- TORN jumped 71% after the U.S. removed Tornado Cash wallets from its sanctions list.

- A federal court ruled Tornado Cash’s code is autonomous and can’t be sanctioned like a person or company.

- The U.S. Treasury remains focused on stopping North Korea’s crypto-funded cybercrime operations.

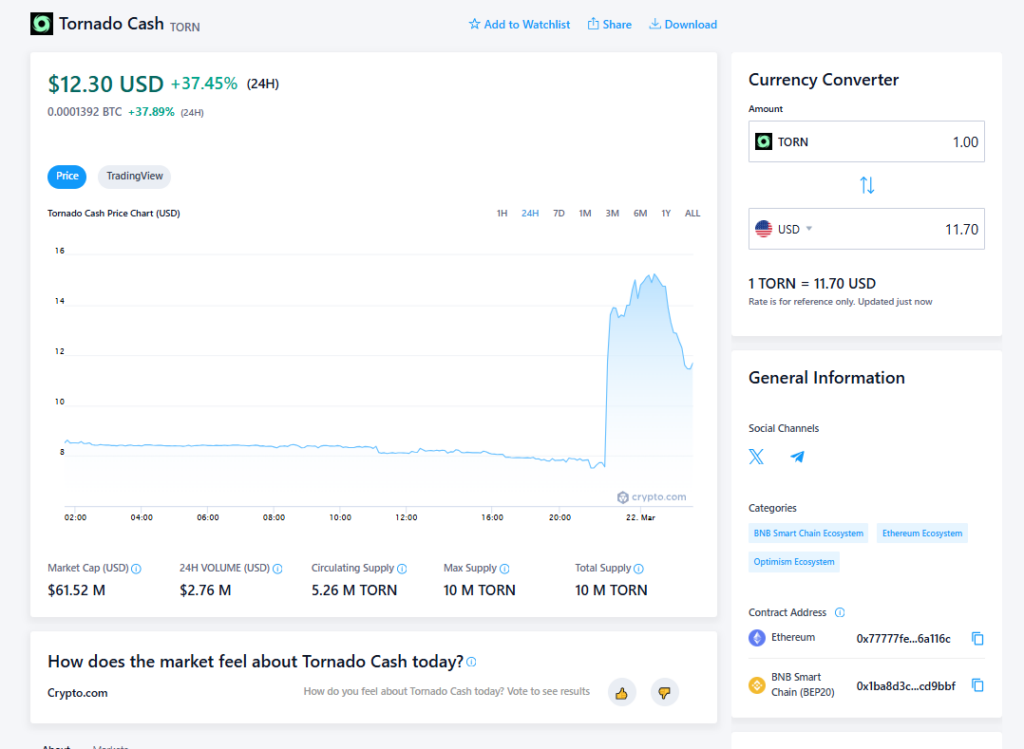

The crypto world saw a jolt of energy on March 21 as TORN, the native token of privacy protocol Tornado Cash, rallied more than 70%—all within a single day. The reason? The U.S. government just took a step back.

OFAC Delists Tornado Cash Wallets

The Office of Foreign Assets Control (OFAC) announced it had officially removed several Ethereum wallet addresses tied to Tornado Cash from its sanctions list. This marks a turning point for the decentralized privacy protocol, which had been under fire since 2022 when it was accused of being a tool for money launderers—including North Korea’s infamous Lazarus Group.

After the announcement, TORN soared to $12.90, up a wild 71% in 24 hours. Privacy advocates and DeFi fans quickly flooded social media with celebration, calling the move a win for decentralized tech and individual privacy.

Legal Clarity: Tornado Cash Isn’t Going Away

Tornado Cash was built to make Ethereum transactions more private. It mixes users’ assets in a smart contract pool, then lets them withdraw, making it tough—sometimes impossible—to trace the origin of the funds.

In 2022, OFAC sanctioned the protocol. But in January 2025, a federal judge in Texas delivered a landmark ruling: Tornado Cash’s smart contracts couldn’t be sanctioned because they’re autonomous and unowned. Basically, code isn’t a person—and you can’t blacklist it the same way you can a company or individual.

The judge emphasized that the protocol operates without any central controller, and once deployed, the code can’t be turned off. That fact seriously undermined OFAC’s position.

OFAC’s latest move reflects a larger shift—recognizing that regulating decentralized, immutable software isn’t as simple as putting a name on a list.

Focus Still on North Korea’s Cyber Ops

Despite clearing Tornado Cash, the U.S. Treasury hasn’t dropped its guard. Officials remain focused on stopping illicit use of crypto, especially by state-sponsored hackers like the Lazarus Group.

The group has siphoned billions from crypto platforms, allegedly funneling those funds into North Korea’s weapons development programs.

Treasury Secretary Scott Bessent stated that the government remains committed to blocking these threats:

“Securing the digital asset industry from abuse by North Korea and other illicit actors is essential to establishing U.S. leadership and ensuring that the American people can benefit from financial innovation and inclusion.”

What’s Next for TORN?

With the sanctions lifted and legal clarity on its side, Tornado Cash may see a new wave of interest. But the debate around privacy tools in crypto isn’t over—and regulators are still figuring out how to handle code that doesn’t play by old rules.

Still, for now, TORN holders are celebrating—and keeping a close eye on what comes next.