- TRUMP’s price decline shows increased selling pressure, but volume remains strong.

- Market cap drop hints at cautious investor sentiment amid broader market movements.

- Liquidity is still high, keeping TRUMP in play despite short-term pullbacks.

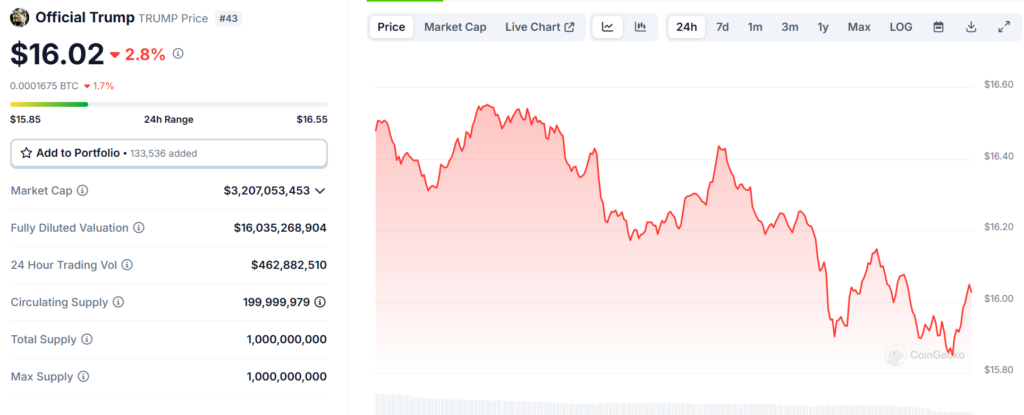

TRUMP token has been facing some downward pressure, settling at $16.02 after fluctuating between $15.85 and $16.55 throughout the day. This movement suggests that while the token still has strong market activity, there’s also a wave of selling pressure that’s keeping it from bouncing back immediately.

Looking at the broader price trend in CoinGecko, TRUMP has been experiencing short-term pullbacks that have tested support levels multiple times. While the dip may seem concerning for some traders, such corrections are common, especially after a period of strong upward movement. The real question is whether TRUMP can find enough buying support to stabilize or if further declines are on the horizon

TRUMP’s Price Dips, But Is It a Buying Opportunity?

The market cap has dropped to $3.2 billion, reflecting the lower price action. However, what stands out is the 24-hour trading volume, which remains high at $462 million. This level of liquidity means that traders are still actively engaged, whether they’re buying dips or taking profits.

Another interesting factor is the fully diluted valuation (FDV) of $16 billion, which remains significantly higher than the market cap. This suggests that while short-term sentiment is shaky, long-term holders still see potential in TRUMP’s price movement. As long as volume remains strong, the token could still see another bounce if buyers regain control.

The circulating supply remains steady at 200 million tokens, with a total and max supply of 1 billion. Since there are no sudden supply increases, TRUMP’s price movement is purely driven by market demand and investor behavior.

What’s Next for TRUMP?

The big question now is whether TRUMP’s price decline is just a normal correction or the start of a bigger trend shift. If buyers step in around the current support levels, the token could see a recovery and push back toward $17+. However, if selling pressure continues, there’s a chance we could see another retest of lower support levels.

Traders should keep a close eye on volume spikes and market sentiment. If TRUMP maintains high liquidity and shows a reversal in price action, it could mean the market is absorbing the selling pressure and preparing for another upward move. On the flip side, if volume starts dropping off, it might signal that traders are losing interest, leading to a slower recovery.

At this point, TRUMP remains an actively traded asset, meaning volatility is expected. Whether this dip is a buying opportunity or a warning sign depends on how the next few days play out.

The Story Behind TRUMP Token

TRUMP token is a politically themed meme coin that capitalizes on the branding of the 47th U.S. President Donald Trump. Unlike traditional cryptocurrencies built for utility, TRUMP thrives on market speculation, social media trends, and cultural relevance.

It has gained a strong following among traders who enjoy high-volatility assets, and its ability to generate attention has kept it in the spotlight. While its long-term viability is still uncertain, its high liquidity and constant engagement from traders make it a token worth watching.

Will TRUMP bounce back from this dip, or is the hype fading? The market will decide soon enough.