- $9.3 billion in ERC-20 stablecoins was transferred to exchanges following Trump’s election victory, hinting at rising demand.

- The Coinbase Premium Index surged, suggesting strong U.S. demand and expectations of a potential crypto rally.

- Spot Bitcoin ETFs, including BlackRock’s, witnessed record inflows as investors anticipate further price growth.

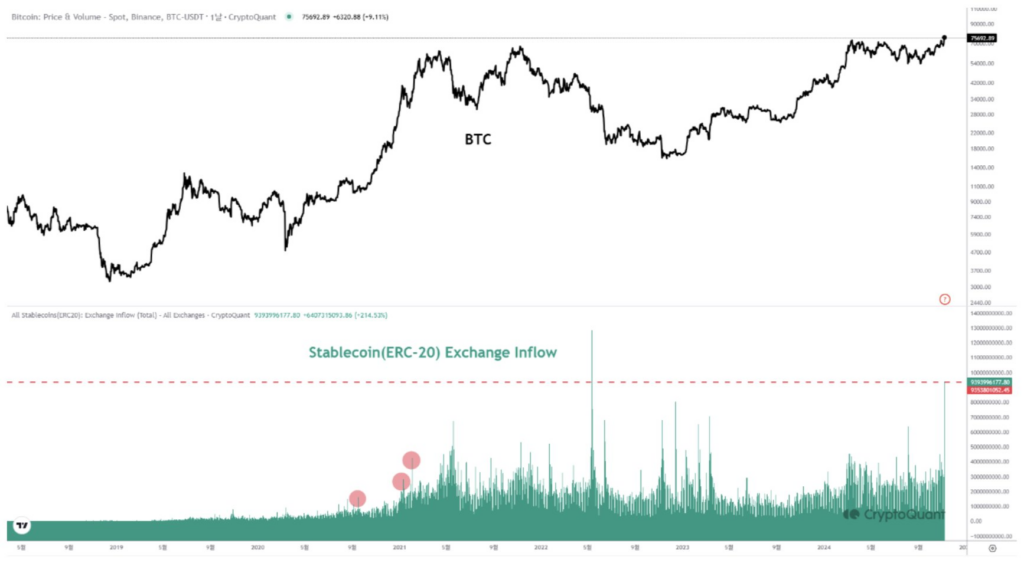

The crypto market has seen an influx of ERC-20 stablecoins following Donald Trump’s presidential election win, signaling increased activity and investor confidence. On Nov. 6, market intelligence platform CryptoQuant reported that over $9.3 billion in ERC-20 stablecoins were transferred to cryptocurrency exchanges. This influx marks one of the largest since stablecoins were introduced, suggesting renewed optimism in the digital asset space.

On Nov. 7, CryptoQuant noted that such large stablecoin transfers historically precede price rallies, as seen in past bull runs. During the 2021 market boom, a similar pattern of large stablecoin deposits into exchanges set the stage for Bitcoin’s rise. Of the $9.3 billion stablecoin transfers, Binance received approximately $4.3 billion, while Coinbase saw around $3.4 billion in deposits.

Source: CryptoQuant on X

Market Trends and Investor Sentiment

As Trump prepares for his upcoming term, the U.S. crypto sector is closely watching his economic policies. In a statement to investors, QCP Capital expressed optimism that Bitcoin’s positive trend could continue, especially given Trump’s proposed 60% tariffs on China and fiscal policies affecting national debt. QCP added that Bitcoin might carry a lower risk premium than traditional equities, possibly positioning it to outperform other high-risk investments.

The Coinbase Premium Index, a key metric that reflects the price gap between Bitcoin on Coinbase and Binance, also hit 0.098 on Nov. 6. This level, the highest since mid-April, suggests rising demand for Bitcoin from U.S.-based traders, buoyed by inflows into Bitcoin spot ETFs from major financial institutions such as BlackRock.

Bitcoin ETFs and Future Inflows

Spot Bitcoin ETFs experienced notable inflows, with over $1.38 billion moving into these investment products on Nov. 7, according to SoSoValue data. BlackRock’s spot Bitcoin ETF, IBIT, alone saw inflows of $1.1 billion, reversing a brief period of outflows in recent days.

Analysts expect this momentum to build as investors prepare for a shifting landscape under the new administration. The stablecoin inflows and ETF investments point toward sustained market interest in digital assets as traders and investors eye potential gains in the months ahead.