- A U.S. judge initially ruled Trump’s tariffs unconstitutional and halted them, but a federal appeals court just reversed that, putting them back in effect.

- The sudden policy whiplash rattled markets—especially crypto.

- Over $100 billion in value was wiped from the crypto market within 24 hours of the reversal.

On April 2, 2025, former President Donald Trump announced sweeping tariffs under the “Liberation Day” initiative, imposing a 10% baseline tariff on most imports and higher rates on goods from countries like China and the EU. These tariffs were justified under the International Emergency Economic Powers Act (IEEPA), citing national economic threats.

However, on May 28, the U.S. Court of International Trade ruled that these tariffs exceeded presidential authority, stating that the IEEPA does not grant the president unchecked power to impose such tariffs. The court emphasized that only Congress has the constitutional power to regulate foreign commerce .

In a swift turn of events, a federal appeals court temporarily reinstated the tariffs on May 29, allowing them to remain in effect during the appeals process .

Crypto Markets React: $100B Wiped Out

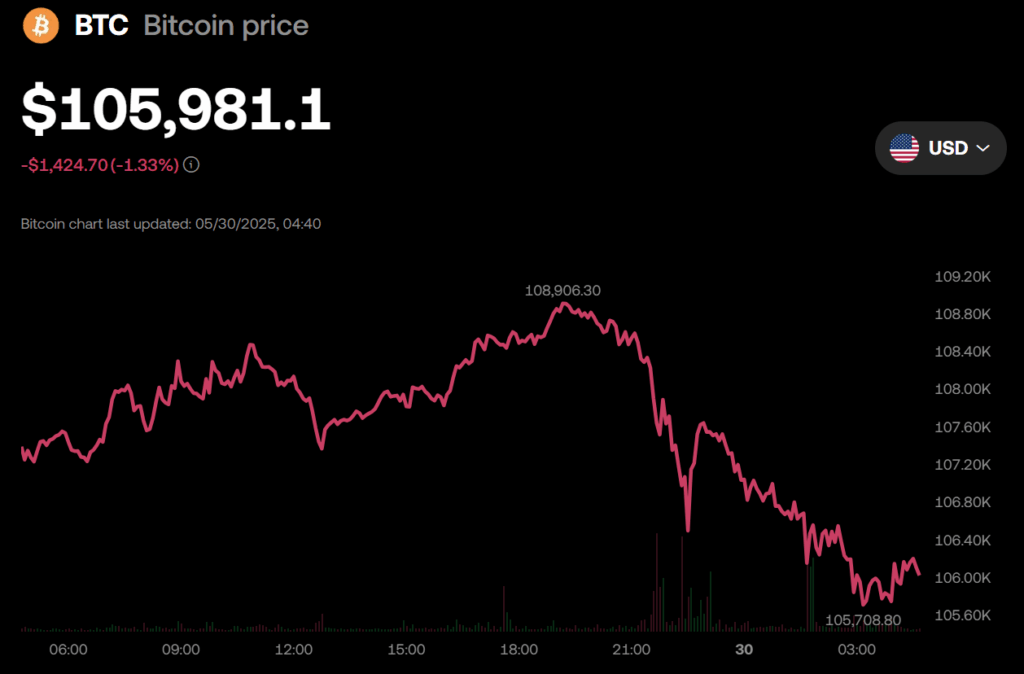

The reinstatement of Trump’s tariffs sent shockwaves through the cryptocurrency market. Bitcoin‘s price fell below $92,000, and Ethereum dropped to $2,553, contributing to a collective loss of over $100 billion in market capitalization .

This market turmoil underscores the sensitivity of digital assets to geopolitical developments. Investors, already wary of regulatory uncertainties, reacted swiftly to the news, leading to significant sell-offs across major cryptocurrencies.

Looking Ahead

As the legal battle over the tariffs continues, the crypto market remains on edge. The outcome of the appeals process will be closely watched, not just by traditional industries but also by the digital asset community, which is increasingly influenced by global trade policies.

For now, the reinstated tariffs serve as a reminder of the interconnectedness of global economic decisions and the volatile nature of emerging markets like cryptocurrency.

Note: This article is based on events and data available as of May 29, 2025.