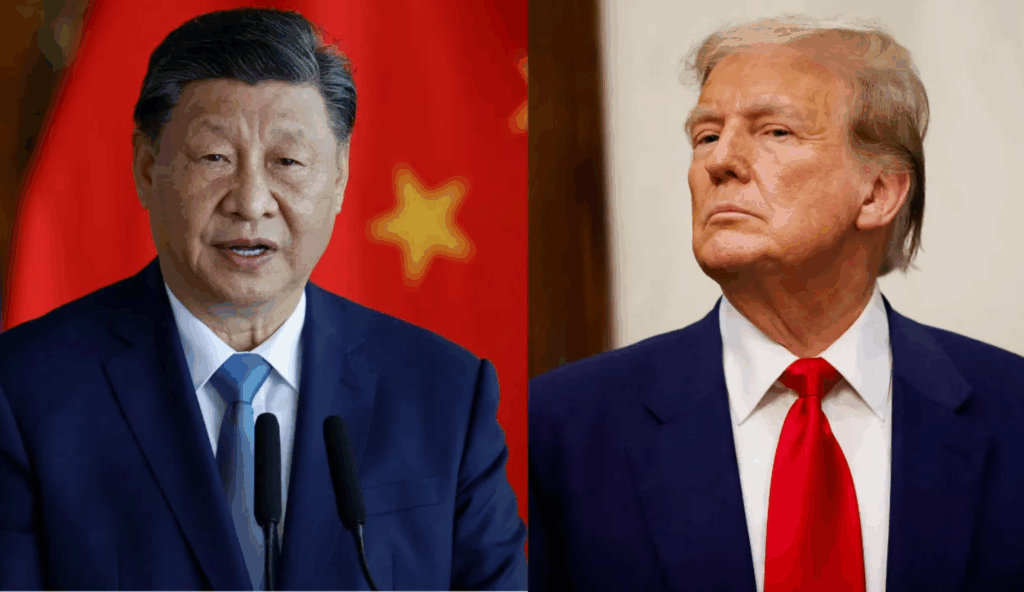

- Trump says a “fair deal” with China is in the works and hints that steep tariffs may soon be reduced.

- The White House is reportedly considering cutting tariffs on Chinese goods by up to 65% to ease economic tensions.

- Markets rallied after Trump promised not to fire Fed Chair Powell and expressed optimism about resolving the U.S.-China trade standoff.

President Donald Trump says a trade agreement with China is still on the table—and if all goes as planned, those massive tariffs might not stick around for long.

“We’re gonna have a fair deal with China. It’s gonna be fair,” Trump told reporters casually on the White House lawn Tuesday. “Everything’s active,” he added when asked if talks with Chinese leaders were underway. Not exactly a full reveal, but definitely not a shut door either.

This softer tone is a bit of a pivot. Just a few weeks ago, things looked rough. The 145% tariffs slapped on Chinese imports were shaking markets and stirring nerves across industries. But now, Trump’s signaling he’s not trying to play “hardball” anymore. In fact, he said the tariffs “will come down substantially”—eventually.

A Big Cut Might Be in Play

According to a Wall Street Journal report, insiders say the White House is mulling over a sizable reduction—potentially slashing those 145% tariffs by anywhere from 50% to 65%. One unnamed senior official said it’s all part of the plan to keep things from spiraling.

“Everyone’s gonna be happy,” Trump promised, before throwing in a signature line: “But we’re not gonna be the country that gets ripped off by everyone else anymore.” He’s not just talking China here—he’s referring to a much broader circle of trade negotiations involving nearly 100 countries.

Markets Breathe Easier

Wall Street clearly liked what it heard. Stocks jumped Wednesday, not only thanks to Trump’s China remarks but also because he said he has “no intention” of firing Fed Chair Jerome Powell—something he’s been hinting at on and off for weeks. Treasury Secretary Scott Bessent also chimed in recently, calling the current U.S.-China trade standoff “not sustainable.”

Trump’s remarks came during an unscheduled stop on the North Lawn, where he was eyeballing a spot for a towering 100-foot American flagpole. Yep, that happened. He even mentioned putting up a second one on the South Lawn—because why not?

Still a Mess, But Maybe Less of One

In recent weeks, the tariff war has gotten intense. The U.S. dropped multiple rounds of import taxes this month, driving up the total rate on Chinese goods to a staggering 145%. Naturally, China fired back with its own set of retaliatory tariffs, topping out at 125% on U.S. exports.

And while the administration gave some wiggle room—exempting stuff like smartphones, chips, and computers from the 125% hit—they’ve said that exemption’s temporary. The 20% blanket tariff tied to fentanyl-related goods is still in place for now.

So yeah… it’s a mess, but maybe a fix is coming?