- TRON rebounds from its 250-day moving average, signaling strong accumulation.

- A falling wedge pattern hints at a potential bullish breakout above $0.35.

- Analysts see renewed strength across TRON’s ecosystem, led by growing interest in ARES.

TRON (TRX) might be gearing up for something big. After a small dip that pulled the price close to $0.35, the network’s been showing quiet signs of strength, holding steady on key support zones. Analysts are starting to believe that TRON’s recent behavior — the steady accumulation, the refusal to break down — might be a signal that it’s preparing for its next bullish phase.

At the moment, TRX trades around $0.3119, down just 1.65% in the past day. Its market cap sits near $29.5 billion, with daily trading volume just under $3 billion. While that drop might sound mild, the underlying market structure is what’s catching everyone’s eye. Technical indicators show a simmering strength building beneath the surface — not flashy, but solid.

TRX Finds Its Footing at the 250-Day Moving Average

One of the most interesting signals comes from the 250-day moving average, often called the Mayer Multiple 1.0. This line’s been a strong indicator of long-term bull markets in the past, and TRX just bounced right off it. According to crypto analyst Crypto Patel, that kind of rebound often means one thing: accumulation. Long-term buyers quietly loading up.

Historically, the 250-day MA marks where uptrends begin. When prices hover and recover from that point, it tends to show confidence — and this time looks no different. TRX’s current consolidation mirrors previous setups that led to multi-month rallies. Patel mentioned this might just be the calm before a major push upward, with TRX gathering momentum behind the scenes.

Wedge Pattern Adds Fuel to the Bullish Fire

Adding more optimism to the mix, TRX’s latest pullback also landed on the 0.382 Fibonacci retracement level, a common reversal area. Here, it’s started to form a falling wedge pattern, which often signals that the market’s about to flip direction. In other words, TRON could be quietly coiling up for a breakout.

The Potential Reversal Zone (PRZ) sits right on top of this strong support level — a sweet spot where past price action suggests buyers tend to step back in. Still, crypto being crypto, nothing’s ever guaranteed. Analysts warn that volatility can flip the script quickly. But with steady accumulation and increasing on-chain activity, TRON’s setup looks promising.

TRON Ecosystem Shows Signs of Expansion

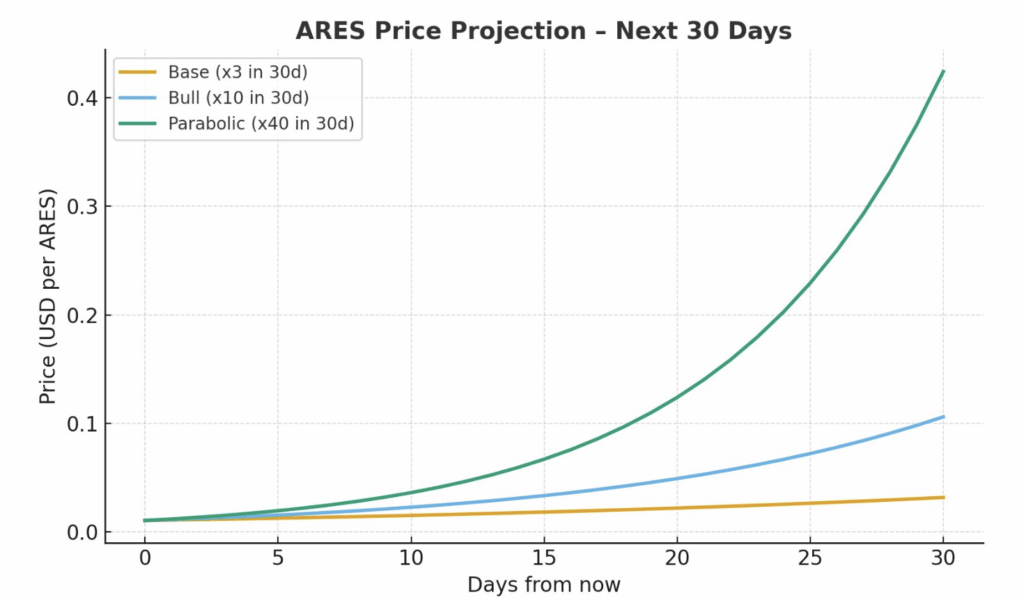

Beyond TRX itself, eyes are turning toward the ARES token in the TRON ecosystem, which is trading at around $0.0106. Analyst M. Yilmaz mapped out a few potential scenarios: a modest 3x rise, a strong 10x breakout, or a full-on parabolic move — something like 40x if momentum really catches fire. That would push ARES near $0.42, which feels ambitious but not impossible in a bullish environment.

With TRON’s core support holding strong and its ecosystem showing renewed energy, the broader sentiment is leaning bullish. If momentum keeps building like this, TRX could re-enter a powerful uptrend later this year, potentially kicking off its next big cycle. For now, all signs point to patience paying off — just the way it usually does before the real move begins.