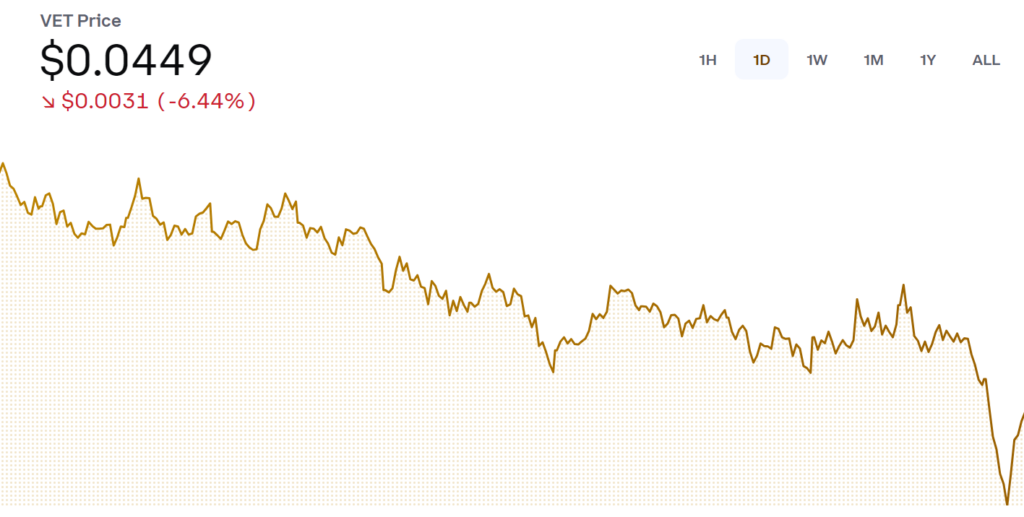

- VET is trading at $0.0449, showing a 6.44 percent daily decline.

- VeChain’s partnerships and use cases provide a solid foundation for recovery.

- Breaking above $0.0460 could signal renewed interest and potential upward movement.

VeChain (VET) is a blockchain platform designed to streamline supply chain management and enhance business processes. Its dual-token ecosystem and focus on transparency make it an integral tool for industries seeking efficiency and accountability in their operations.

A Decline in Market Sentiment

VET is currently trading at $0.0449, reflecting a 6.44 percent decline over the past 24 hours. The recent downtrend highlights increased market volatility, driven by broader crypto market corrections and a lack of significant news surrounding VeChain’s ecosystem. Over the past week, VET has struggled to maintain its earlier momentum, failing to hold key support levels near $0.0480.

Trading volume has also seen a decrease, currently hovering around $180 million, suggesting waning short-term interest among traders. Despite the decline, VeChain’s underlying fundamentals, such as its partnerships and use cases, continue to offer long-term potential for recovery.

Network Strength and Strategic Partnerships

One of VeChain’s core strengths lies in its robust network and partnerships across various industries. VeChain Thor, the blockchain powering VET, remains a popular choice for enterprises seeking traceability and efficiency in their supply chains. Collaborations with brands in retail, logistics, and healthcare demonstrate its utility and scalability.

Recent developments, including VeChain’s push toward sustainability-focused solutions, have bolstered its reputation as a business-centric blockchain. However, the lack of significant updates in recent weeks may have contributed to the subdued market sentiment, as the crypto market tends to respond favorably to high-profile announcements.

The Coinbase chart indicates that VET may test its next support level around $0.0435 if the current bearish trend continues. A reversal above $0.0460, however, could reignite buyer interest and set the stage for a gradual recovery.

Future Outlook and Recovery Potential

VeChain’s long-term prospects remain tied to its ability to innovate and expand its use cases. As the blockchain industry continues to grow, demand for enterprise-grade solutions like VeChain Thor could drive renewed interest in VET. The current downtrend reflects broader market conditions rather than fundamental weaknesses in the project.

If VeChain maintains its focus on securing partnerships and delivering impactful solutions, VET could recover lost ground and potentially test higher levels in the coming months. Market conditions and investor confidence will play a pivotal role in shaping its trajectory.