- Tether minted $1 billion in USDT on Tron with no transaction fees.

- Tron’s low-cost network drives high stablecoin usage in developing markets.

- Tron and Ethereum networks hold nearly equal amounts of circulating USDT.

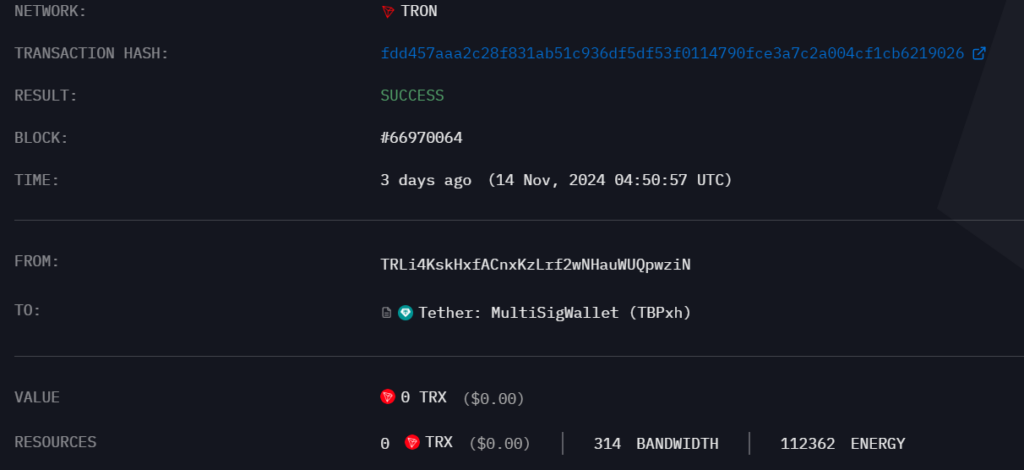

Tether has issued $1 billion in USDT stablecoins on the Tron network, leveraging its fee-free transaction capabilities. Data from Arkham Intelligence highlighted the transaction, which occurred on November 14.

The stablecoins were minted from a “black hole address” on Tron and transferred to Tether’s multisignature wallet before being moved to the company’s treasury. Both transactions incurred no fees, underscoring Tron’s position as a cost-effective blockchain for stablecoin activity.

Tron’s Low-Cost Advantage in Stablecoin Transactions

Tron’s minimal transaction fees have made it a preferred network for stablecoin users, particularly in regions where high remittance costs can significantly reduce the value of funds sent. According to Tether’s transparency page, the network currently hosts $62.7 billion in circulating USDT, close to Ethereum’s $62.9 billion.

Despite Ethereum’s larger ecosystem, Tron’s competitive fee structure has drawn significant stablecoin traffic, contributing to the blockchain’s $577 million revenue during Q3 2024. This makes Tron a key player in the stablecoin sector, with its market share only second to Ethereum.

Source: Arkham Intelligence

Gauging Market Sentiment Through Stablecoin Supply

Tether’s recent minting follows a trend of replenishing authorized but unissued USDT supply, held until issuance requests are made. These movements are closely watched by traders as an indicator of market sentiment.

An increase in stablecoin supply often signals heightened investor activity and market optimism, while a decline can indicate reduced trading interest. Tether CEO Paolo Ardoino has previously clarified that such transactions are intended to maintain liquidity and meet future issuance demands.