- Tether discontinues EUR₮ stablecoin citing alignment with evolving European regulatory frameworks such as the upcoming MiCA regulations.

- Users have one year to redeem holdings, with EUR₮ redemptions ending on November 25, 2025.

- Focus shifts to MiCA-compliant projects, including partnerships with Quantoz Payments to support EURQ and USDQ stablecoins.

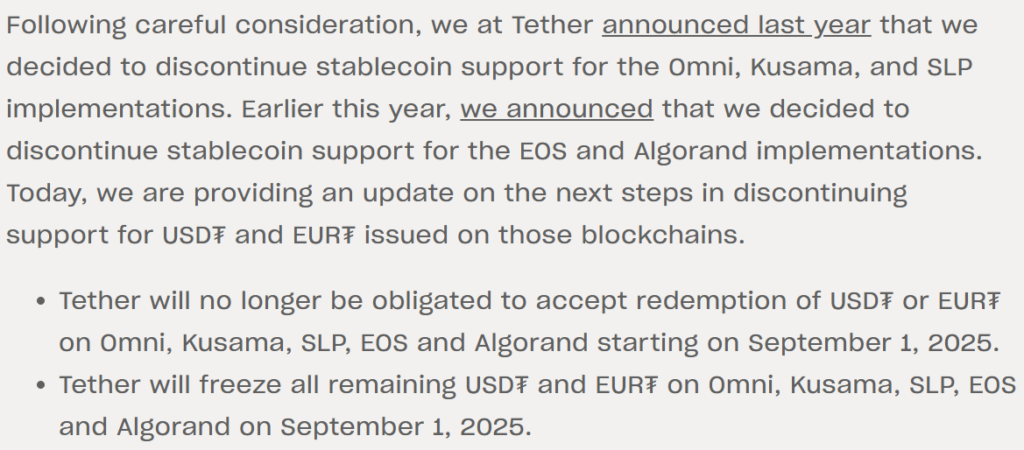

Tether has announced it will discontinue its euro-pegged stablecoin EUR₮, halting issuance across all blockchains. The company explained this move reflects its broader strategy to adapt to changing regulatory landscapes in Europe, specifically with the incoming Markets in Crypto-Assets Regulation (MiCA).

Launched in 2016, EUR₮ was designed to maintain a 1:1 peg to the euro, offering stability in the volatile cryptocurrency market. However, as of November 27, the stablecoin accounts for only $27 million in market capitalization—less than 0.02% of Tether’s USD₮ stablecoin market value.

Users holding EUR₮ have until November 25, 2025, to redeem their holdings, after which support will fully terminate.

MiCA Influence and Future Tether Initiatives

Tether’s decision follows significant regulatory developments in the European Union. MiCA is expected to bring comprehensive rules for crypto-assets, including stablecoins, by the end of 2024. Tether’s leadership previously criticized aspects of MiCA, citing potential risks to financial stability within the stablecoin sector.

As EUR₮ is phased out, Tether plans to prioritize MiCA-compliant stablecoins. This includes supporting EURQ and USDQ, issued by Dutch fintech firm Quantoz Payments, using Tether’s new Hadron technology solution.

Hadron is designed to streamline the issuance and management of stablecoins, ensuring robust compliance and anti-money laundering safeguards. Tether emphasized its commitment to fostering innovation while adhering to evolving regulations, focusing on financial tools that align with user needs and regulatory requirements.

Through these efforts, Tether aims to remain a leading force in developing adaptable solutions within the global financial ecosystem.