- XRP bounced off the $1.70 support level, showing signs of slowing bearish momentum and potential reversal.

- The token remains stuck between the 100-day and 200-day moving averages, hinting at continued consolidation.

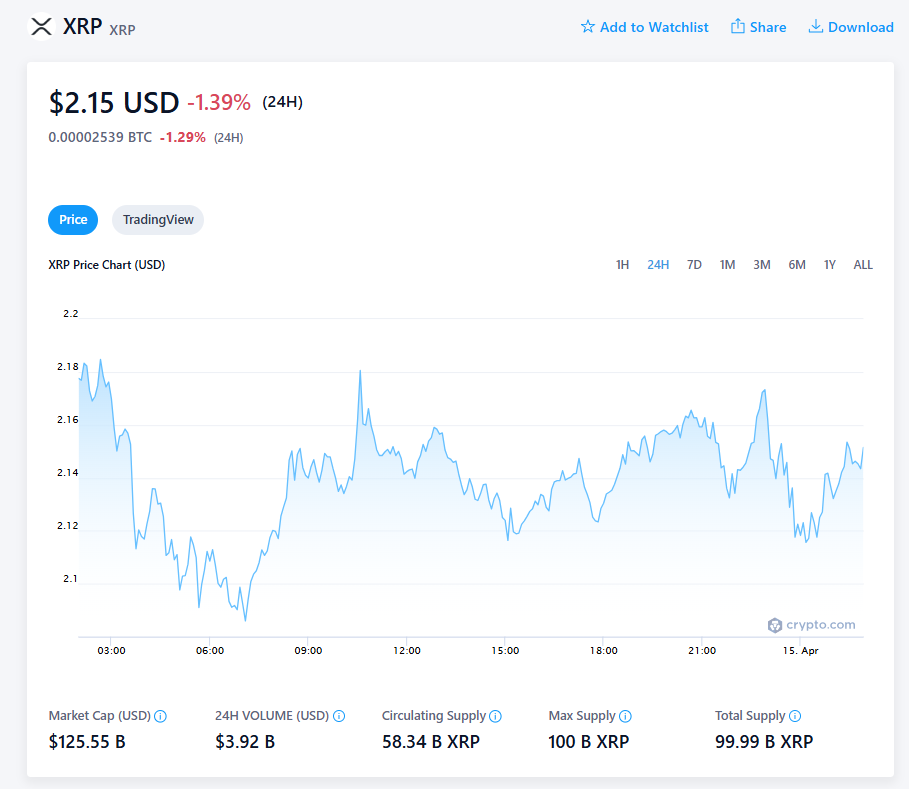

- A breakout above $2.20 could spark a bullish trend, but failure to clear it might send XRP back toward $1.70.

XRP‘s been catching some breath lately, bouncing right off that $1.70 zone — yeah, the one where the 200-day moving average and Fibonacci retracement lines kinda overlap. That combo acted like a soft cushion, giving bears a reason to chill out… at least for now.

Traders jumped in as the price held steady, and we even saw a bullish divergence on the RSI. That’s usually a good sign — it hints the selling pressure’s easing up, maybe even gearing up for a trend flip. But before we get carried away, XRP’s still sandwiched between the 100-day and 200-day moving averages. So, it’s kinda stuck in a holding pattern.

Worth noting — that 100-day MA at around $2.50? Yeah, it lines up perfectly with the top of this long descending wedge XRP’s been trapped in. If — and it’s a big if — XRP can break out above that level, it could light the spark for a solid upward move toward fresh resistance levels.

Zooming In: 4-Hour Chart Gets Interesting

Looking closer, the short-term picture’s showing some action. XRP faked a bearish breakout from an expanding wedge but then pulled a U-turn — classic bear trap vibes. Price popped back into the pattern, which caught some eyes and triggered a decent wave of buying.

Now it’s heading toward that $2.20 mark — the previous local high and a big decision point. If XRP can close strong above $2.20, we’d be talking higher highs and, potentially, a real shift in structure that could drag the price closer to $2.50 again.

That said, if momentum fizzles out and $2.20 holds as resistance, a pullback to $1.70 wouldn’t be surprising. It’s still a coin toss right now — but at least we’re seeing signs of life.