- Trump Media’s assets surged to $3.1B after buying $2B worth of Bitcoin, making it one of the top corporate crypto holders despite a $20M Q2 net loss.

- Truth Social and Truth+ are expanding globally, with positive operating cash flow and new features like digital wallets, subscriptions, and upcoming AI tools.

- High legal and non-cash expenses—mainly from the 2024 SPAC merger—continue to weigh on financials, but the company remains focused on crypto ETFs and fintech growth.

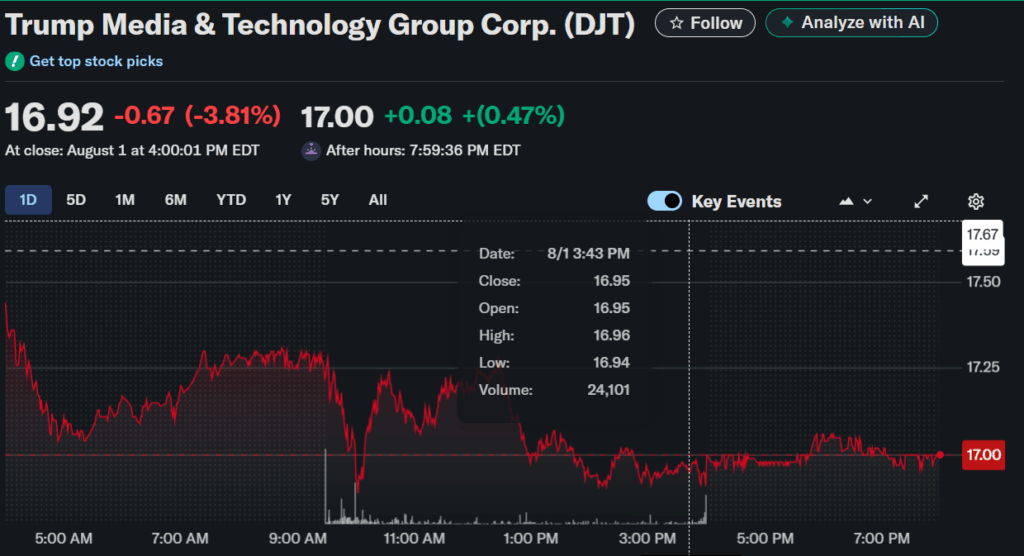

Trump Media & Technology Group (DJT) has officially gone all in on Bitcoin. Despite logging a $20 million loss in Q2, the company’s asset pool swelled to $3.1 billion—fueled mostly by a jaw-dropping $2 billion BTC buy. Shares slipped nearly 4% during the day on August 1, closing at $16.92, but clawed back a little after hours to settle at $17 flat.

Yeah, the loss stings, but that Bitcoin stash? That’s what really turned heads.

A Treasury Filled with Bitcoin

So, here’s what happened: Trump Media pulled in nearly $2.4 billion through a private funding round involving roughly 50 big-money backers. That cash was used to snap up around $2 billion worth of Bitcoin and related crypto assets. This basically catapults DJT into the major leagues of corporate Bitcoin holders.

The company’s pitch? Bitcoin isn’t just a flex—it’s a strategic asset. They’re calling it a safeguard against debanking and a potential income generator. Plus, it gives them financial ammo for future products and acquisitions. The crypto grab happened mostly in July, right after the fundraising wrapped.

Cash Flow, Platforms, and New Tools

Surprisingly, Trump Media recorded positive operating cash flow for the first time—about $2.3 million in the green. That’s a big moment as it pushes expansion of its Truth Social app and the new Truth+ streaming platform. Truth+ is now live in most regions, with its Patriot Package subscription in beta. Think: auto-verification, new posting tools, and eventually, a digital wallet baked right in.

Oh, and they’re also cooking up an AI-powered tool for Truth Social to boost user experience. More features = more users = better engagement. At least, that’s the idea.

Legal Fees Drag, But Future Looks…Interesting

On the downside, revenue only came in at $0.9 million—up just 6% from last year. Meanwhile, legal bills are through the roof—$15 million in Q2 alone, mostly tied to the 2024 SPAC merger drama. Toss in another $20.5 million in non-cash expenses (stock comp, depreciation, etc.) and yeah, it’s messy.

Still, management thinks wrapping up the litigation could clean things up fast. They’re also eyeing a suite of ETFs, some with a crypto twist, to boost their footprint in fintech.