- TRX and XRP stay strong: Over 80% of Tron and Ripple holders remain in profit, making them some of the most resilient assets despite recent market dips.

- ETH and SOL struggle hard: Ethereum and Solana have seen steep profitability drops, with only 44.9% and 31.6% of holders in profit, respectively, signaling deep losses.

- Bitcoin, TON, and DOGE hover in the middle: Bitcoin and Toncoin maintain solid profitability, while Dogecoin is on the edge, with just 50.8% of its supply still in the green.

So, while the crypto markets are still riding out the aftershocks of recent turmoil, on-chain data from Glassnode just dropped an interesting nugget: some tokens are holding up way better than others when it comes to profitability.

Let’s break it down—because the numbers are kinda wild.

TRX & XRP: Holders Still Laughing (Kinda)

At the top of the heap? Tron (TRX). Yup, somehow still holding strong with 84.6% of its supply sitting in profit. That’s only a 5.6-point dip year-to-date. Not too shabby.

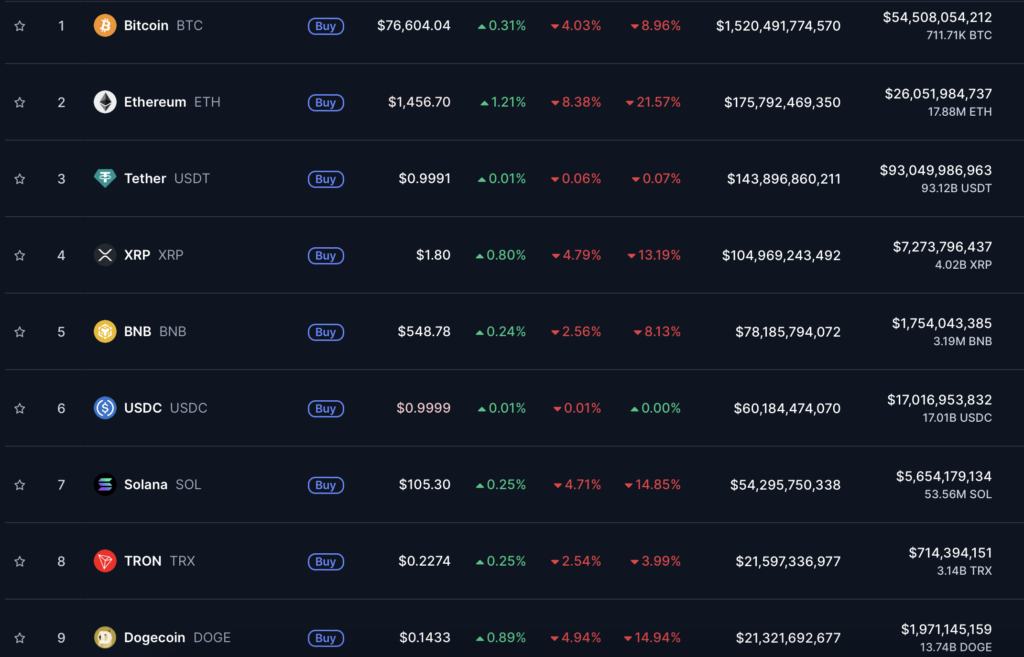

TRX is trading around $0.2349, up 4% in the past 24 hours. It just pushed above its 20-day EMA at $0.2334, which usually signals positive short-term momentum. And hey, it’s still not far off from its all-time high of $0.44, hit just four months ago.

Right behind it is XRP, with 81.6% of its supply in profit. Sure, it’s down 10.4 points YTD, but that’s still solid compared to the broader bloodbath. XRP is hovering near $1.87 after a nice 7.28% pop.

The catch? It needs to reclaim $2 and then break above resistance at $2.13 if it wants to make a real move higher. Still, not a bad spot to be.

ETH & SOL: Yikes. Just… Yikes.

Ethereum (ETH), not so lucky. Only 44.9% of ETH holders are still in profit—a drop of almost 40 percentage points since the year began.

Even after a mild 5% rebound in the past day, ETH is still down nearly 30% for the month and sitting over 50% belowits all-time high of $4,878. And let’s not forget—it hasn’t made a new high this cycle. Not once.

Oh, and just to add a little drama, a dormant whale—an Ethereum OG, apparently—just moved 2,000 ETH ($3.11 million) to Kraken after seven years of sitting on it. Make of that what you will.

Solana (SOL)? Even rougher. Only 31.6% of SOL’s supply is profitable right now, down nearly 47 points YTD. Despite a nice little bounce to $107 (up 7.7% today), it’s still facing tough resistance at the $122 zone. Plenty of holders still very much underwater.

The In-Between Crew: BTC, TON, ONDO & DOGE

Not everything’s black or white, though. Some major coins are hanging out somewhere in the middle.

Bitcoin (BTC), for example, still has 76.8% of its supply in profit—even after slipping nearly 12 points YTD. It briefly popped above $80K (thanks to some fake news about Trump delaying tariffs), but has since pulled back to around $78,923.

Toncoin (TON) and Ondo (ONDO) are both holding up fairly well, with 76.7% and 74.3% of their supplies in profit, respectively. TON’s trading around $3.11, and ONDO just bounced 6.7% today to $0.7478.

Dogecoin (DOGE), meanwhile, is straddling the line. Right now, 50.8% of its supply is profitable, down 32.3 points this year. It’s trading at about $0.1504 after a decent 7.5% jump.

But here’s the twist: some analysts think DOGE might be headed for a breakdown to $0.06 if it fails to hold this momentum. That would be a steep drop, obviously—but with meme coins, nothing’s ever really off the table.