- A dormant whale sold 512K UNI after 4.5 years, locking in an $11.65M loss — clear capitulation behavior.

- UNI has dropped from $10.2 to $6.4 as whales flipped from buying to heavy selling.

- Positive exchange netflows, bearish DMI signals, and strong sell momentum could drag UNI down to $5.8 unless bulls reclaim $7.6.

Uniswap’s biggest players have been acting strangely lately — and not in a bullish way. One dormant whale, silent for 4.5 years, suddenly resurfaced and dumped 512,000 UNI, booking a staggering $11.65 million loss. This whale originally bought at peak euphoria, around $29.8, when the stash was worth over $15 million. Now, with UNI below $7, the same bag was worth just $3.64 million. Selling at that kind of loss isn’t rebalancing. It’s capitulation.

UNI’s price collapses after the “UNIification” pump

Just ten days after Uniswap’s Unification proposal lit up the charts, pushing UNI to $10.2, things turned ugly. Profit-taking — from both whales and retail — triggered a sharp reversal. UNI tanked into a downtrend, sinking to $6.4before a tiny bounce to around $6.5. That’s a 9.14% drop in a single day, and the chart doesn’t look any friendlier across lower timeframes.

As the price fell, whale behavior shifted fast. Those who piled in earlier began dumping aggressively, amplifying the sell pressure.

Whales flip from accumulation to panic selling

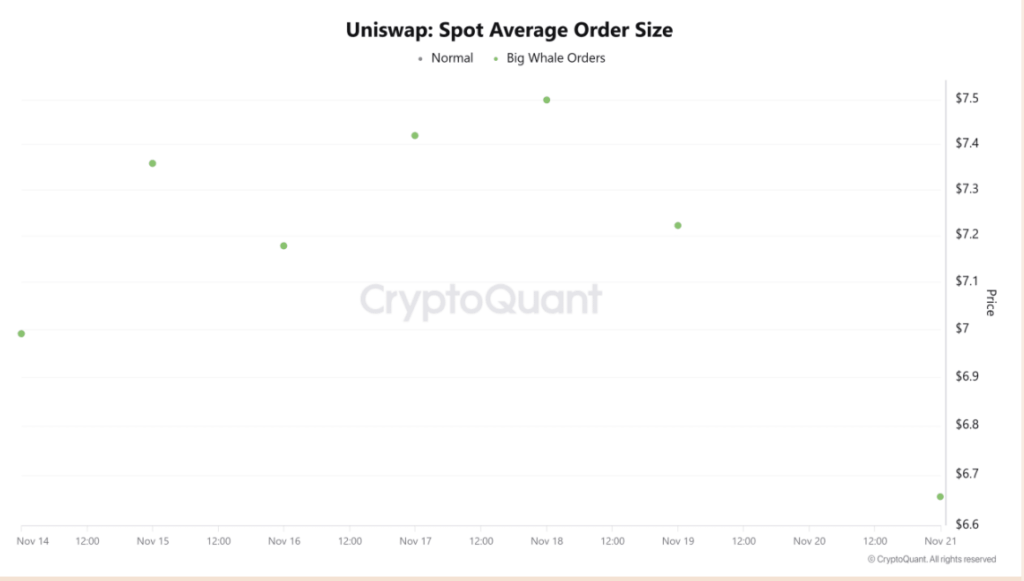

CryptoQuant’s Spot Average Order Size data showed heavy whale buying on November 10 and 11, right after the UNIification hype. But once price peaked, sentiment flipped like a switch.

- On November 11, one whale sold 1.71 million UNI worth $15 million, all of which had been accumulated between February and October.

- Despite months of holding, this whale still took a $1.4 million loss, according to Lookonchain.

Selling at a loss after a hype-driven spike? That’s classic fear-driven capitulation — the kind you usually see deeper in bear markets.

And the selling hasn’t slowed. Over the past three days, whales dumped 5.6 million UNI into the market.

Exchange Netflow spikes as selling pressure intensifies

Uniswap has now seen three straight days of positive Exchange Netflows — meaning more UNI is flowing onto exchanges than leaving. Tokens sent to exchanges usually represent one thing: selling intent.

UNI’s momentum indicators echo the same story.

The Positive Directional Movement Index (DMI) just made a bearish crossover — a technical confirmation that downside momentum is still in control.

The Fibonacci Bollinger Bands show price clinging to the lower region, with no meaningful sign of stabilization.

How low could UNI fall next?

If the current trend holds — whales selling, momentum weakening, and netflows growing — UNI could easily slip toward $5.8, wiping out all gains from the UNIification rally.

For bulls to invalidate this bearish setup, they must reclaim the middle band of the Fibonacci Bollinger Bands at $7.6. Only then can UNI attempt a move toward the next resistance at $8.4.

Until that reclaim happens, every bounce risks becoming another short opportunity for traders watching this breakdown unfold.