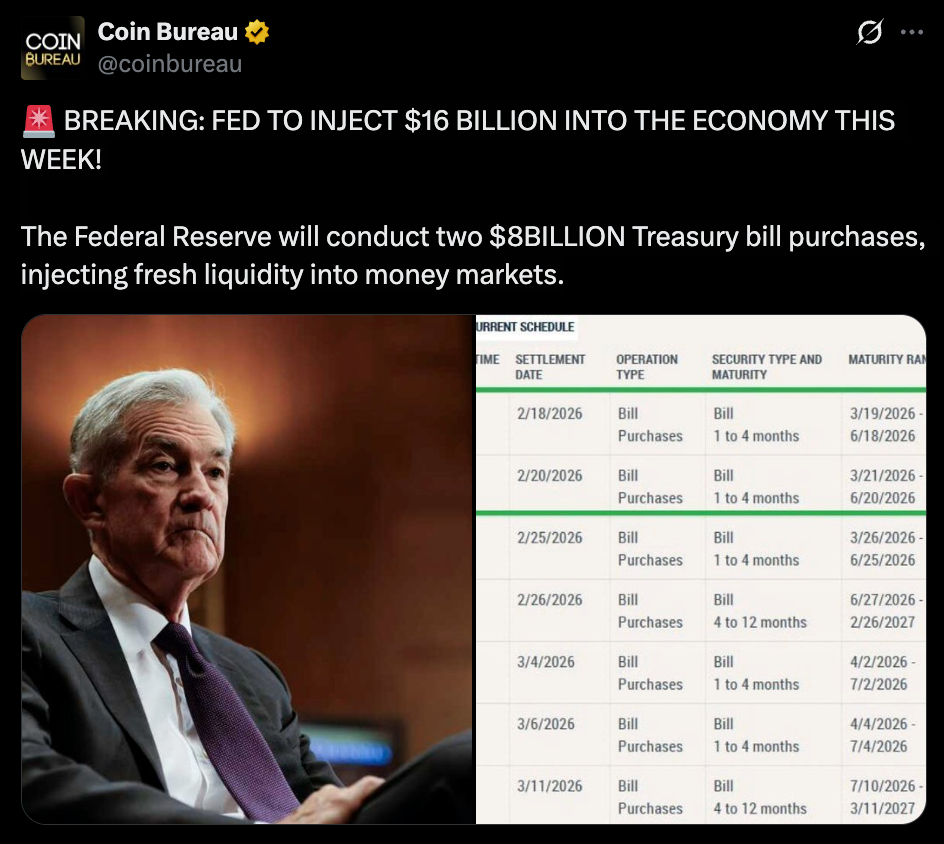

- The Fed is buying $16B in Treasury bills through two operations

- Fresh reserves ease funding conditions even if policy stays “tight”

- Liquidity shifts often ripple into equities and crypto markets

When the Federal Reserve steps in with $16 billion in Treasury bill purchases, describing it as routine misses what actually matters. Two separate $8 billion operations mean real dollars entering the system this week. Not forward guidance. Not projections on a dot plot. Actual liquidity moving into money markets in real time.

In an environment where officials keep repeating that financial conditions remain restrictive, this kind of action feels contradictory. You can frame it as standard balance sheet management, sure, but reserves still increase. And when reserves increase, the system feels it.

How Treasury Bill Purchases Change the Plumbing

Treasury bill buying is one of the cleanest tools the Fed has to influence liquidity. The central bank purchases short-term government paper, bank reserves rise, and pressure in funding markets tends to ease. Repo rates soften. Short-term borrowing gets a bit more comfortable. The pipes unclog, even if only slightly.

You can debate the Fed’s intention all day long. Was it technical? Was it seasonal? Was it precautionary? But the mechanical effect remains the same. More reserves in the system mean less immediate funding stress, and traders tend to notice that before economists do.

Why Crypto and Risk Assets Care About Flow

Liquidity moves first. Risk assets usually respond after. When excess cash builds in the system, it doesn’t just sit idle forever. It looks for yield, momentum, or opportunity. Sometimes that means equities. Sometimes it’s credit. And increasingly, it’s crypto.

This doesn’t mean Bitcoin or altcoins suddenly explode higher the next morning. Markets rarely move in straight lines. But rising liquidity often reduces downside pressure and gives rallies fuel instead of friction. Flow matters more than speeches, and markets trade on flow.

The Pattern Markets Keep Seeing

Officials continue to stress that policy remains tight and that inflation risks are still being managed. Yet small injections like this keep appearing. Quiet bill purchases here. Subtle balance sheet adjustments there. Individually they may look minor. Collectively, they start to tell a different story.

Sixteen billion dollars is not trivial. It’s a reminder that liquidity still underpins the system, even when rhetoric suggests restraint. You can ignore that if you want. Markets almost never do.