- Ethereum dropped 57% since December, sparking fear and heavy selling from whales and ETFs.

- Key support sits at $1,887, but failure to hold could send ETH sliding to $1,440 or lower.

- Despite bearish signals, whales just bought 470K ETH and 1.2M ETH left exchanges—bullish signs might be brewing.

Ethereum hasn’t exactly been crushing it lately. Over the past four months, ETH has lagged behind, and that’s got folks asking some tough questions—like whether it’s time to cut losses and move on, or double down in hopes of a comeback.

Ali Martinez Weighs In

On-chain analyst Ali Martinez stepped in to shed some light, and honestly, it’s a bit of a mixed bag.

Let’s rewind: ETH dropped a brutal 57%, from $4,100 to $1,750, between December and mid-March. Naturally, fear kicked in. People sold. Even whales. The number of wallets holding 10,000+ ETH dropped from 999 to 919 in just a few weeks. That’s a big deal.

Between mid-Feb and March 17, whale wallets offloaded at least 130,000 ETH. And in the same window, over 100,000 ETH was moved to exchanges (aka, prepping to sell). Meanwhile, spot ETH ETFs in the U.S. saw $760 million in outflows in the past month. Not exactly bullish vibes.

Charts Say… Trouble?

Technically speaking, things have looked shaky. A three-day ascending triangle suggests ETH might tumble to $1,000. A daily chart breakdown hints at $1,250. And price bands flag $1,440 as a make-or-break level.

Martinez pinpointed $1,887 as the key support. If ETH can stay above that? There’s hope. If not? We’re talking possible dives to $1,440, $1,250, or even $1K. Oof.

On the flip side, if ETH manages to break through the resistance between $2,250 and $2,610, the bearish case kinda falls apart.

But Wait—Something’s Changing

Here’s where things get interesting: despite the doom-and-gloom charts, whales bought 470,000 ETH just last week. And in the last 48 days, 1.2 million ETH has been pulled off exchanges. That’s a strong reversal in sentiment.

So, even though recent activity screamed “sell,” the quiet accumulation and exchange withdrawals may be the early signs of a shift.

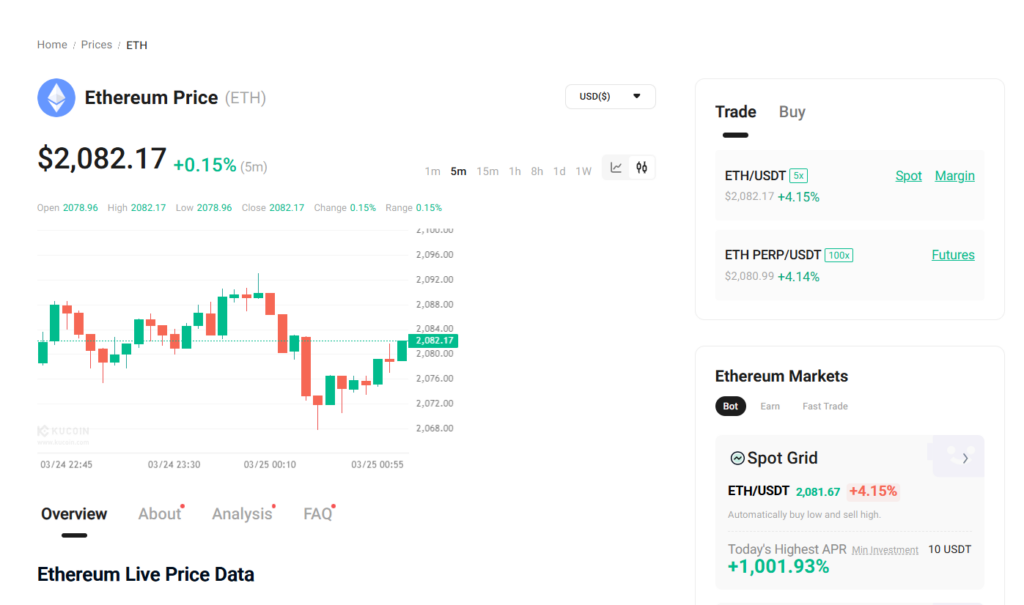

ETH is already up nearly 10% in the past week, sitting around $2,090. Maybe it’s not out of the woods yet, but the tides might just be turning.

Bottom line? ETH’s still walking a tightrope—but someone’s stacking while others are selling. And that usually means something’s brewing.