- Trump says the next Fed chair should consult him on interest rates, a practice he says should return.

- He’s leaning toward Kevin Hassett or Kevin Warsh, signaling a push for faster, lower-rate policy.

- Trump wants rates around 1% or lower next year, following a recent 0.25% Fed cut passed in a tight vote.

President Donald Trump said Friday that whoever becomes the next chair of the Federal Reserve should consult him on setting interest rates. In a Wall Street Journal interview, he argued this kind of coordination “used to be done routinely” and should return, even if the chair doesn’t follow the White House’s view word-for-word. The point, in Trump’s framing, is that the president’s perspective should be heard, especially when rates shape everything from mortgages to market risk.

Hassett and Warsh Emerge as Top Contenders

Trump said he’s leaning toward either National Economic Council Director Kevin Hassett or former Fed governor Kevin Warsh for the role. That shortlist matters because it signals what kind of leadership style could replace Jerome Powell, whose term as chair expires next May. The subtext is pretty clear: Trump wants a chair more aligned with fast easing, and less comfortable with the slower, cautious pacing Powell has often defended.

The 1% Rate Target and “Lowest in the World” Pitch

Trump said he would like to see interest rates at 1%, and “maybe lower than that” by this time next year. He also added that the U.S. “should have the lowest rate in the world,” a line that ties monetary policy directly to competitiveness and growth. The tradeoff, of course, is that pushing rates down too quickly can clash with inflation control, which is exactly the tension the Fed has been managing this year.

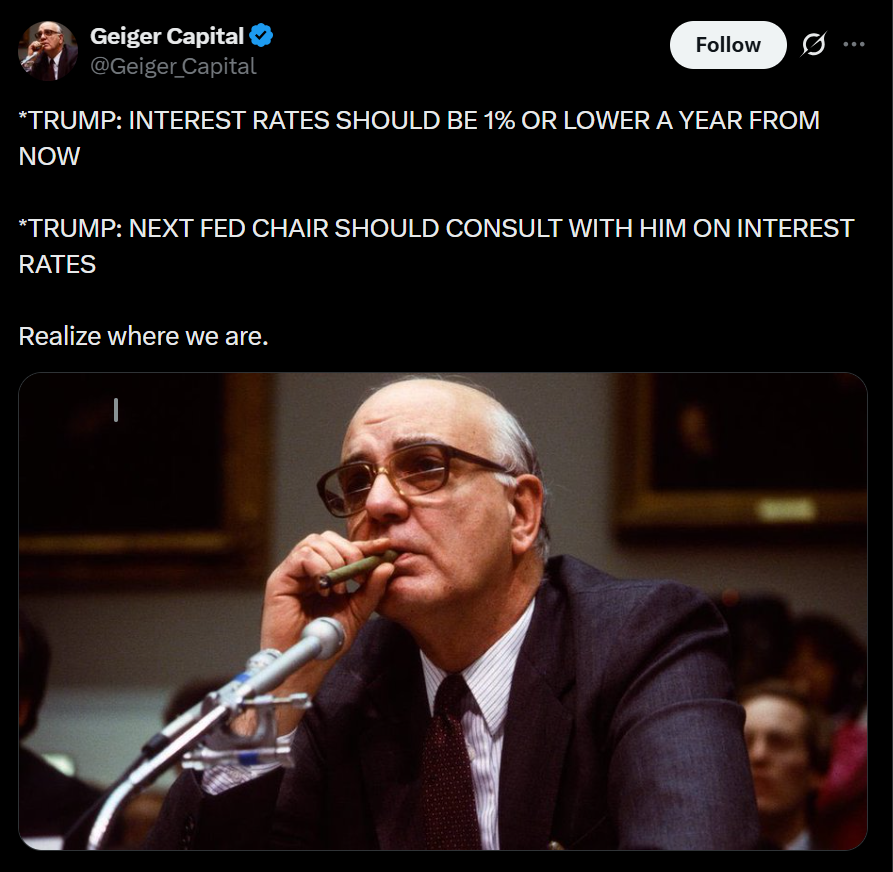

Why This Lands Right After a Divisive Fed Cut

The comments come just days after the Fed cut rates by 0.25 percentage points, a decision that passed in a narrow, debate-heavy vote. That split underscored how sensitive the committee is right now to the inflation-versus-employment balancing act, and Trump is basically stepping into that gap with a louder preference. With Powell heading toward the end of his term, markets may start pricing not just the next cut, but the next chair’s philosophy too.