- The SEC has ended its investigation into Uniswap Labs, deciding not to pursue enforcement action.

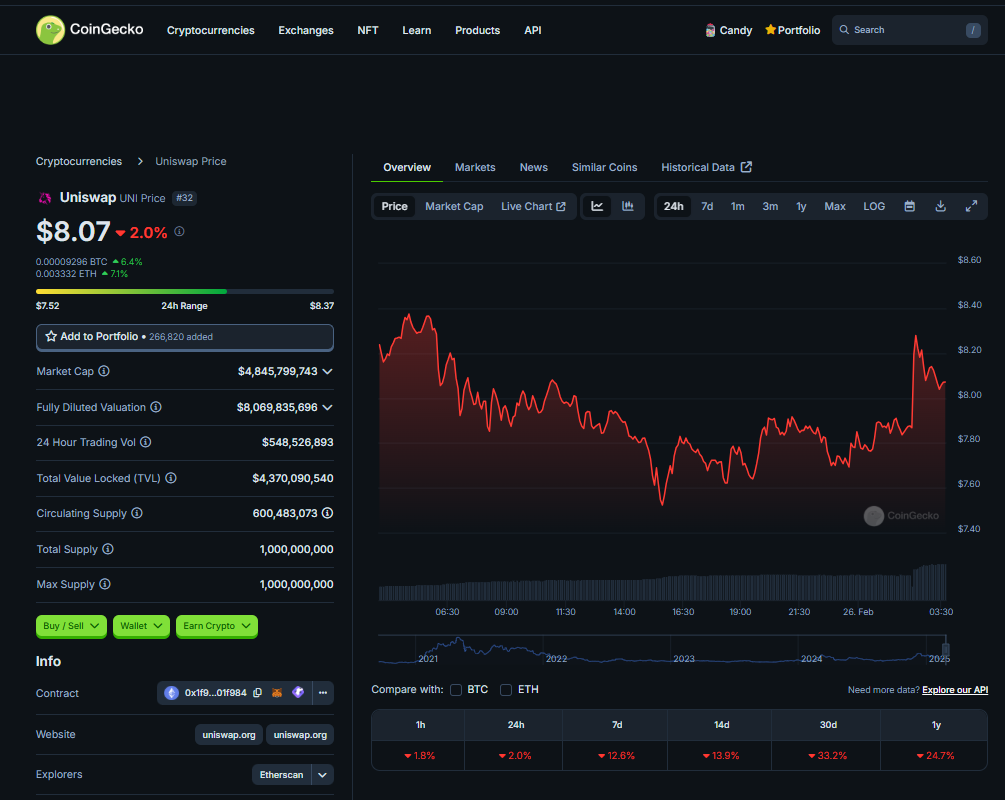

- UNI token jumped 4.6% on the news, though it remains down 0.5% over the past 24 hours.

- Uniswap v4 launched in January 2025, introducing new developer tools, security audits, and a $15M bug bounty.

Uniswap just dodged a major regulatory bullet. The SEC has officially ended its investigation into the decentralized exchange’s creator, Uniswap Labs, and won’t be pursuing enforcement action, according to a Wall Street Journal report.

The decision comes months after Uniswap received a Wells notice in April 2024, which had signaled potential legal trouble over allegations that:

- Uniswap was operating as an unregistered securities exchange.

- Its UNI token might have been an illegal securities offering.

Back in May 2024, Uniswap Labs pushed back hard, arguing that the protocol doesn’t fit the SEC’s definition of an exchange. Looks like that defense held up.

UNI Token Jumps on the News

Traders reacted instantly—UNI spiked 4.6% in an hour, though it’s still down 0.5% over the past 24 hours, per CoinGecko data.

This news comes just weeks after Uniswap launched v4 in January 2025, an upgrade that:

- Expanded Uniswap into a full developer platform.

- Brought in new customizable features & security audits.

- Offered a $15M bug bounty to strengthen security.

For now, Uniswap Labs can breathe easy—but the bigger picture? Regulatory pressure on DeFi isn’t going away anytime soon.