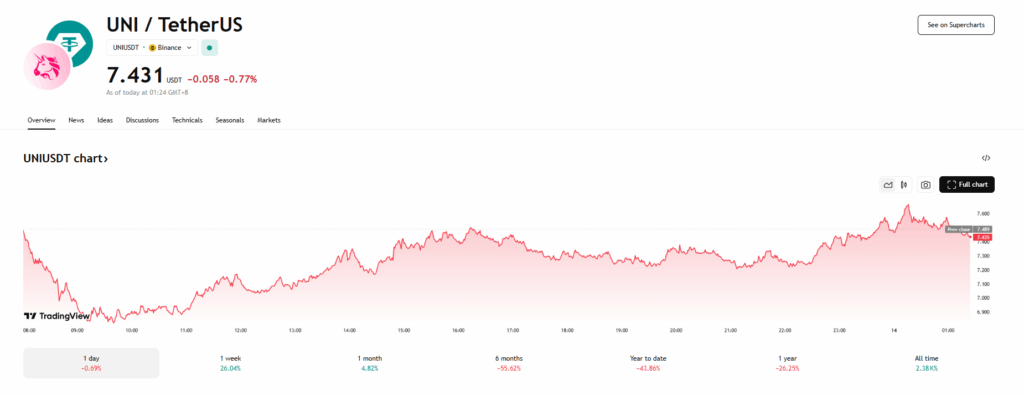

- Uniswap’s UNI token fell over 6% following renewed Middle East tensions sparked by Trump’s threats against Iran.

- After rebounding from a steep overnight drop, UNI faces renewed pressure with support near $7.26 and resistance at $7.50.

- Geopolitical instability continues to dictate short-term crypto sentiment, with investors shifting to caution amid uncertainty.

Uniswap’s UNI token fell 6.36% in the last 24 hours, landing at $7.3864 as global markets absorbed heightened geopolitical risk. Earlier in the day, UNI had mounted a swift 9.5% bounce from $6.82 to $8.40 after a sharp overnight drop, but the recovery faded following an aggressive message from U.S. President Donald Trump targeting Iran. The warning escalated fears of broader Middle East conflict, prompting a shift in sentiment across high-risk assets like crypto.

Trump’s Warning Sends Shockwaves Through Risk Assets

Trump’s Truth Social post early Friday issued an ultimatum to Iran, warning of catastrophic consequences if a deal isn’t reached. The former president claimed Iran had ignored multiple chances to negotiate and promised further “death and destruction” if they continued to resist. The threatening tone sparked fresh anxieties among investors, with crypto assets including UNI reacting swiftly to the deteriorating global risk environment.

UNI Technicals Show Strain at Key Support Levels

UNI’s price experienced a dramatic V-shaped reversal earlier, plunging 12.5% from $7.90 to $6.82 before climbing back to over $8.40. Trading volume peaked during this rebound, particularly between 13:31 and 13:44 UTC, when UNI broke above the $7.30 resistance level. Support has since formed near $7.26 after several retests, though the latest decline shows the token consolidating just above this key threshold as bearish momentum re-emerges.

Traders Eye $7.26 Support as Market Jitters Persist

With UNI now hovering around $7.38, market participants are closely watching for any breach below $7.26, which could invite deeper downside. Resistance is currently building near $7.50, limiting any short-term upside potential. The broader crypto market remains on edge, with geopolitical developments likely to shape near-term trading dynamics as fear and volatility dominate investor psychology.