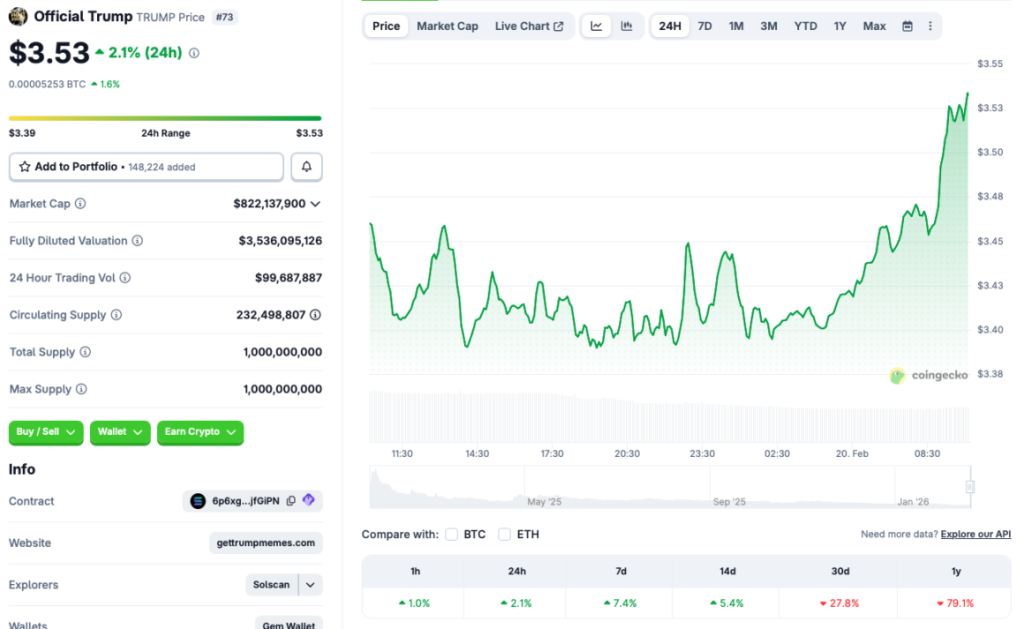

- TRUMP is up 2.1% in 24 hours and 7.4% on the week following the event

- The token jumped from around 98th to 73rd by market cap

- Despite the bounce, TRUMP remains down nearly 80% since February 2025

Trump Coin (Official Trump/TRUMP) is catching momentum after the recent event hosted at the First Family’s Mar-a-Lago property. According to CoinGecko, TRUMP gained 2.1% in the past 24 hours, 7.4% over the week, and 5.4% across the 14-day chart. Its market cap ranking improved significantly, climbing from the 97th–98th range to the 73rd spot.

That sounds impressive on the surface. But zoom out and the picture changes. The token is still down 27.8% over the last month and more than 79% since February 2025. This isn’t a breakout yet, it’s a bounce inside a larger downtrend.

The Mar-a-Lago Catalyst Is Driving Sentiment

The immediate driver behind the rally appears to be the Mar-a-Lago gathering. Reports suggest roughly 400 high-profile attendees were present, including Binance founder Changpeng Zhao, rapper Nicki Minaj, FIFA president Gianni Infantino, and Goldman Sachs CEO David Solomon. President Trump did not attend, but members of the Trump family addressed the audience.

For narrative-heavy tokens like TRUMP, events matter more than fundamentals. Visibility equals liquidity. A room full of recognizable names creates speculation, and speculation fuels short-term price spikes. That’s just how memecoin-adjacent assets behave.

Controversy Keeps the Spotlight On

The Trump family’s deepening involvement in crypto has also generated ongoing debate. Reports that an Abu Dhabi royal acquired 49% of World Liberty Financial shortly before President Trump’s inauguration stirred questions among lawmakers and investors. Whether viewed positively or negatively, these headlines keep attention locked onto the ecosystem.

And attention is oxygen for tokens like TRUMP. The more it trends, the more it trades. But attention can fade quickly once the news cycle moves on.

The Bearish Macro Backdrop Is Still the Bigger Force

Even with this rally, the broader crypto market remains fragile. Bitcoin continues to struggle around the $68,000 level, and most altcoins are still reacting to BTC’s movements. In weak environments, momentum-driven tokens often struggle to sustain gains.

If Bitcoin fails to reclaim higher levels convincingly, TRUMP’s rally could stall. The current upswing looks sentiment-driven rather than structurally supported. In bear markets, sentiment pumps tend to be short-lived unless reinforced by sustained volume.

What Happens Next?

For TRUMP to extend its rally, it needs more than one high-profile event. It needs consistent volume and a stable or improving Bitcoin backdrop. If those align, the token could push higher in the short term.

But if the broader market weakens again, TRUMP is likely to face renewed selling pressure. Right now, this looks like a narrative spike in a cautious market, not a confirmed trend reversal.