- Toncoin’s breakout and Telegram backing have sparked a wave of optimism, with price hitting $2.98 and projections suggesting a 100x gain could push it to $298, turning a $10K investment into $1M.

- Ecosystem momentum is building fast — with booming DeFi apps, gaming dApps, and AI integrations, plus $8.24B in Q1 transfer volume and cross-chain support from LayerZero and Wormhole.

- Targets like $100–$298 aren’t off the table if adoption scales and institutional interest grows; even mid-range moves ($10–$50) could yield solid returns for early investors.

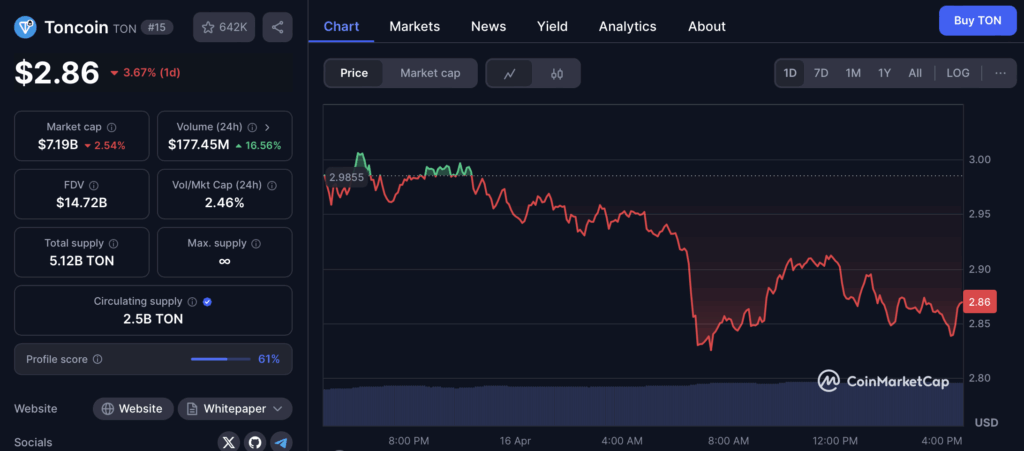

Toncoin’s been heating up again, and if you’ve been watching the charts, you probably noticed that sweet breakout from its long, dragging downtrend. As of now, TON’s sitting comfy around $2.98 — that’s a solid 5% gain in the last 24 hours alone.

So, yeah… the big question: is this just the start of something bigger? Let’s crunch some numbers and play the “what if” game. Like, what would it actually take for a $10,000 bag of TON to balloon into $1 million?

What the Numbers Say

Right now, $10K gets you about 3,355 TON. If you’re aiming for that magical million-dollar payday, you’d need each TON token to hit $298. That’s a 100x move from where it’s chillin’ today.

Feeling a bit more bold? Tossing $15K into the mix bags you roughly 5,033 TON. That brings your million-dollar target down to a slightly less crazy $198.75 per coin.

Seems wild? Maybe. But it’s crypto. We’ve seen stranger things.

Why This Isn’t Just Hype: What’s Fueling TON?

First off, TON ain’t just some trend riding on vibes. It’s got real infrastructure — and a pretty massive ace up its sleeve: Telegram. Backed by a huge user base and actual adoption, this project’s been quietly laying groundwork while others were making noise.

In Q1 2025 alone, transfer volume exploded 319% year-over-year, climbing to $8.24 billion. Telegram’s founder Pavel Durov is back in the spotlight, actively hyping TON, and the devs are putting in work both in the U.S. and Asia.

And the chart? Yeah, it’s telling a story too. After busting out of a long wedge pattern, TON flipped $2.80 into support — clean. The next zones? $3.50, $4.20, and maybe even $5.50 if buyers keep stepping in.

The Ecosystem’s Catching Fire

DeFi’s popping off, with protocols like EVAA and Storm Trade pulling in $110M+ TVL. Meanwhile, games like Cattea and Bombie? Millions of users. No joke. Then there’s TapSwap — one of those mini apps that’s going viral faster than you can say “airdrop.”

On top of that, you’ve got serious cross-chain action. TON’s now plugged into LayerZero, Wormhole, and Axelar, which means liquidity is flowing in from over 100 other chains. Throw in AI-native tools like Husky, and now you’re talking about a network that’s doing way more than just pumping tokens.

Could TON Really Hit $100–$298?

Sure, it’s a stretch. But is it impossible? Definitely not.

For TON to hit $100+, it’ll need some serious wind at its back — think institutional money, mass adoption, and more Telegram integration. But if that happens? All bets are off.

Even a jump to $10–$50 puts you in the 3x to 15x return range, which isn’t bad at all. And if TON keeps growing like early Ethereum or Solana? That $298 mark might not be so out-there after all.

So whether you’re in for $10K, $15K, or just watching from the sidelines, TON’s current momentum and ecosystem growth make it one to keep a close eye on. The risk is real, but so is the upside.