- Republican lawmakers are determined to restrict the Federal Reserve’s ability to create a central bank digital currency (CBDC) due to privacy concerns. They have introduced legislation to block the Fed from issuing a digital dollar without congressional approval.

- The Biden administration supports the Fed researching a CBDC, seeing potential to emulate China’s digital currency model and make payments faster. However, no decision has been made to actually launch a digital dollar.

- Legislation to halt a digital dollar is unlikely to advance under Biden, but opposing CBDCs has become an important issue for 2024 Republican candidates worried about government surveillance of citizens’ finances.

Republican lawmakers are determined to restrict the Federal Reserve‘s ability to create a central bank digital currency (CBDC). This positions a potential digital dollar as a key issue for the 2024 presidential campaign. Conservative politicians argue a government-backed digital currency could enable mass surveillance of Americans’ finances.

The Biden Administration’s Support for CBDC Research

The Biden administration has directed the Fed to research issuing a CBDC. This could make payments faster and more accessible. However, no decision has been made to actually launch a digital dollar. The administration sees promise in emulating China’s CBDC model.

New Legislation to Block a Digital Dollar

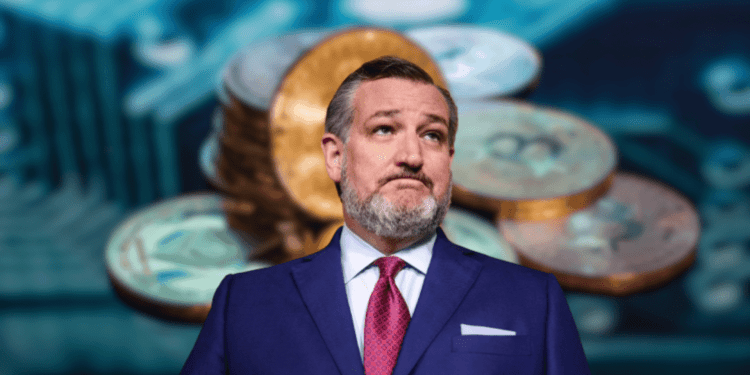

Senator Ted Cruz and colleagues will introduce the “Central Bank Digital Currency Anti-Surveillance State Act.” This bill says the Fed lacks authority to issue a CBDC without Congress’s approval. It aims to prevent the Fed from using a digital currency to control the economy or monitor spending.

Concerns Over Privacy and Government Overreach

Lawmakers fear a digital dollar would let the Fed see citizens’ private finances and use this data for surveillance. China uses its CBDC to track spending. Critics argue this could lead to rights violations. Some 2024 candidates have opposed CBDCs over privacy concerns.

Outlook for Passing Anti-CBDC Legislation

While the Fed hasn’t decided on a digital dollar, anti-CBDC bills face challenges. Legislation to block a CBDC is unlikely to advance as long as Biden remains in office. However, Republican lawmakers see opposing CBDCs as an important issue for voters worried about privacy.

Conclusion

In summary, GOP legislators are strongly against a central bank digital currency due to worries over government spying. They have introduced bills to halt the Fed’s ability to issue a digital dollar without congressional approval. This sets up a fight over privacy rights and the Fed’s powers as a key theme for the 2024 election.