- Early Solana token trades can turn $100 into life-changing wins—but only with speed + discipline.

- Use a rug filter, pre-trade presets, and auto profit-taking to capture upside without hesitation.

- Tools like Archer Bot cut out execution friction and make high-speed trading manageable.

Perfect Solana trades happen every single day. Tokens launching at $10K market caps and hitting $10M within hours. Early holders capturing 1000x gains while late arrivals buy tops and watch their money evaporate. The pattern is predictable, the opportunities are real, but most traders never capture them.

The difference isn’t luck, insider knowledge, or superior analysis. It’s understanding the anatomy of how these trades actually develop and having the infrastructure to execute each phase perfectly. From alpha discovery in small Telegram groups to systematic profit-taking during explosive moves, every stage requires specific tools and timing. The winning traders have solved this with tools like Archer Bot that execute trades instantly through Telegram, eliminating every friction point that kills profits. Stop missing perfect trades →.

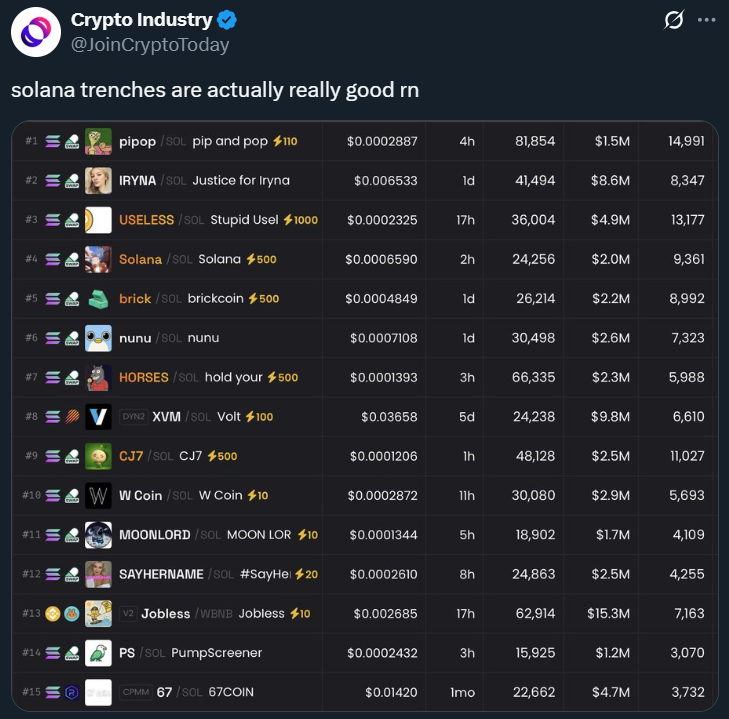

1) Discovery in the Trenches

You don’t need 50 feeds. You need ‘early’ and ‘real’. The perfect trade usually starts with a tiny signal: fresh liquidity pool or launchpad launch, unique holders climbing, a hard working team pushing good content, a meme that actually sticks. The moment a contract hits your chat, your hands shouldn’t leave it—tab-hopping is how edges die.

What to look for (fast):

- Fresh pool + growing unique holders

- Tight spreads and non-janky initial liquidity

- Token team responsiveness (someone’s actually at the wheel)

- A meme/hook that catches and repeats across rooms

Discovery and action in the same place. Paste the contract in Telegram, confirm pair, execute. Open Archer and begin hyper trading now

2) The One-Minute Rug Filter

Speed does NOT equal reckless. Before touching buy, run a 60-second sanity check—enough to kill obvious traps without missing the window.

Your veto list:

- Contract verified on the explorer

- Mint / freeze authority renounced or in reputable multisig

- Top holders Less than 20% concentration; no mystery whale funded from a mixer ten minutes ago

- Liquidity real (ideally locked) and not musical chairs

- Tiny test buy/sell to detect taxes, transfer limits, or weird blocks

Two red flags? Walk. Opportunities are endless; your bankroll isn’t.

Archer moment: Keep this checklist pinned right in chat; if it’s clean, you’re two commands from entry. Trade safely, quickly — with Archer →

3) Decide Before You Click (Pre-Trade Setup)

Write the rules first; the market merely triggers them. Think small risk, clear invalidation, and exits you don’t have to “feel.”

Preset the essentials:

- Risk: 1-5% of account per attempt

- Slippage: tight enough to avoid ugly fills, loose enough to actually fill

- Invalidation: the exact level/behavior that proves you wrong

- Profit ladder: partials that fire automatically (example below)

Archer moment: Save a preset — 1.0% size, 1.2% slippage, TPs at 2x/5x/10x, protective trigger on reclaim break. One tap = your plan. Set Archer presets →

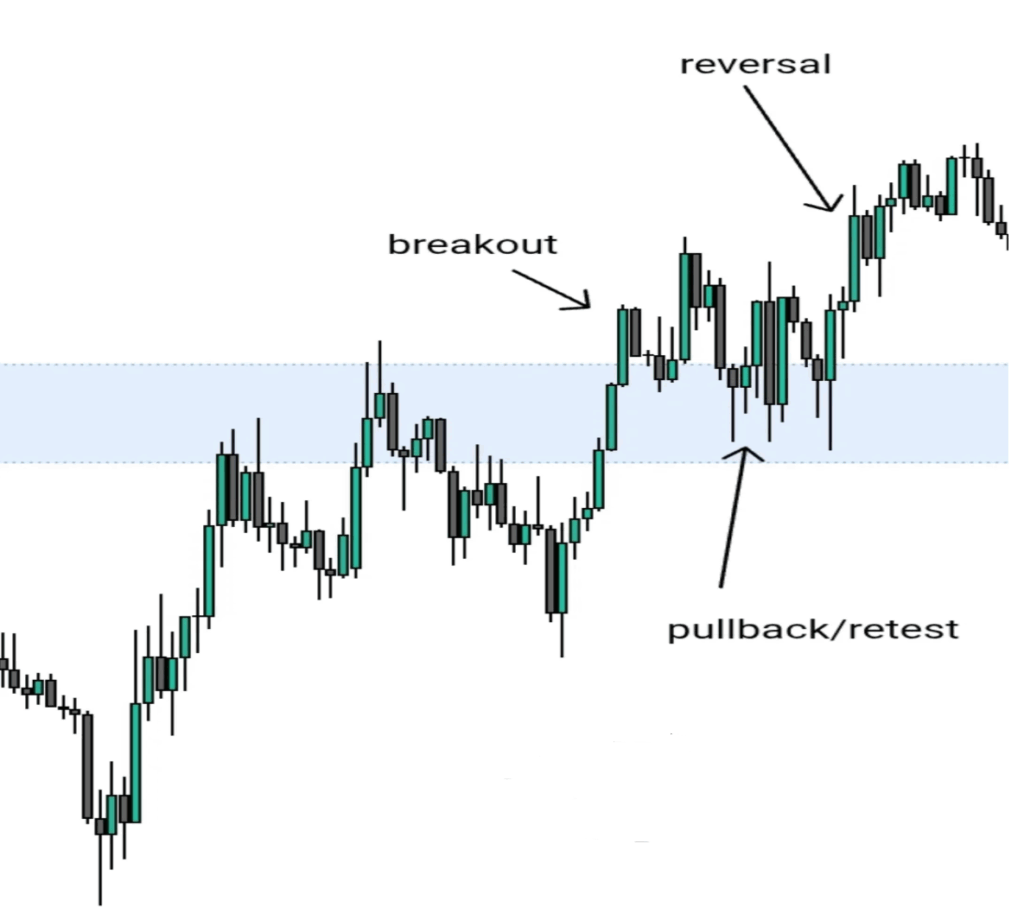

4) Entry: Buy the Reclaim, Not the Hype

Chasing five green candles? Fun, until it isn’t. The clean Solana entry is boring on purpose:

Breakout → pullback → reclaim → buy the retest.

Photo credit: r/Daytrading

Let the price come back to you so the stop is tight and honest.

Micro-tips:

- Enter in one–two clips, not a panic slam

- If the spread widens or liquidity thins mid-tap, abort

- Avoid averaging down on microcaps (you’re not value-investing a meme at 3:07am)

Archer moment: Execute the instant your level tags—no form hunting, no copy-paste scramble. Execute instantly with Archer →

5) Automation: Bank Strength Without Overthinking

Most traders donate profits because they hesitate. Fix it with automation: lock gains while you breathe.

A ladder that just works:

- 25% at 2x, 25% at 5x, 25% at 10x, final 25% rides only if structure still deserves it

- If the reclaim breaks cleanly, you’re flat. No debates, no “mental stops”

Archer moment: Auto-TPs + protective triggers do the unemotional work for you. Turn on auto-TPs in Archer →

6) Mid-Trade Management: Trail, Trim, Chill

Once it’s moving, your job is protection, not heroics.

Do this:

- Trail your “I’m wrong” line up as higher lows form

- Take profit into velocity (tops are obvious only after)

- If the parabola dies, either farm the range small… or be done and move onto the next trade (there are ALWAYS more)

Don’t do this:

- No averaging down on tiny caps, do NOT chase the bottom

- No “one more candle” bargaining

- No turning a fast trade into therapy

Archer moment: Real-time PnL + one-tap trims keep you out of decision hell. Manage positions in Archer →

7) Exit & Debrief: Finish Clean, Learn Fast

Endings matter. Close when the plan says close—even if the next candle squeezes higher. Then journal one sentence: why you entered, why you exited, one thing to repeat or ditch. That tiny habit compounds faster than most “alpha.”

Quick wrap formula:

- Entry reason → Exit reason → One improvement (12 seconds, tops)

Archer moment: Snapshot fills + PnL, paste into notes, done. Track & wrap in Archer →

A Mini Walkthrough (the whole thing, condensed)

Trade alert hits the alpha group: A fresh pair, holders ticking up, team responsive. You paste the contract into Archer, confirm the pair, and clear the one-minute rug filter. Preset is already loaded (5% risk, 10% slippage, take profit set at a 3x). Price breaks out, pulls back, reclaims—you buy the retest in a single clip.

Two minutes later: 2x tags, first partial fires; you raise the “I’m wrong” line. A shove to 5x trims more; you resist the “just one more push” voice.

When momentum tires and reclaim gives way, the protective trigger flattens the rest. Take newly acquired profits, and move onto the next ticker.

Want this flow to feel calm instead of chaotic? Run it inside Archer from discovery to exit. Get Archer Bot →

20-Second Gut Check That Could Save Your Portfolio

- Do I know exactly where I’m wrong?

- Is per-trade risk Less than 5% of the account?

- Are authorities + liquidity good?

- Holder growth looks organic, not botted hype?

- Are partial take profits set already?

If four of five aren’t yes… take a walk, not a trade.

If they are: execution should take seconds, not minutes. Trade now with Archer →

How to Give Yourself an Unfair Advantage While Trading Solana Memecoins

Great Solana trades are logistics: clean discovery, ruthless filters, planned entries, automatic exits. The market will always be fast; your edge is making your process faster and calmer than everyone else’s. Tools don’t replace judgment—but the right ones make good judgment effortless under pressure.

Trade Solana at the speed it actually moves.

Get Archer Bot → • Set auto-TPs → • Lock position sizing → • Execute from Telegram NOW