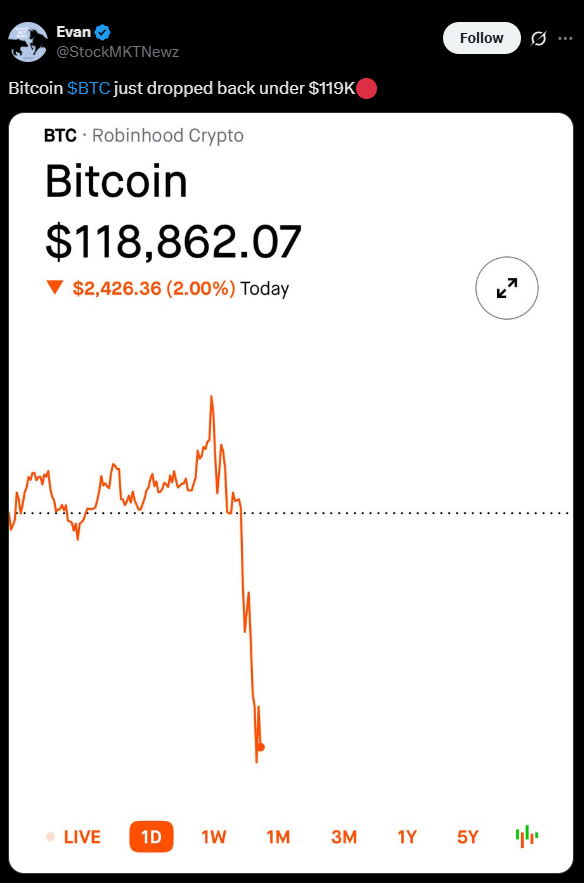

- Bitcoin fell below $119K after Trump threatened new tariffs on Chinese goods.

- ETH, SOL, and XRP followed with sharp declines amid global risk-off sentiment.

- Gold surged above $4,000, showing investors’ flight to safety amid trade war fears.

The crypto market faced renewed pressure Friday after U.S. President Donald Trump announced plans to impose a “massive increase” in tariffs on Chinese goods, reigniting fears of a trade war. The statement came just hours after China introduced new export restrictions on rare earth metals, escalating tensions between the two superpowers.

Bitcoin, which had recently notched a new all-time high near $126,000, quickly plunged to $118,738, shedding more than 6% in four days. Major altcoins followed suit, with Ethereum (ETH) sliding to $4,112, Solana (SOL) to $211, and XRP seeing a similar sharp decline. Analysts described the sell-off as a textbook risk-off move, triggered by global uncertainty and a rush to safer assets.

Crypto Stocks and Broader Markets Take a Hit

The shockwaves extended beyond crypto markets into related equities. Circle (CRCL) dropped over 6%, while Robinhood (HOOD) and Coinbase (COIN) each fell around 5% amid declining trading volumes and sentiment. Even MicroStrategy (MSTR)—known for its massive Bitcoin holdings—slipped about 3%, reflecting broader investor caution.

Traditional markets also took a hit. The S&P 500 and Nasdaq closed down 1.6% and 1.3%, respectively, while WTI crude oil dropped nearly 4% to below $60 per barrel, marking its weakest level since early May. Meanwhile, gold surged more than 1%, climbing back above $4,000 per ounce, underscoring its enduring role as the preferred hedge in times of geopolitical stress.

Rare Earths and Economic Retaliation

China’s move to tighten export controls on rare earth minerals—critical components in electronics, military hardware, and EVs—sparked the U.S. response. Analysts warn that a prolonged standoff could rattle supply chains and slow global manufacturing output, further destabilizing risk assets like cryptocurrencies.

Market strategist George Chen commented that both Washington and Beijing are “using trade tools as negotiation leverage,” adding that “crypto markets are reacting to uncertainty, not fundamentals.” Traders fear that if tariffs intensify, liquidity across speculative markets could dry up, prompting more defensive positioning.

Bitcoin’s Role in a Risk-Off Market

While Bitcoin has long been marketed as “digital gold,” Friday’s price action painted a different picture. The simultaneous surge in gold and drop in BTC suggests that investors still see Bitcoin as a high-risk asset, vulnerable to macro shocks.

At press time, Bitcoin hovered around $118,800, down roughly 2% in the last 24 hours. Despite the pullback, some analysts view the correction as healthy consolidation following an overheated rally, with leverage wipeouts and sentiment resets likely paving the way for stabilization.