- Trump threatened a “massive increase” in tariffs on Chinese imports after Beijing restricted rare earth exports.

- The U.S.-China meeting at APEC may be canceled, reigniting global trade tensions.

- Markets reacted sharply: stocks fell, gold rose above $4,000, and Bitcoin dropped below $119K.

President Donald Trump has threatened to impose a “massive increase of tariffs” on Chinese imports in response to Beijing’s newly announced export restrictions on rare earth minerals. The move marks the sharpest escalation in U.S.-China trade tensions since Trump returned to office, reigniting fears of a renewed trade war that could ripple across global markets.

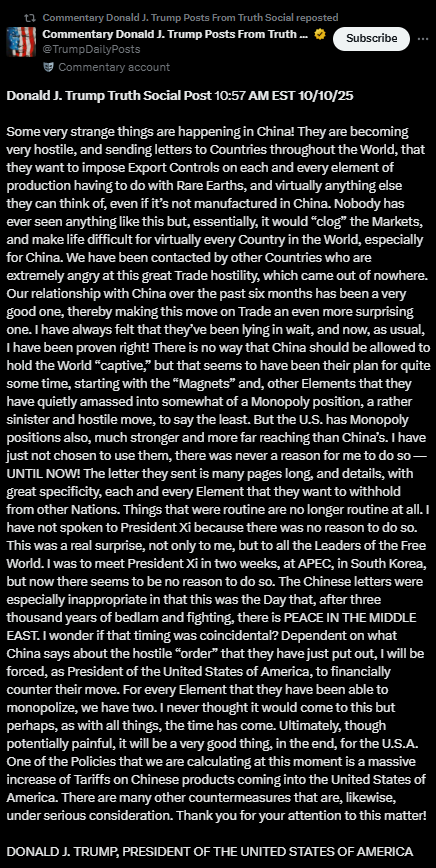

In a Truth Social post on Friday morning, Trump accused China of trying to “hold the world captive” through its control of rare earth resources, which are essential for technologies ranging from electric vehicles and defense systems to semiconductors. “One of the policies we are calculating at this moment is a massive increase of tariffs on Chinese products,” Trump wrote, adding that “many other countermeasures” were also under consideration.

He further warned that he might cancel his upcoming meeting with Chinese President Xi Jinping, previously scheduled to take place at the APEC summit in South Korea later this month. “There seems to be no reason to do so,” Trump said, describing Beijing’s move as a “real surprise” that “came out of nowhere.”

China Tightens Rare Earth Export Rules

The Chinese Ministry of Commerce announced on Thursday that foreign entities will now need special licenses to export any products containing more than 0.1% of rare earths sourced or processed in China. The new rules, set to take effect December 1, also cover materials derived through Chinese extraction, magnet-making, or recycling technologies.

China currently controls about 70% of global rare earth mining and 90% of processing capacity, making it the dominant player in a market crucial to the world’s tech supply chain. The new export controls are seen by analysts as a strategic countermeasure to ongoing U.S. restrictions on semiconductor and advanced chip exports to China.

Trade expert George Chen of The Asia Group noted, “This move mirrors Washington’s chip controls — it’s economic statecraft through critical materials.”

Market Reaction: Global Sell-Off and Safe-Haven Rally

Trump’s post had immediate market consequences, triggering a wave of risk-off sentiment. The Dow Jones Industrial Average, S&P 500, and Nasdaq all fell between 1.3% and 1.6% in early trading. Meanwhile, Bitcoin plunged below $119,000, extending its weekly losses, while gold surged over 1% past $4,000 per ounce as investors fled to safe havens.

In energy markets, WTI crude oil dropped nearly 4% to just under $60 a barrel, its lowest level since May. Analysts attributed the decline to fears that escalating trade hostilities could dampen global demand.

Rising Geopolitical Stakes

Trump’s remarks also risk derailing diplomatic progress that had been made since his re-election. The U.S. and China had been working toward a bilateral summit in Beijing to discuss trade normalization and technology cooperation. However, with Trump’s latest comments, the meeting now appears uncertain.

“Some very strange things are happening in China,” Trump wrote, claiming that Beijing had sent letters to other countries outlining plans to impose export controls on “virtually anything else they can think of.”

The president said several nations had reached out to Washington expressing frustration at China’s move, calling it a “great trade hostility.”

What Comes Next

Analysts warn that the situation could escalate quickly if tariff measures are formalized. A new round of U.S. tariffs could impact automotive, electronics, and renewable energy sectors, many of which rely heavily on Chinese-sourced components.

Former Commerce Department official Nazak Nikakhtar called the development “a major inflection point,” noting that “the U.S. and its allies must now invest heavily in building a mine-to-magnet supply chain outside of China.”

With rare earths positioned at the heart of the clean tech and defense industries, the latest dispute underscores just how strategically entangled the world’s two largest economies remain — and how fragile that balance is heading into 2026.