- Bitcoin ETFs could reach 1 million BTC holdings amid anticipated November market drivers.

- Major events, including US election and Fed meeting, may influence Bitcoin’s trajectory.

- Russia’s Bitcoin mining developments and Fed rate cuts may support potential BTC gains.

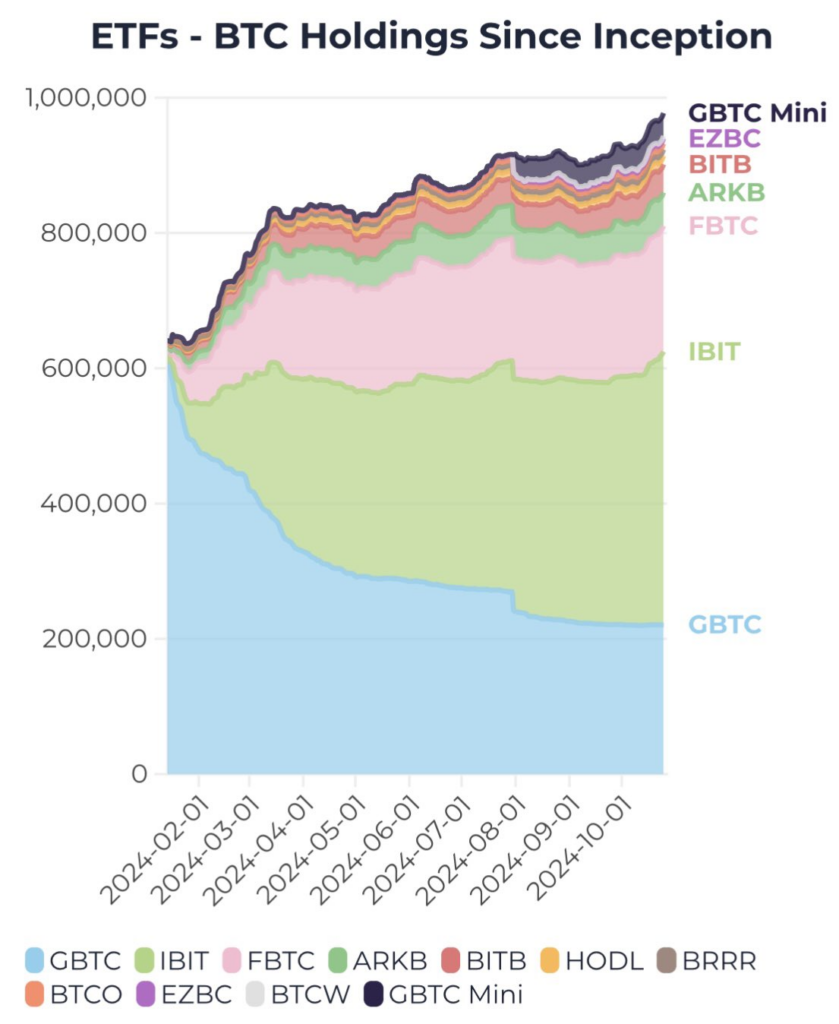

United States spot Bitcoin ETFs are on track to reach a significant milestone, potentially holding 1 million BTC as early as this week. Currently, these funds manage nearly 977,000 BTC, worth about $66.2 billion. As a proportion of Bitcoin’s market cap, this ETF holding already accounts for 5%, data from Apollo and SoSoValue shows.

Multiple factors may drive Bitcoin prices in November, including the US election and a possible Federal Reserve interest rate cut. Also, Russia’s move to lift its Bitcoin mining ban on Nov. 1 is expected to enhance network decentralization and boost security, according to analysts. In anticipation, US spot Bitcoin ETFs would need $1.55 billion in net inflows to reach 1 million BTC in assets under management by week’s end.

Source: Nate Geraci on X

Election, Fed Rates Could Shape BTC Momentum

Bitcoin typically sees price increases in the months following halving events, and many anticipate a repeat of this trend after the recent April 2024 halving. Crypto analyst CK Zheng noted that Bitcoin surged by 43% in November 2020 following the last halving. Regardless of the election outcome, he anticipates similar gains this year. However, Apollo Capital’s Henrik Andersson suggested that a Trump victory could push Bitcoin toward a potential all-time high of $100,000 by year-end.

Meanwhile, Federal Reserve officials are expected to meet on Nov. 6-7, with a 94.7% likelihood of a 25-basis point rate reduction, according to CME Group’s Fedwatch. Rate cuts typically provide relief to consumers, which can have positive short-term effects on broader financial markets. Bitcoin is currently trading around $67,700, with analysts observing robust support levels around $65,000.