• TRUMP Coin rallies 43% in a week amid optimism around U.S.–China trade progress.

• Fed rate cuts failed to lift most assets, but TRUMP defied the trend.

• Analysts warn a 30% pullback could follow as momentum cools.

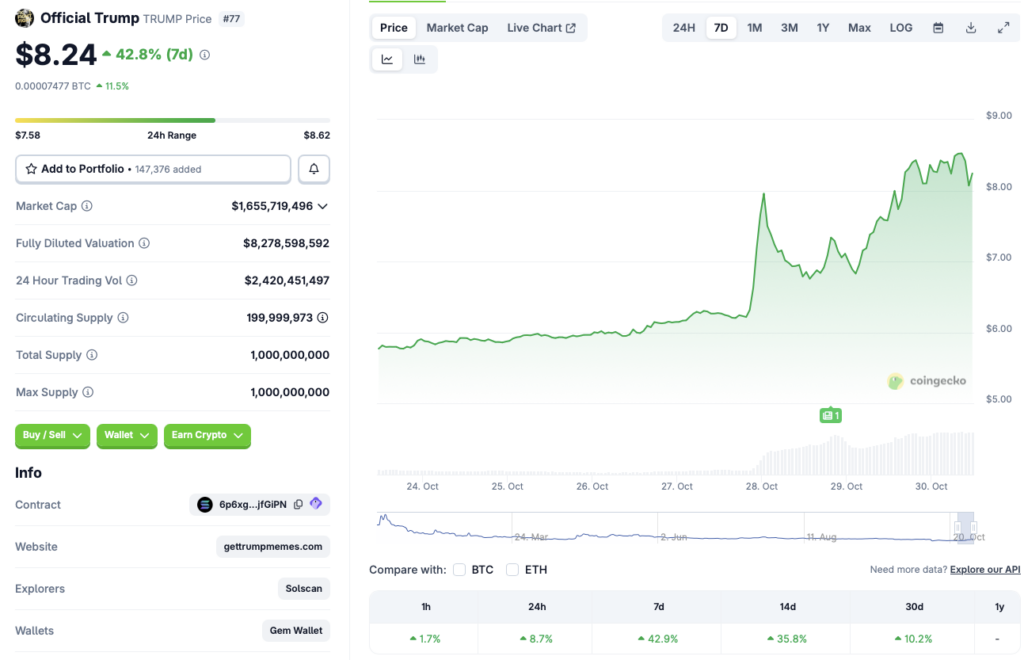

While most of the crypto market is struggling through a correction, Trump Coin (TRUMP) is moving in the opposite direction — and fast. According to CoinGecko, TRUMP has jumped 8.7% in 24 hours, 42.9% in the past week, and 35.8% over the last 14 days, showing strength across every major time frame. Even as Bitcoin and other top assets slide, TRUMP continues to post green candles, surprising traders who expected broader sell pressure to weigh on all altcoins.

The Trade Deal Boost

The key catalyst seems to be renewed optimism around U.S.–China trade talks. Earlier this month, the market tanked after tensions escalated, triggering massive liquidations. But sentiment shifted when President Trump announced progress toward a new deal, and risk appetite briefly returned. The news helped TRUMP outperform peers, as investors linked the memecoin to political optimism and Trump’s economic narrative.

At the same time, the Federal Reserve’s latest rate cut failed to lift broader markets. Fed Chair Jerome Powell’s cautious remarks on inflation and slow growth dampened risk appetite, sending most cryptocurrencies lower. Still, TRUMP held its momentum — likely benefiting from a mix of hype, political relevance, and renewed speculative inflows tied to the trade news cycle.

Analysts Warn of Short-Term Pullback

Despite the strong rally, analysts aren’t convinced it will last. CoinCodex projects TRUMP’s price could drop to $5.73 by November 8, implying a 30% correction from current levels. With Bitcoin still struggling to hold $110,000, broader market pressure could easily spill over into meme tokens like TRUMP once the news-driven momentum fades.

Still, the short-term action reflects one clear trend — political coins remain hot in 2025, especially when headlines revolve around Trump’s policies or global negotiations. For traders, that volatility can mean opportunity, but it also comes with a heavy dose of risk.