- TAO lost the critical $290 multi-month support, shifting the market structure bearish.

- Spot Taker CVD shows heavy sell-side dominance and fading buyer strength.

- A recovery requires a surge in Spot buying volume; otherwise, sellers likely continue driving TAO lower.

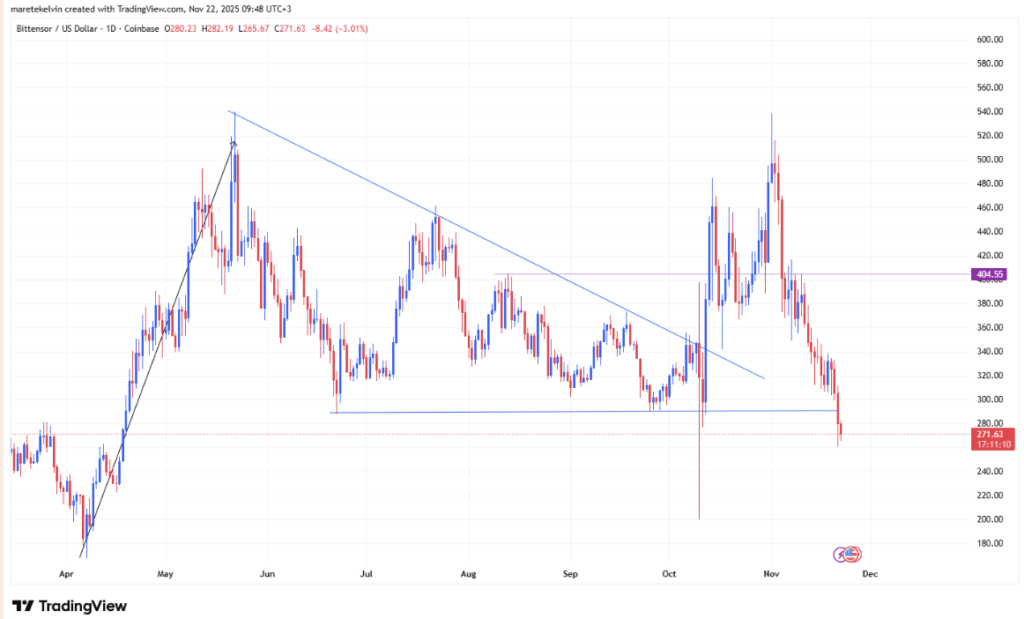

Bittensor’s $290 zone mattered way more than most casual traders realized. It wasn’t just a random support line — it was a multi-month demand zone, a spot where buyers consistently stepped in and defended price since July. When TAO slipped beneath it, that wasn’t a small dip… it was a structural break. A shift in tone.

And the market has been reacting accordingly.

Sellers are running the show — and the data is loud about it

TAO suddenly saw a huge burst in trading activity these past few days. Token Terminal recorded $1.5 billion in 24-hour volume, the highest spike since early October. But here’s the catch — almost all of that activity leaned bearish.

Both Spot and Futures markets showed seller dominance, meaning most of the volume came from people hitting market-sell orders rather than accumulating.

CryptoQuant’s Spot Taker CVD (90-day) is deep in red territory. That metric measures whether aggressive spot buyers or sellers are winning — and recently, it’s been overwhelmingly sellers. Spot buyers are thinning out, and every attempt at a recovery fizzles within a couple of sessions.

Momentum flipped after the November peak

Ever since TAO’s peak on November 1st, every bounce has been weaker than the last. The chart printed a string of red candles throughout November, and each attempt to push higher was immediately met with sell pressure.

Breaking below $290 essentially erased the strongest support zone TAO had, leaving a gap underneath with no major demand clusters.

Can TAO recover from here? Or do sellers push it deeper?

There is a scenario where TAO gets a small short-term bounce — but only if buyers return with real volume, not the small reactive flows we’ve been seeing. A strong shift in Spot buying would be the first sign of a potential reversal.

But right now?

The bearish structure is still fully intact.

Sellers remain in control.

And the confirmed break below $290 keeps downside risk alive until proven otherwise.

TAO isn’t doomed, but it’s definitely in a dangerous pocket… and unless demand steps back in hard, the market looks ready to push it lower before any meaningful recovery forms.