- Senator Lummis plans a December markup for the long-delayed crypto market structure bill.

- The proposal could shift major authority to the CFTC and reshape US digital asset oversight.

- Industry leaders push for fast alignment as bipartisan talks intensify before the holidays.

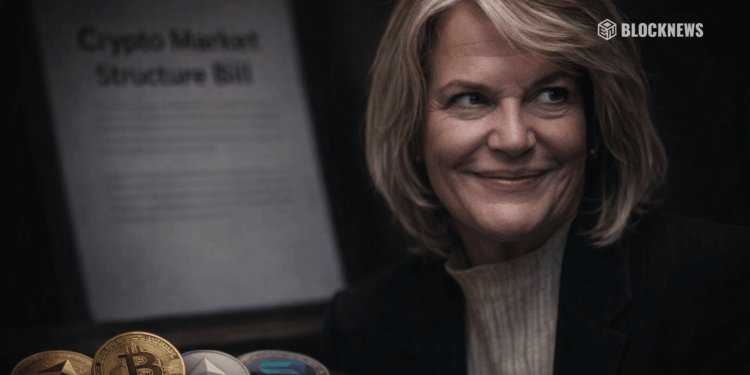

Wyoming Senator Cynthia Lummis says she plans to push the Responsible Financial Innovation Act into a markup hearing next week, marking the most significant step forward for US crypto market structure legislation this year. Speaking at the Blockchain Association Policy Summit, she admitted the industry had become “a little concerned” by delays, especially as bipartisan drafts were being reworked almost daily. With her and Senator Gillibrand’s teams worn down, she said it’s time to move a finished product into markup before Congress leaves for the holidays.

A Markup Hearing Could Finally Break Months of Stagnation

A markup hearing would allow lawmakers to propose amendments and refine the bill before sending it to the full Senate. Lummis plans to share a draft by the end of this week so industry leaders and lawmakers on both sides can provide feedback. Progress has been stalled by the historic federal shutdown and disagreements around DeFi provisions, but recent reports suggest bipartisan negotiations are now back on track for a December markup.

What the Market Structure Bill Could Mean for Crypto

Although the final text isn’t public yet, earlier drafts suggested a major shift in regulatory power — giving the Commodity Futures Trading Commission broader authority over digital assets. That would be a dramatic change from today’s landscape where the SEC plays the dominant role. Many firms see this bill as essential to unlocking clearer rules, better market behavior, and smoother onchain finance adoption. Coinbase legal chief Paul Grewal said the industry needs Congress to align on the last details without delay.

A Long Road Ahead Even if Markup Happens Next Week

Even with momentum picking up, the path to becoming law is still long. The bill must pass both the Senate Banking and Agriculture Committees before heading to the floor, and partisan disagreements could easily stretch the timeline into late 2026. Still, Lummis remains confident that next week’s markup would mark a turning point — one that finally puts the US on track toward a coherent digital asset market structure.