- Sui’s DeFi TVL hits $2.28B, but price drops 8% on regulatory fears.

- Chart signals show room for growth if SUI can break above $5.

- Pullback may offer an entry point before the next leg higher.

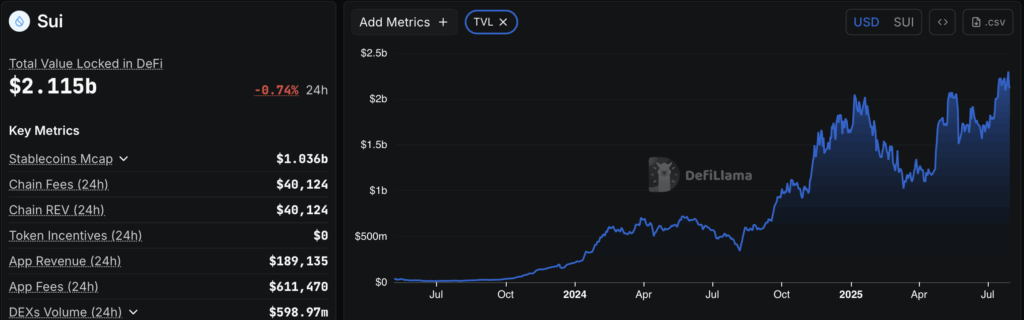

The Sui network’s DeFi scene is on fire—$2.28 billion in total value locked and climbing. But here’s the weird part: SUI’s price just slipped 8%, even with that kind of ecosystem growth. Chalk it up to the usual suspect—regulatory uncertainty. It’s a reminder that sometimes the fundamentals and the market just aren’t on speaking terms.

Still, zoom out a bit and things don’t look all that bleak. On-chain data’s looking solid, and if sentiment steadies out, SUI could be lining up for a strong move. Let’s dig into what’s going on with SUI’s price right now, and maybe peek at a few other altcoins that might be flying under the radar.

SUI Charts Say “Not Over Yet”

Price-wise, SUI’s floating in that mid-$3 to mid-$4 range—wobbling, but not crashing. Over the last month, it’s actually pumped close to 40%. So yeah, this recent dip stings, but in context, it’s more of a breather than a breakdown.

The key level to watch? Five bucks. That’s the resistance gate. If SUI can punch through there with decent volume, it might be headed toward the $6 mark—a 25%+ move from where it’s at now. Its 10-day moving average looks chill, and the RSI’s hanging comfortably below overbought territory. Basically, SUI’s got room to run if buyers show up.

Price Dips, Fundamentals Hold

Sure, the regulatory FUD has cooled things down, but SUI’s underlying growth hasn’t skipped a beat. TVL’s exploding, and that kind of adoption usually doesn’t happen by accident. If things settle down on the policy front, we could see the price snap back faster than people expect.

Bottom line? SUI still has strong hands in its corner. For traders watching from the sidelines, this pullback might just be the setup they’ve been waiting for. And it’s not just SUI—other altcoins with solid fundamentals and decent setups could follow suit once the fog clears.