- High-profile U.S. Senators have shown support for Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act.

- This bill focuses on enhancing control and supervision over the rapidly growing digital currency market.

- Several organizations recognize the act’s aim to prevent illegal activities within the digital currency sphere.

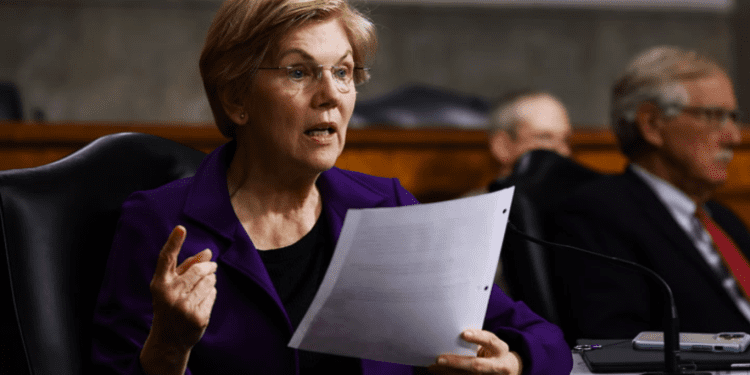

In a unified display of political support, Senator Elizabeth Warren’s proposed Digital Asset Anti-Money Laundering Act has garnered the endorsement of multiple influential U.S. Senators. This group of supportive Senators includes Democrats Dick Durbin, Tina Smith, Gary Peters, Jeanne Shaheen, Michael Bennet, Bob Casey, Richard Blumenthal, and Catherine Cortez Masto. Adding to the Democratic voices, independent Senator Angus King has publicly declared his backing for the act.

The significance of these endorsements is underlined by the roles some of these Senators occupy. For instance, Gary Peters oversees the Senate Homeland Security and Governmental Affairs Committee, and Dick Durbin has a leading role in the Senate Judiciary Committee.

This combined political backing underscores the importance of addressing the challenges presented by the swiftly growing digital currency sector. Warren highlighted the collective support by stating the bill reflects Congress’ commitment to understanding the complexities and potential risks of the digital currency field and ensuring that appropriate regulatory powers are granted where needed.

It’s not just political figures rallying behind the bill; various organizations have expressed their endorsement. Notable supporters include the Major County Sheriffs of America, National Consumer Law Center, Transparency International U.S., National Consumers League, National District Attorneys Association, and Global Financial Integrity. This wide-ranging organizational backing emphasizes the act’s intention to introduce solid steps to combat unlawful activities linked to digital currency transactions.

Originally presented in July 2023 by Senators Warren, Roger Marshall, Joe Manchin, and Lindsey Graham, the act’s primary goals are to fortify rules around digital wallets, enhance the Bank Secrecy Act’s provisions, and introduce rigorous legal systems to hinder any malevolent usage of digital assets.

Highlighting a related concern, Senator Warren pointed out the potential financial impact of a lagging crypto tax structure. According to estimates, without necessary reforms, the U.S. Treasury, in association with the Internal Revenue Service, could stand to miss out on roughly $1.5 billion in tax revenue for the fiscal year 2024. This brings into focus the need to modernize tax rules in tandem with the evolution of the digital currency landscape.

U.S. Crypto Leadership Faces Questions in 2023

In a year dominated by evolving digital currency narratives, the stance of the U.S. Congress on Bitcoin remains unclear. However, notable events and expert insights suggest a wider dialogue on the country’s positioning in the global crypto landscape.

Recent discussions at the Cato Institute Center for Monetary and Financial Alternatives’ conference highlighted apprehensions about the U.S. potentially lagging in cryptocurrency leadership. This sentiment was compounded by market fluctuations witnessed in Bitcoin prices, which some attribute to external influences, including BlackRock’s noteworthy ETF filing for the cryptocurrency.

Adding to the fiscal discourse, the Federal Reserve has not remained silent, raising alarms about possible downturns in the cryptocurrency market. Furthermore, the Biden Administration has been navigating a sea of cryptocurrency and fintech transformations, influenced by both market instability and the drive to adapt regulatory frameworks to the digital age. While these developments indicate a robust engagement with cryptocurrency matters, the specific viewpoint of the U.S. Congress on Bitcoin in 2023 remains to be fully articulated.