- TRON Futures market shows strong buyer dominance with inflows surging 170%.

- Spot market selling pressure still weighs heavy, keeping TRX capped.

- USDT supply on TRON hits $23B, signaling rising network demand.

TRON [TRX] has been stuck in a tight trading pocket lately, barely moving outside the $0.34 to $0.35 band. After bouncing up to $0.3549 a few days back, the token hasn’t been able to break free, instead drifting slightly lower. At press time, TRX traded near $0.351, down about 0.17% in the last 24 hours. While the market cools, some investors are quietly positioning themselves, waiting for the next decisive move.

Futures Market Shows Strong Buyer Activity

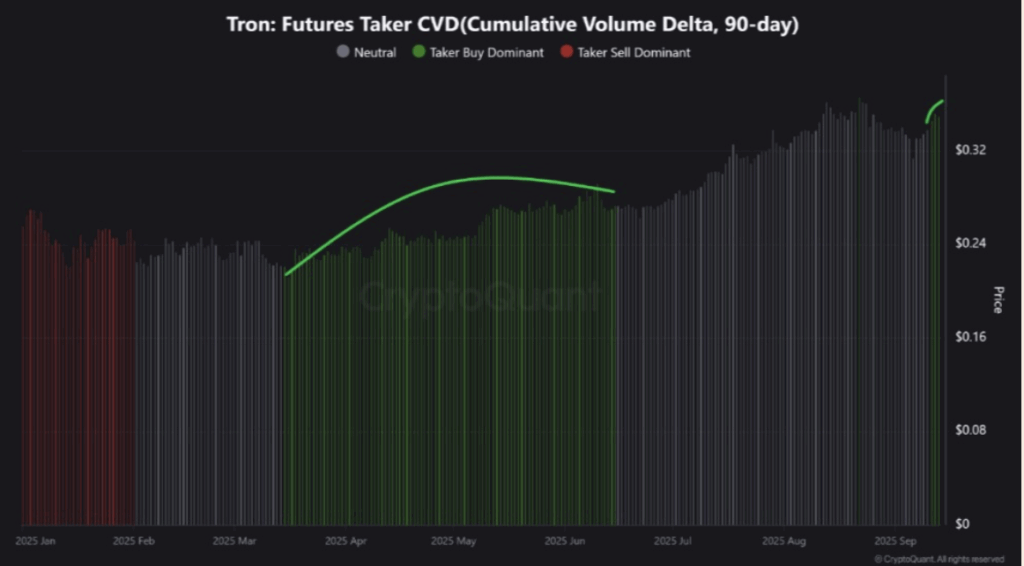

According to analyst Burak Kesmeci, TRON’s Futures market has seen a noticeable shift. The Taker CVD (90D) flipped green for three days straight, only the second time that’s happened in 2025. The last stretch of green activity ran from mid-March to mid-June — during that period, TRX climbed from $0.26 to $0.29. That’s usually a sign buyers are tightening their grip.

CoinGlass data backs this up, showing a Futures inflow of $75.38 million compared to $67.91 million in outflows. That pushed Futures Netflow up by 170% to $7.48 million. In simple terms, capital is flowing in, and buyers seem to be gaining the upper hand.

Spot Market Tells a Different Story

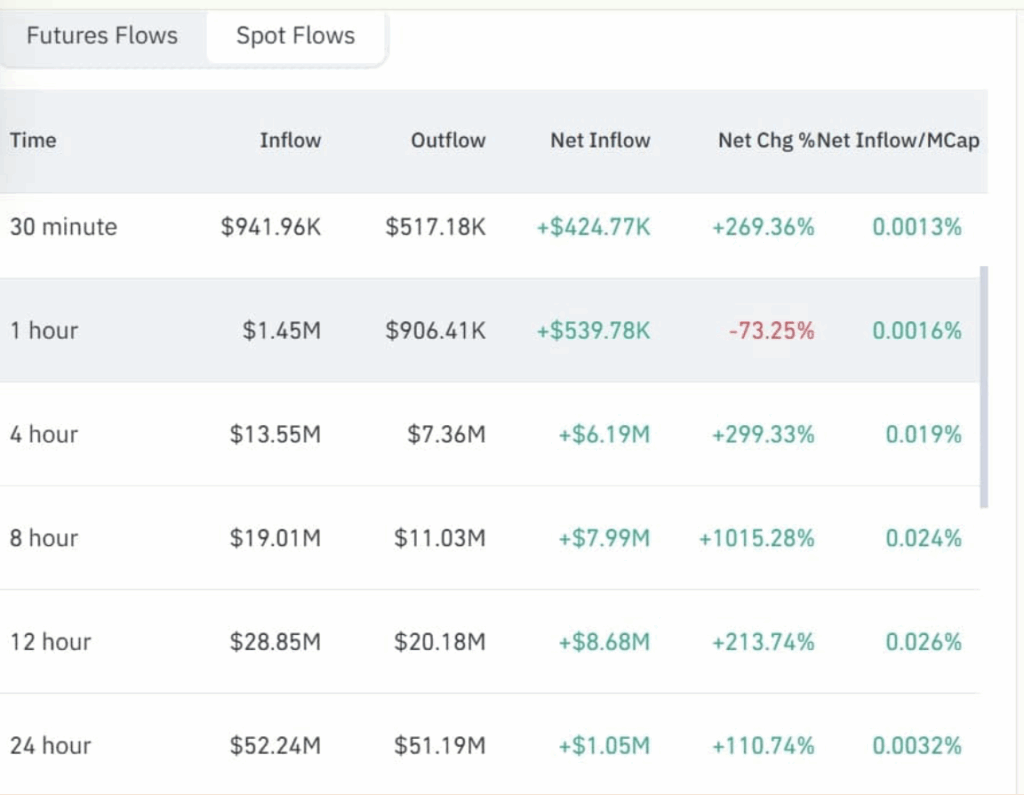

But while Futures look bullish, the Spot market is flashing red. Data shows the Spot Taker CVD (90) has stayed negative for an entire month, meaning sellers are hitting bids harder than buyers are lifting asks. That imbalance points to bearish sentiment.

Adding to that, TRON’s Spot Netflow flipped positive again after two straight days in the negative. With $52.24 million flowing in against $51.19 million out, netflow jumped 110% to $1.05 million. That’s a clear signal of heavy spot selling pressure, which could limit upward momentum.

USDT Supply on TRON Hits Record Levels

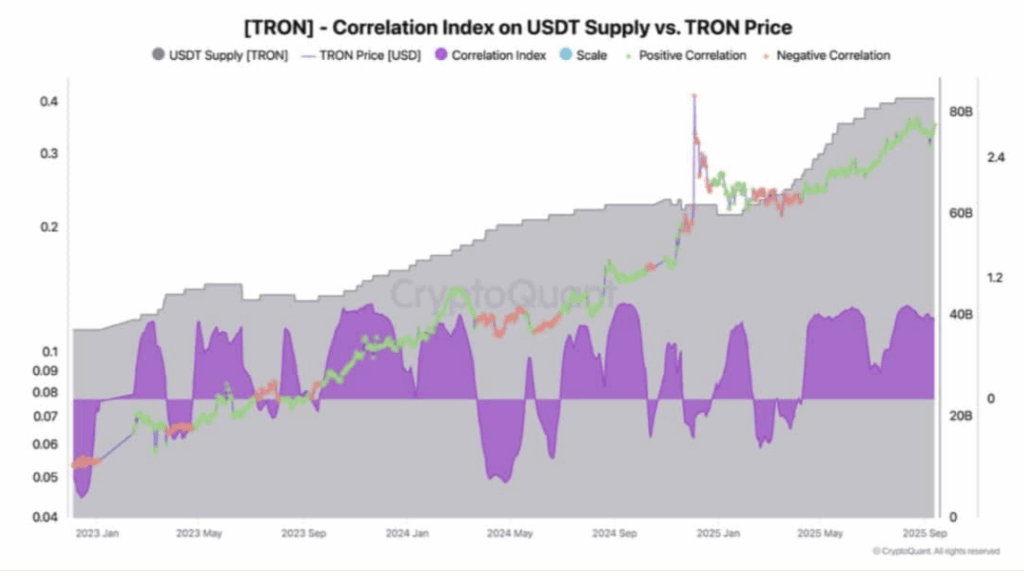

Outside of trading activity, TRON has quietly been seeing massive growth in stablecoin usage. Data from analyst Darkfost shows the USDT supply on TRON reached $23 billion in 2025. Historically, spikes in USDT supply on the network tend to precede strong rallies in TRX, as higher stablecoin flows usually point to surging demand and user activity.

TRON Price Prediction: Rally or More Sideways Action?

Right now, TRON’s setup looks like a tug-of-war between bullish Futures markets and bearish Spot activity. If the Futures inflows stay strong and USDT supply continues climbing, TRX has a real shot at breaking out of its range and aiming for $0.37.

But if sellers keep pressing in the Spot market, price may remain trapped in consolidation, with $0.344 acting as the key support. The next few sessions could decide whether TRON finally rallies or stays locked in its sideways grind.