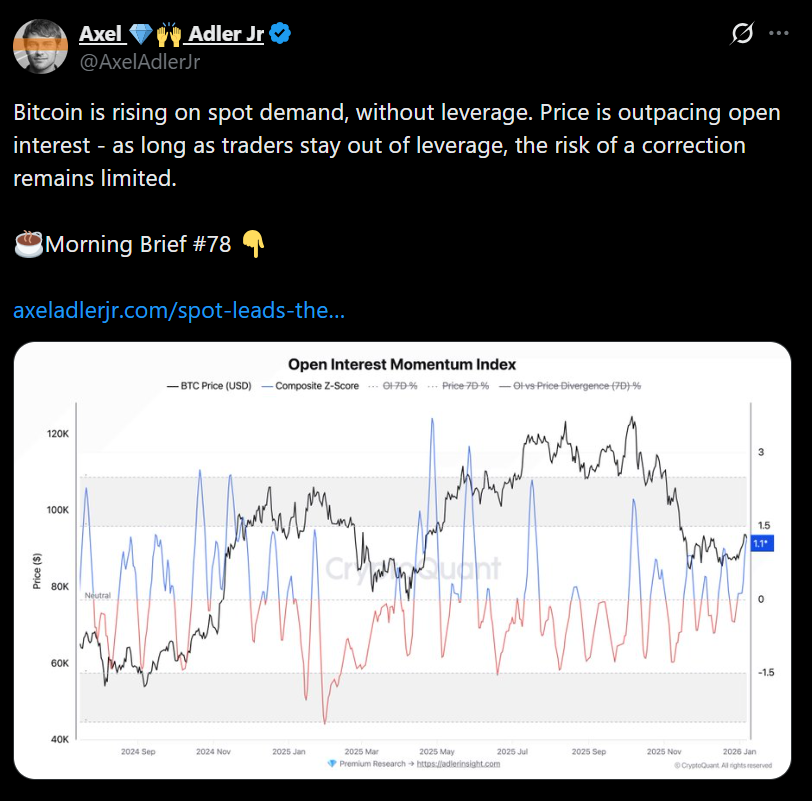

- Bitcoin is rising above $90K without leverage driving the move.

- Open interest lagging price suggests spot demand is leading.

- Cleaner structure reduces downside risk and supports sustainable upside.

Bitcoin holding above $90,000 without leverage doing the heavy lifting is more important than it looks. Anyone who’s been around long enough knows the usual script. Price starts moving, leverage rushes in, funding flips, and eventually the market snaps back hard. Leverage hasn’t helped crypto mature. It’s turned rallies into traps and pullbacks into liquidation events. So when Bitcoin grinds higher without that baggage, it deserves attention.

Spot Demand Is Leading, Not Leverage

The key shift is in the relationship between price and open interest. Right now, price is moving ahead while open interest lags behind. That means buyers are showing up with real capital, not borrowed conviction. Axel Adler Jr highlighted this directly, and it lines up with what seasoned traders have been waiting for. Moves driven by spot demand don’t rely on cascading liquidations to survive. They stand on their own.

Why Corrections Feel Different This Time

When leverage stays on the sidelines, downside risk changes. Pullbacks tend to be slower and more controlled instead of violent flushes. That reduces stress across the market and removes the constant fear of sudden liquidation cascades. It doesn’t eliminate volatility, but it reshapes it into something far more manageable.

Healthier Bitcoin Builds Healthier Markets

Bitcoin sets the emotional baseline for everything else. When it rises steadily without leverage games, confidence improves. Traders stop reacting to every red candle like it’s the end of the cycle. Risk appetite returns gradually rather than explosively. That’s when capital rotates instead of fleeing, and that’s how broader market structure improves.

Why This Kind of Strength Matters

This isn’t a hype-driven breakout or a one-day wonder. It’s a cleaner move built on actual demand. Bitcoin rising without leverage may look boring on the surface, but boring strength is exactly how sustainable trends begin. After years of leverage amplifying every mistake, this kind of price action feels overdue.