- Trump’s 2025 presidency may bring pro-crypto policies fostering decentralized finance expansion and innovation.

- Bitcoin’s price surges often drive increased activity and innovation across DeFi platforms.

- Bitcoin staking could become a mainstream investment strategy as the asset nears $100,000.

Speculation is mounting in the cryptocurrency industry as Donald Trump’s incoming administration is expected to potentially shape a more favorable landscape for decentralized finance (DeFi) and Bitcoin staking. Marcin Kaźmierczak, co-founder of RedStone, expressed optimism about the administration’s possible impact on digital finance policies during a recent interview.

Kaźmierczak stated that policy shifts under the new administration could push DeFi from a niche sector to the mainstream by reducing regulatory hurdles and promoting innovation. He also highlighted how Bitcoin’s price growth typically fuels broader DeFi activity, creating a ripple effect across decentralized platforms.

Pro-Crypto Policies and Challenges

Trump’s administration is expected to foster policies aimed at easing barriers in the cryptocurrency space. Kaźmierczak noted that such policies could catalyze growth across DeFi platforms, potentially leading to the emergence of new digital finance paradigms.

Despite this optimism, challenges remain. The recent launch of Trump’s World Liberty Financial (WLFI) token faced setbacks, including a complex purchasing process and technical issues, leading some observers to question its execution.

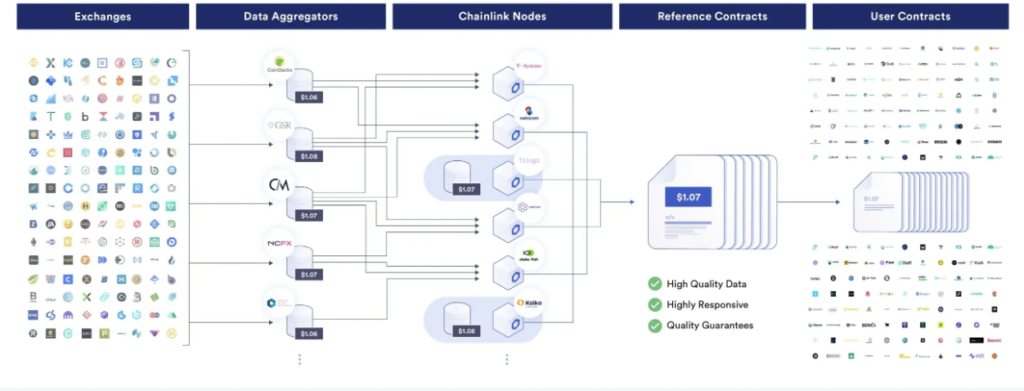

Source: Chainlink

Bitcoin Staking as a Game-Changer

Kaźmierczak also discussed Bitcoin staking as a transformative investment strategy, particularly as the cryptocurrency approaches the $100,000 mark. He predicted that staking could become as common as stock dividends, attracting a diverse range of investors, from retail traders to institutional funds.

The potential for Bitcoin to serve as both a store of value and a source of income could enhance its appeal, especially with reduced selling pressure from long-term holders. However, Kaźmierczak warned that Bitcoin’s well-known volatility might remain a challenge for conservative investors.

As the cryptocurrency market continues to evolve, the next few years under Trump’s administration could be pivotal for advancing decentralized finance and reshaping Bitcoin’s role in investment portfolios.