- TRX is holding near $0.30 despite a small dip; USDT supply on TRON now exceeds $80B.

- Technicals show strength—RSI and MACD lean bullish, with resistance at $0.31 in focus.

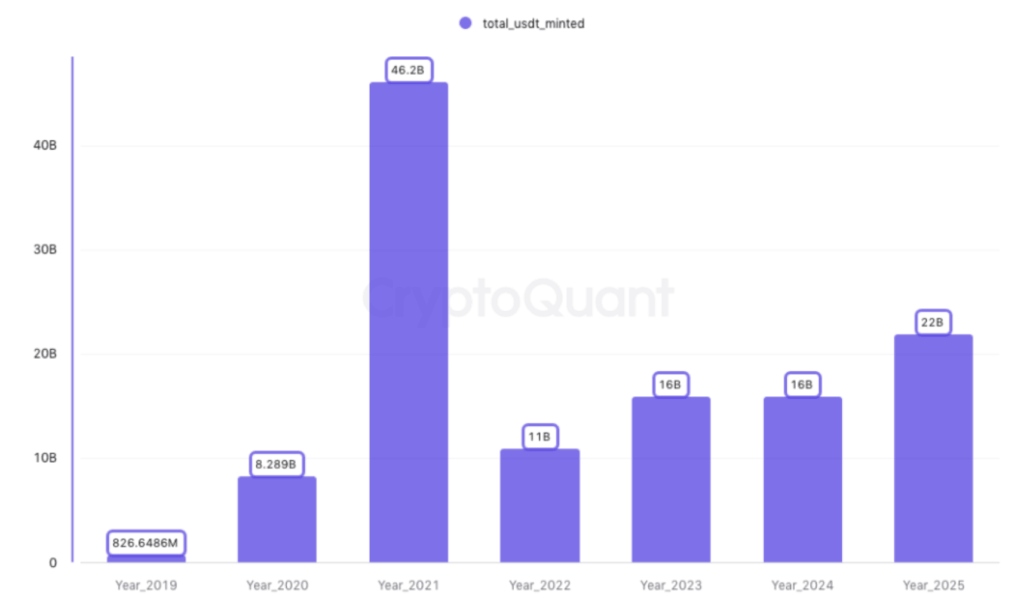

- USDT mints on TRON in 2025 already beat full-year totals for 2023 & 2024, hinting at institutional demand.

TRON (TRX) is holding firm near $0.30 even after a slight 0.76% dip in the last 24 hours. Might seem minor on the surface, but under the hood? Momentum’s still cooking. Technicals look strong, and TRON’s becoming a powerhouse for stablecoins—especially Tether (USDT), which is flooding the network like never before.

Here’s the kicker: over $80 billion worth of USDT now lives on TRON. That’s not just a new milestone—it’s a serious flex. In just the first half of 2025, more than $22 billion in USDT has already been minted. That’s more than the entiresupply added in both 2023 and 2024, which hovered around $16B each. We’re talking a 38% leap over previous records.

And get this—there’ve been three separate $2 billion USDT mints this year alone. None of those happened in 2024. That kind of volume doesn’t just appear—it usually means big institutions are stepping in or some serious back-end deployment is underway.

Technicals Still Lean Bullish (With a Bit of Caution)

TRX is trading above all the major moving averages right now. The SMA7, 20, 50, and 200 are stacked up nicely at $0.30, $0.29, $0.28, and $0.25 respectively. That upward slope tells a pretty clean story: bulls are still in charge.

The RSI’s hanging out at 69.39, getting close to overbought territory, but not quite flashing red lights just yet. MACD? Still positive—sitting at 0.0071 with a bullish histogram ticking at 0.0016. There’s some steam left in this engine.

Stochastics are a bit spicy—%K is at 77.19 and %D at 83.14. It’s flirting with overbought, but nothing’s rolled over yet. Meanwhile, TRX is hugging the upper Bollinger Band at $0.31, with %B at 0.8255. That usually means strong momentum—and maybe a breakout’s coming if resistance cracks.

ATR’s sitting at $0.01, which signals low volatility. Some traders might love that—less whipsaw, more control.

Crunch Zone: $0.31 Resistance vs. $0.30 Pivot

Right now, TRX is tap-tap-tapping on the $0.31 ceiling, while the $0.30 pivot holds underneath. Break above? It could open the gates for another leg up. Fall back? You’re looking at support catching it around $0.27 or $0.26.

On the 12-hour chart, TRX has stayed above $0.30 since that breakout earlier in July. And really, the uptrend’s been alive since March—higher lows, higher highs, steady volume. That’s the stuff bulls dream about.

TRON’s Stablecoin Crown Gets Heavier

TRON isn’t just vibing with price action—its network utility is booming too. USDT minting is exploding thanks to the blockchain’s low fees and fast transaction times. It’s becoming the default highway for stablecoins. And the latest numbers? Kinda wild.

2021 was the king year for USDT issuance on TRON with $46 billion printed. But 2025’s already knocking at the door—and it’s only July. If this pace keeps up, we’ll be looking at an all-time high by year-end.

That breakout over $0.30 matters too. It wasn’t just a number—it was a psychological lid holding TRX back since late last year. Clearing it, with volume spiking, gives this rally more legs.

TRON’s 52-week range runs from $0.16 to $0.43. Right now, we’re consolidating near key resistance with a lot of bullish tailwinds. Above every moving average, growing network usage, and more stablecoin action than any other chain—it’s got fuel. Let’s see if it takes off.