- SUI gained 11% in 24 hours, trading around $3.74 with volume up 12%.

- Analysts warn of a possible pullback to $3.10–$2.50 before confirmation.

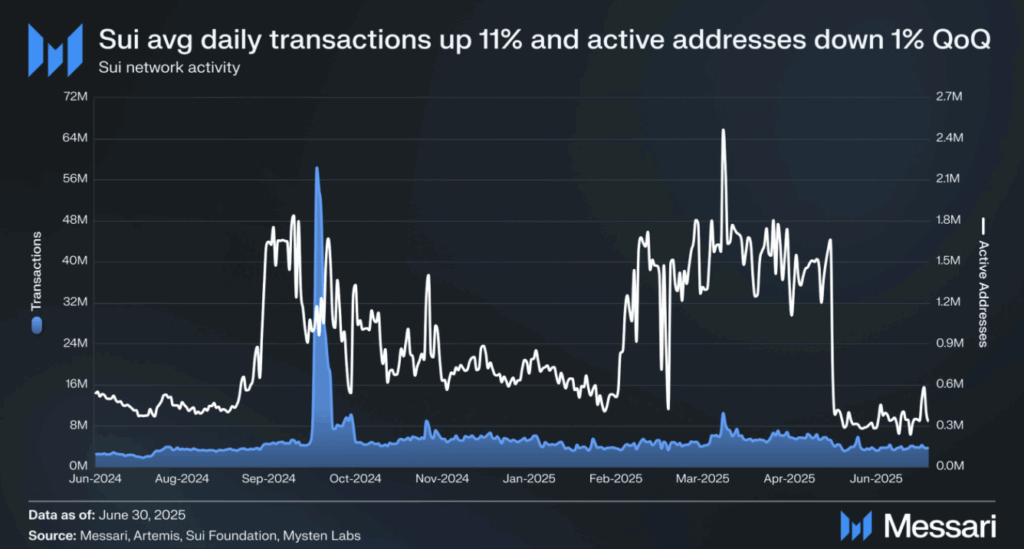

- Network fundamentals are strong, with TVL over $2B and daily transactions up 11% QoQ.

SUI’s price spiked nearly 11% in a single day, snapping back after heavy profit-taking dragged it down earlier in the week. The rebound came as the broader crypto market rallied, with traders rushing back in, pushing volume higher. Now, the question hangs—can SUI keep this momentum alive or will sellers return to drag it back to key support?

Breakout or Another Pullback?

The token recently broke above a macro triangle pattern, but the move wasn’t clean. According to analyst Rekt Capital, SUI is still in the “post-breakout retest” phase, meaning it hasn’t fully confirmed the breakout yet. If bears regain control, price could slide back toward $3.10, or in a sharper downturn, all the way to $2.50. On the bullish side, Robinhood’s listing of SUI is being seen as a major catalyst, giving U.S. investors new access and helping validate the breakout setup.

Institutional Interest and Network Growth

Beyond price charts, Sui’s fundamentals look increasingly strong. Institutional adoption has been expanding quickly, with Messari highlighting growth in gaming projects and infrastructure rollouts on the network. DeFi TVL has now surpassed $2B, while market cap climbed above $11.9B. Daily transactions also rose 11% quarter-over-quarter to 5 million, even as active wallet addresses dipped slightly. The team is also working on bringing “robots on-chain,” building automation tools designed to handle real-time IoT tasks. That kind of expansion could give the network staying power beyond short-term speculation.

Market Structure and Technical Outlook

At the time of writing, SUI trades near $3.74, after ranging between $3.39 and $3.80 over the past 24 hours. Volume rose 12%, showing stronger interest from traders. On the daily chart, price sits under the 50 and 100-day SMAs but above the 200-SMA, keeping the structure neutral-bullish. RSI at 51.8 reflects balance, though leaning slightly positive. Analysts like Ali Martinez and Crypto Tony had flagged a possible pullback to $3.17 before another leg higher, and that still remains a scenario to watch. Meanwhile, futures markets show growing interest—open interest climbed 9% to $1.92B, suggesting derivatives traders are positioning for more volatility.

What’s Next for SUI?

SUI’s bounce has traders split. Bulls see the breakout and Robinhood listing as proof of more upside, with potential targets above $4. Bears point to profit-taking risk and the still-untested support levels around $3.10. As always, the coming days will be crucial—if volume keeps flowing in, SUI might confirm its breakout and aim higher. If not, another dip into support looks likely before the next rally attempt.