The senators’ meeting to examine the demise of FTX took place two months before the hearing on “Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets.”

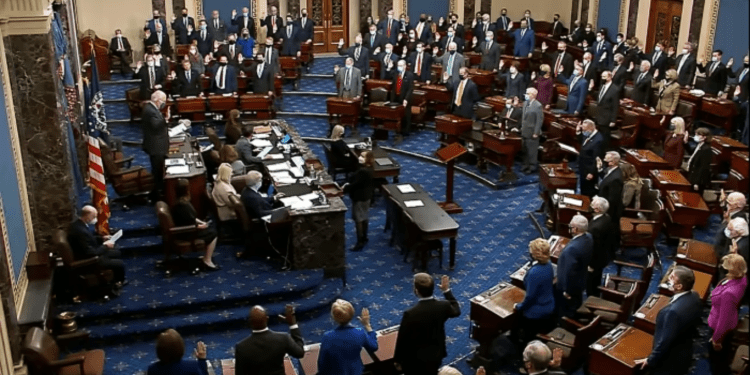

- Senate Banking Committee members from the United States have set a second hearing to discuss the effects of a crypto market crash.

- Given the “big hole” in past committee arrangements, senators intend to establish a brand-new subcommittee devoted to digital issues.

Announcement

Senators will meet on February 14 for a hearing titled “Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets,” Senate Banking Committee Chair Sherrod Brown announced on February 3. A hearing on the demise of the cryptocurrency exchange FTX was held on December 14 and will occur two months later.

Many U.S. legislators focused on Bankman-Fried and FTX when the cryptocurrency exchange filed for bankruptcy, and allegations surfaced that the former CEO utilized user assets to finance investments at Alameda Research. On December 12, officials in the Bahamas apprehended Bankman-Fried as part of the extradition procedure with the US. His detention without bond will last until at least February.

Politico Report

According to a Politico report from February 2, Senator Tim Scott named the crypto framework one of his objectives for the 118th Congress. He seems concerned about several aspects of cryptocurrencies, including the fall of exchanges like FTX (whose “high-profile failures resulted in lost client money”) and its application in illicit financial activities.

Pat Toomey, a former senator who completed his tenure without running for reelection, recently handed up the ranking member position to Scott. Toomey backed numerous bills promoting innovation in the digital asset sector. At the same time, Committee Chair Sherrod Brown urged Treasury Secretary Janet Yellen to collaborate with lawmakers and financial regulators on comprehensive crypto legislation.

To investigate the demise of FTX, the Senate Banking Committee scheduled a hearing in December. The investigation may be continued in the upcoming 2023 congressional session. Additionally, the House Financial Services Committee, chaired by Representative Patrick McHenry, may schedule another hearing on FTX.

Since the Republican Party now controls the House of Representatives, McHenry can decide what legislation the financial committee will review. He wants to create a new subcommittee for digital issues, given the “huge void” in previous committee structures.

Alternate Legislation for Crypto Regulation

The FTX incidents were not the driving force behind any alternate legislation that different legislators proposed to control particular elements of the cryptocurrency industry. Senator Toomey urged that stablecoins be used as the starting point for regulation, citing a framework he offered in April and a bill introduced in June by Senators Cynthia Lummis and Kirsten Gillibrand.

Senator Elizabeth Warren, a cryptocurrency critic in Congress, spent her time promoting links between virtual currency and funding for terrorism and ransomware. She introduced a measure alongside Senator Roger Marshall that would require more Anti-Money Laundering, or AML, regulations for financial service providers and set up AML rules and review procedures at the Treasury Department, SEC, and CFTC.

Conclusion

Following a hearing by the Senate Agriculture Committee on December 1 and a hearing by the House Financial Services Committee on December 13, the Senate hearing was the third to examine the collapse of FTX. According to the House committee, a second hearing on FTX is scheduled to occur sometime in 2023. Ben McKenzie is a famous actor from Hollywood. Kevin O’Leary, a Shark Tank investor, Jennifer Schulp from the Cato Institute, and Hilary Allen, a law professor, all testified in the December hearing. Sam Bankman-Fried, the former CEO of FTX, was supposed to speak at the House Financial Services Committee hearing before he was detained in the Bahamas. It is unknown who will speak at the hearing in February.