- Trump says the next Fed chair must cut rates immediately

- Kevin Hassett holds a 77% probability of being nominated

- Traders price multiple 2026 cuts as likely, with macro easing back in play

President Donald Trump has made it clear once again: the next Federal Reserve chair must immediately cut interest rates. In a new interview with Politico, Trump said this will be a “litmus test” for whoever replaces Jerome Powell, underscoring his push for cheaper borrowing and faster economic acceleration. His comments come just as markets prepare for tomorrow’s FOMC meeting, where rate-cut advocate Kevin Hassett — now the frontrunner for Fed chair — is pushing for a 25 bps cut.

Hassett dominates the betting markets as rate-cut expectations climb

Polymarket shows Hassett with a 77% probability of being Trump’s nominee, reinforcing the administration’s aggressive rate-cut stance. Several current Fed governors — Chris Waller, Michelle Bowman, and Stephen Miran — have already signaled openness to easing. If Hassett takes over, Trump could gain significantly more influence over the FOMC, though he still needs one additional Board seat for a full voting majority. Powell’s chair term ends in May, though his Board term runs to 2028 — leaving open the possibility of resignation.

Traders are already speculating on how many 2026 cuts are coming

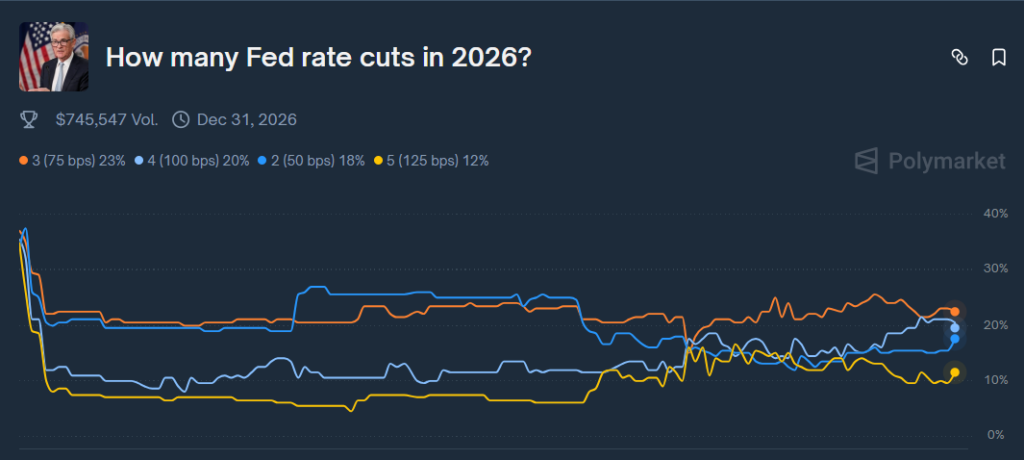

Crypto traders have quickly turned their attention to next year. Prediction markets now price a 23% chance of three rate cuts in 2026, with growing odds for even deeper easing. The probabilities currently sit at:

– 3 cuts: 23%

– 4 cuts: 20%

– 5 cuts: 18%

Powell will preside over three of eight meetings before his chairmanship ends, and he is expected to emphasize tomorrow that all future cuts will remain data-dependent. With PPI inflation data arriving January 14, the Fed will have substantially more input before the first meeting of 2026.

Why this matters for crypto

A Trump-aligned, rate-cut-focused Fed would dramatically shift macro conditions. Lower rates typically expand liquidity, strengthen risk-asset flows, and historically boost Bitcoin and large-cap crypto performance. However, crypto traders remain cautious after October’s unexpected crash despite prior easing. Still, if rate cuts accelerate in 2026 under new leadership, digital asset markets could experience a significant resurgence.