- Market cap dips below key support, reflecting investor uncertainty

- Trading volume surges, signaling heightened activity and potential reversal

- Whales accumulating? On-chain movements hint at strategic buys

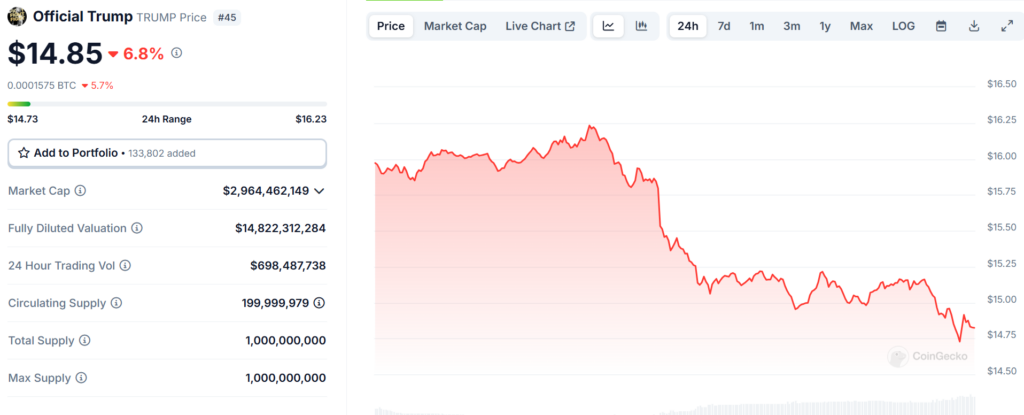

The TRUMP token has experienced a turbulent trading session, with its price showing a notable decline over the past 24 hours. As traders scramble to assess the situation, key indicators reveal both risks and opportunities for those keeping a close eye on the market.

A Make-or-Break Moment?

The token’s market capitalization now stands at approximately $2.96 billion, marking a significant decrease in value. This suggests that a considerable number of investors have exited their positions, likely in response to broader market trends or token-specific developments. A shrinking market cap often reflects lower confidence in an asset’s short-term outlook, but it can also create opportunities for those looking to buy at lower levels.

One contributing factor to this sell-off could be liquidity concerns, as traders attempt to mitigate potential losses amid volatile market conditions. If the token continues to see downward pressure, it may struggle to reclaim recent highs unless a strong catalyst emerges to reignite interest.

Trading Volume Skyrockets – A Double-Edged Sword?

Despite the downturn in price, TRUMP token has seen a surge in trading volume, exceeding $698 million within the last 24 hours. High trading volume can indicate heightened market participation, but it can also mean panic selling is taking place. However, a closer look at the price movement suggests that buyers have stepped in at certain support levels, preventing a further collapse.

This increased liquidity means traders have more room to maneuver, with opportunities for both short-term scalping and longer-term accumulation. If the volume remains elevated while price stabilizes, it could signal the beginning of a reversal, but a failure to hold above critical levels may invite further declines.

Whales Accumulating? Signs of Strategic Buying Emerge

CoinGecko data has shown that certain large holders, or “whales,” have been making moves, potentially accumulating TRUMP tokens at discounted prices. This pattern is often a precursor to a recovery, as influential market participants look to capitalize on lower valuations before a rebound.

If whale activity continues and aligns with a stabilization of the token’s price, it could set the stage for a more sustained recovery. However, if large holders are instead offloading their tokens into the rally, it could indicate that further downside risk remains.

Final Thoughts

TRUMP token’s recent price action suggests that the market is at a critical juncture. The declining market cap and intense sell pressure signal caution, while the surge in trading volume and potential whale accumulation hint at a possible rebound. Traders should closely monitor key support levels and on-chain activity to gauge whether the token is poised for recovery or facing further downside.

With the market still digesting recent movements, the next few trading sessions could prove pivotal. Whether TRUMP token stages a comeback or extends its decline will largely depend on broader sentiment and strategic maneuvers from key players in the ecosystem.