- TRON’s daily transactions nearly doubled since Sept. 2023, hinting at strong recovery

- Whales and investors are loading up on TRX, while retail stays cautious—for now

- Price faces tough resistance at $0.28, but rising network activity may tilt things bullish

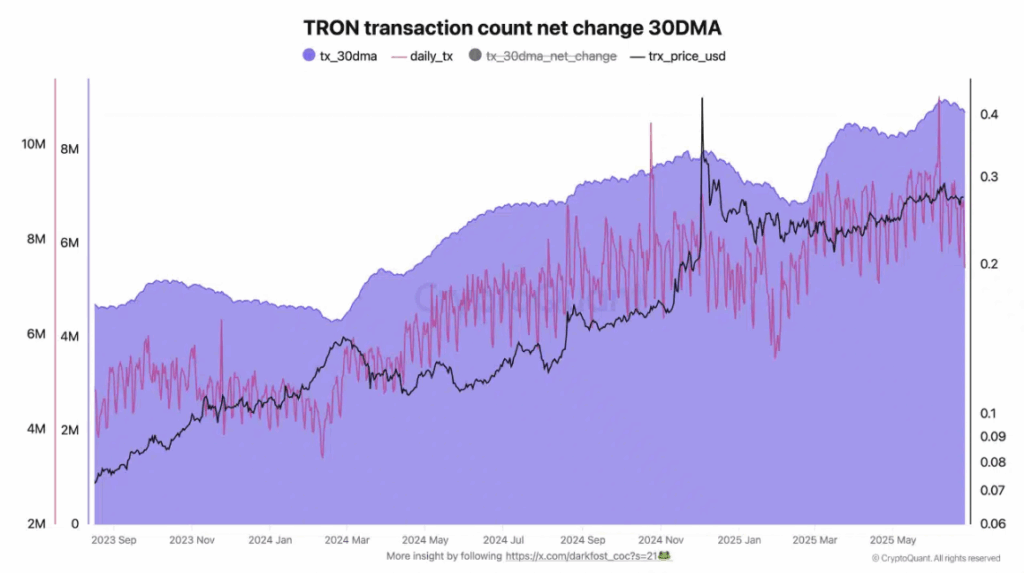

TRON (TRX) has been quietly doing its thing—no massive headlines, just steady growth under the surface. Since September 2023, TRON’s daily transactions have nearly doubled. Yeah, from less than 5 million to close to 9 million. That’s not a small jump, and it hints at a strong comeback from the brutal bear market.

Right now, TRX sits around $0.2713. Part of that push? A small bump in network fees—still paid in TRX—which helped juice demand a bit. More TRX flowing through the system means more network revenue, and that kinda stuff tends to act like price glue, y’know?

Big Wallets Making Big Moves

Zooming in on TRX holders, the whales are clearly feeling it. Over the past month, their holdings jumped 9.38%. But even more interesting? Investor-level wallets—those in-betweeners—notched a 43.01% rise. Retail wallets, on the other hand, barely budged at 3.57%.

That gap says something. The big dogs are buying in, betting on a mid-term upside, while smaller folks are still a bit shy. If retail suddenly joins the party, that extra fuel could give TRX a stronger base to push off from.

Social Buzz and Some Mixed Vibes

Social media chatter about TRX? It’s heating up. After months in the shadows, TRON’s Social Dominance popped past 1.4% before cooling down again. That’s a solid sign of renewed public interest—likely stirred by the price moves and the on-chain pickup.

But, not everything’s looking super sunny. TRX’s funding rates are all over the place. One minute they’re positive, next thing you know—bam, back in the red. That flip-flopping hints at hesitation among futures traders. The good news? It keeps long-side leverage in check, which could make any gains that do come a bit more durable.

Resistance Ahead, But the Core’s Solid

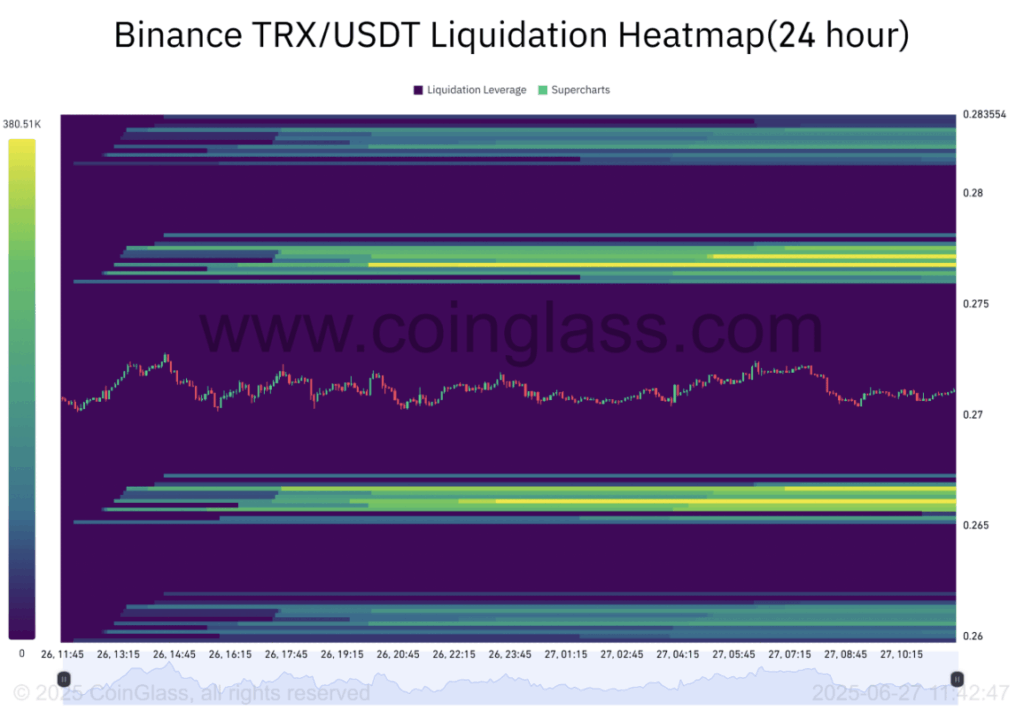

TRX is bumping into some serious resistance between $0.275 and $0.283, where a chunk of leveraged positions are sitting like dominoes. Any move into that range could cause some forced liquidations—messy stuff. On the flip side, there’s some decent support between $0.265 and $0.26, giving it a narrow band to play in.

Unless buyers shove it past $0.28 with conviction, TRX could just bounce back and forth for a bit. Still, with increasing transaction counts, whale accumulation, and social buzz all moving up, the fundamentals are kinda working in its favor. If sentiment turns and derivatives settle, TRX might just break free from the squeeze.