- The Trump administration is reviewing Treasury rules that would let the IRS access data on Americans’ foreign crypto accounts under CARF.

- CARF is a global tax-reporting framework already adopted by major economies including Japan, Germany, France, and the U.K.

- The U.S. plans to avoid new reporting rules for DeFi as global CARF rollout approaches in 2027.

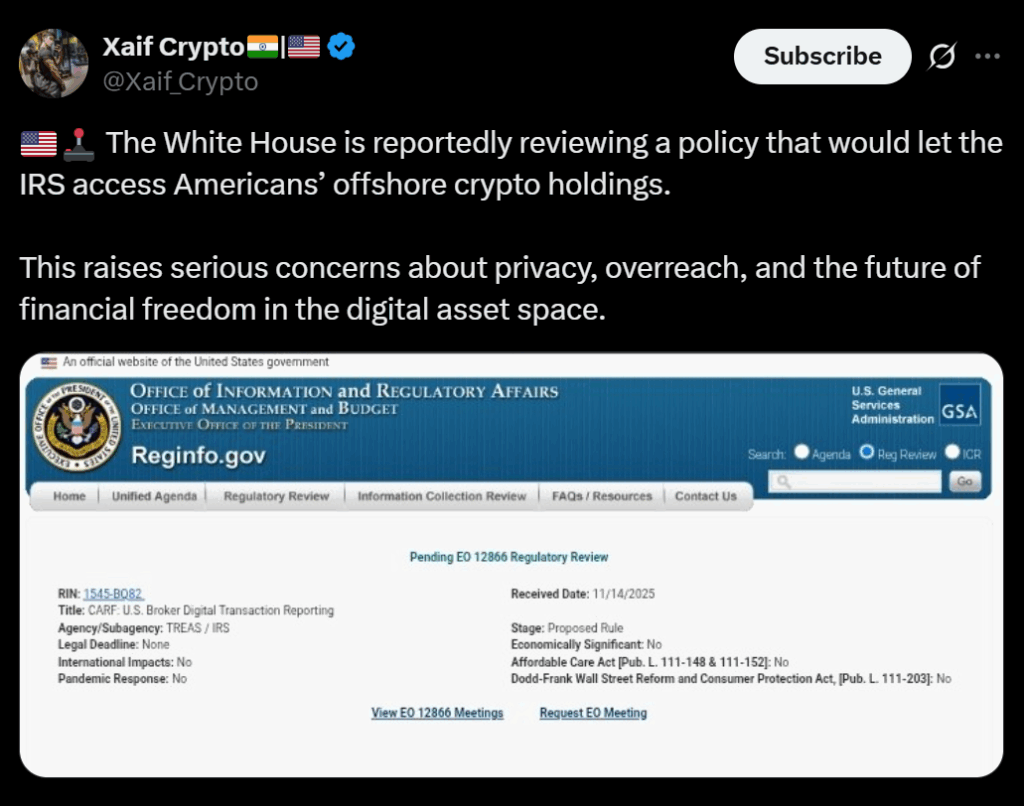

The Trump administration is taking a major step toward allowing the IRS to collect key financial details about Americans’ foreign crypto accounts. Proposed Treasury rules tied to a global tax-reporting framework officially arrived at the White House on Friday, where presidential advisors will now review them. If approved, the United States would join dozens of nations already participating in the Crypto-Asset Reporting Framework (CARF), a system designed to track cross-border digital asset activity and reduce international tax evasion.

What CARF Is and Why the U.S. Is Considering It

CARF was developed by the OECD in 2022 as a global agreement for crypto tax transparency. Under this framework, member nations automatically share information about citizens’ holdings on foreign exchanges. That means if an American taxpayer stores crypto in Singapore, the Bahamas, the UAE, or any other participating jurisdiction, that information would be reported back to the IRS.

Many major economies — including all G7 nations except the U.S. — have already committed to CARF. Earlier this year, the White House signaled strong support for adopting the system, saying it would help prevent Americans from moving crypto offshore to avoid taxes and bring more fairness and consistency to the digital asset landscape.

Trump Administration Advisors Push for CARF Adoption

In a major crypto policy report released this summer, President Trump’s advisors recommended full CARF adoption, arguing it would strengthen domestic oversight without stifling innovation. They also emphasized that any new rules should not add reporting requirements for DeFi transactions — a key concern for both industry leaders and privacy-focused users.

If implemented, CARF would give U.S. regulators access to foreign exchange data while leaving decentralized platforms outside the rule’s scope. The Treasury and IRS have been working on the details since that report, and Friday’s White House review marks the next step toward official rulemaking.

What Happens Next — and Global Timing

If the administration approves the Treasury’s proposal, federal rulemaking would move forward and public comment periods would follow. Global implementation of CARF is expected in 2027, giving governments and exchanges time to align reporting systems.