- Rex filed for crypto-focused ETFs, including funds tied to TRUMP, DOGE, Bitcoin, and Ethereum.

- The TRUMP ETF aims to track the volatile TRUMP memecoin, which briefly hit a $15 billion market cap.

- SEC approval of these ETFs could signal a major regulatory shift under the new administration.

Rex has submitted new ETF registration documents to the Securities and Exchange Commission (SEC), proposing several cryptocurrency-focused funds, including ETFs tied to TRUMP, DOGE, BONK, Bitcoin, Ethereum, XRP, and Solana. The filings showcase a bold move to incorporate both traditional and meme-inspired crypto assets into mainstream finance.

TRUMP ETF and Market Impact

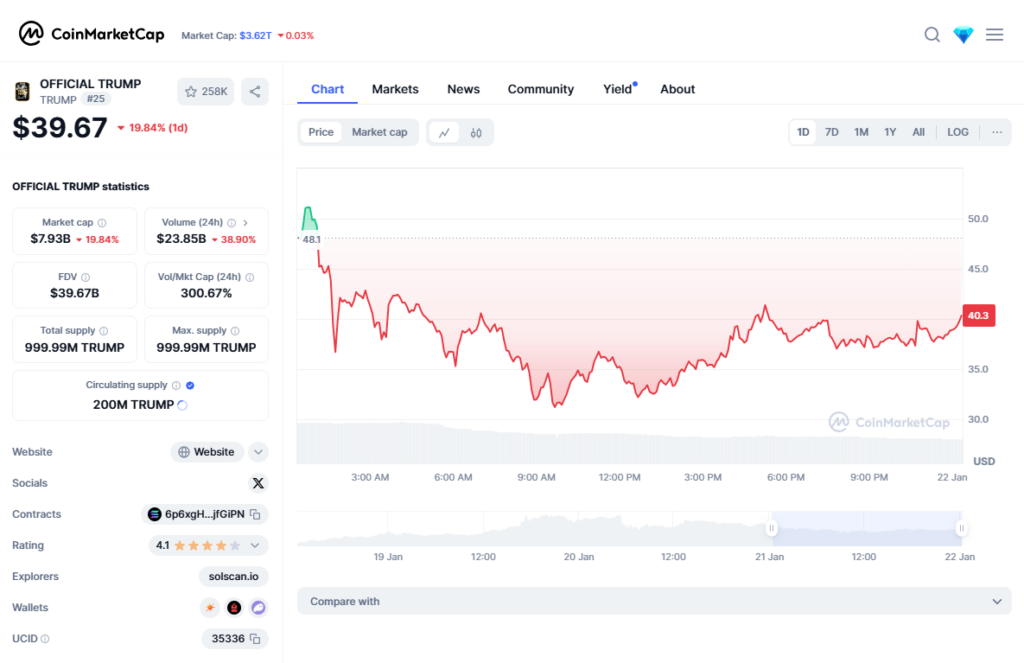

The proposed TRUMP ETF aims to track the performance of the TRUMP memecoin, launched before Donald Trump’s inauguration. The filing highlights TRUMP’s rapid ascent, briefly reaching a $15 billion market cap before dropping by 50%, emphasizing its volatile nature. The ETF would gain exposure through direct holdings, futures contracts, and swap agreements.

SEC’s Evolving Stance

Historically cautious about crypto ETFs, especially those tied to novel assets, the SEC’s decision on these funds could signal a significant shift under the new administration. The inclusion of memecoin-based ETFs like TRUMP and DOGE marks a potential departure from the regulatory conservatism seen during Gary Gensler’s tenure.

Broader Implications for Crypto ETFs

If approved, these ETFs could reshape the market by blending traditional assets with meme-driven tokens, reflecting the growing cultural and financial influence of cryptocurrencies. However, the SEC’s evaluation of portfolio risks and memecoin volatility will be crucial in determining their fate. For now, Trump’s silence on crypto matters leaves the future of these initiatives uncertain.