- TRX outperformed the broader market, climbing above $0.31 as other top coins weakened

- Tron’s stablecoin market cap hit a new all-time high above $84 billion

- Rising address activity, transaction volume, and treasury accumulation are supporting demand

TRX pushed up to $0.31 earlier in the day, extending a recovery that quietly started mid-week. What made the move stand out was the timing, as most top cryptocurrencies were sitting in the red on the weekly chart. While Bitcoin and Ethereum struggled to hold any real upside momentum, TRX managed to move in the opposite direction, which caught traders’ attention pretty fast.

This wasn’t the first time TRX has broken away from the broader market trend either. Since Wednesday, the token is up more than 5%, while many large caps failed to find traction. The shift higher began after TRX’s RSI briefly dipped below the 50 level, a zone that often resets momentum. A closer look suggests this bounce wasn’t just technical noise, but tied to strengthening on-chain activity.

Tron Network Stablecoin Count Hits a New High

TRX’s price recovery lines up with a major milestone inside the Tron ecosystem. The network’s stablecoin market cap has surged to a fresh all-time high, signaling renewed demand flowing through the chain. Data from DeFiLlama shows Tron’s stablecoin supply pushing past $84 billion for the first time this week, a level it hadn’t reached before.

What makes this more interesting is the contrast with Ethereum. While Ethereum still holds a much larger stablecoin market overall, its supply slipped from roughly $164 billion to $161 billion since mid-January. Tron, meanwhile, keeps climbing. That trend reflects a long-term strategy, as Tron has spent years positioning itself as a go-to network for stablecoin transfers, mainly because transactions stay cheap and fast, even during busy periods.

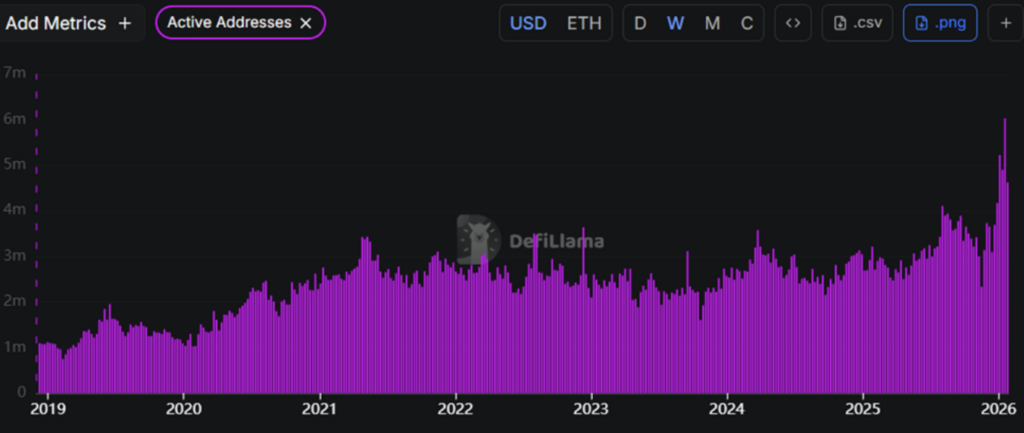

Address Activity and Transactions Continue to Climb

Demand for TRX is also showing up clearly in network usage. Weekly active addresses on Tron crossed 6 million between January 12 and 18, marking the first time activity has reached that level. The build-up has been steady since November, and even before this jump, the network was already on track to exceed 5 million active addresses this month.

More addresses naturally lead to more transactions, and the data confirms it. Daily transaction counts were sitting near 9.2 million at the end of December, then climbed sharply to around 12.2 million by mid-January. Activity has stayed elevated over the past couple of days, reinforcing the idea that TRX’s price strength is being backed by real usage, not just speculation. In Q4 alone, daily transactions consistently pushed above 10 million, with address activity outpacing Q3 levels.

Tron Inc. Adds to TRX Reserves

Network growth isn’t the only factor supporting TRX right now. Tron Inc. has also been adding to its own TRX reserves as part of a longer-term treasury strategy. The company recently disclosed the purchase of 165,824 TRX, bringing its total holdings to around 677 million TRX.

While this latest buy isn’t large enough to move the market on its own, it does add to the broader narrative. As the reserve grows, it helps establish a stronger perceived floor for the asset. Combined with rising stablecoin usage and expanding network activity, the recent TRX price move looks less like a random spike and more like a response to improving fundamentals, even if volatility still lingers.