2030.

- The risk-to-reward ratio appears unfavorable, making VET a difficult investment case.

VeChain was one of the standout performers during the 2021 bull market, a period when nearly every major crypto asset seemed unstoppable. VET surged aggressively, topping out near $0.28 in April of that year as Bitcoin, Ethereum, Dogecoin, Shiba Inu, Cardano, XRP, and Solana all hit their own cycle highs. Back then, VeChain looked like a clear winner riding both hype and momentum.

Fast forward to today, and the picture looks far less exciting. The bull run that once lifted VET has long faded, replaced by years of sideways movement and steady pressure from sellers. For nearly four years now, bears have largely dictated price action, leaving little room for meaningful upside or sustained recovery.

VeChain’s Struggles Since the Bull Market

Since 2022, VeChain has remained relatively weak on the charts, with only one notable spike in December 2024 when the broader crypto market briefly rallied. That move coincided with macro-driven optimism rather than anything VeChain achieved on its own. Outside of that short-lived surge, VET has failed to generate independent momentum or stand out against competing altcoins. Its performance continues to mirror the market rather than lead it.

This lack of individual strength has become a growing concern for long-term holders. When the market slows, VET slows with it — and when the market rebounds, VET struggles to capitalize in a meaningful way. That pattern has made it difficult for traders to justify fresh positions.

Price Forecasts Point to More Pain

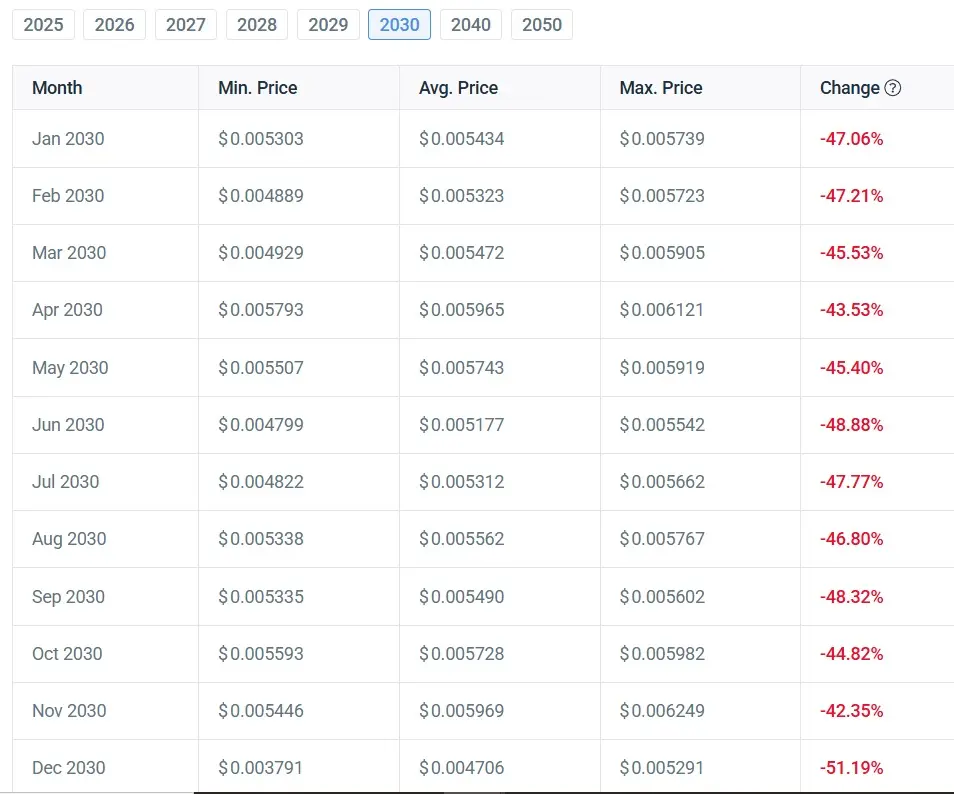

Adding to the pessimism, on-chain data and forecasting platform CoinCodex has issued a notably bleak outlook for VeChain. Their projections suggest VET could continue slipping below its current $0.01 level and may not reclaim that price even by 2030. In practical terms, that means anyone buying now could still be sitting on losses years down the line.

Some estimates indicate VET could lose another 40% to 50% of its value by the end of the decade. Under that scenario, a $1,000 investment today might be worth closer to $500 five years from now. It’s not exactly the kind of risk-reward profile most investors are looking for, especially in a market full of alternative opportunities.

Buy or Ignore VeChain Going Forward?

Given the data, VeChain’s outlook appears unfavorable for those chasing long-term gains. The token’s dependence on broader market cycles, combined with weak independent performance and negative long-range forecasts, makes it a tough sell. While VET still has name recognition from its 2021 run, that alone may not be enough to justify holding or accumulating going forward.

For investors focused on capital preservation and growth, VeChain currently looks more like a risk than an opportunity. Until the project demonstrates clear, sustained strength of its own, ignoring VET may be the safer move.