- Sui (SUI) crashed nearly 87%, plunging from $3.80 to $0.50 after a $144 million token unlock collided with Trump’s surprise 100% China tariff announcement.

- The event triggered over $7 billion in crypto liquidations, with $100 million from SUI positions alone, before the token partially recovered to around $2.76.

- Analysts warn that Sui must hold support near $2.8 to avoid further drops, while RSI levels suggest short-term oversold conditions that could spark a rebound.

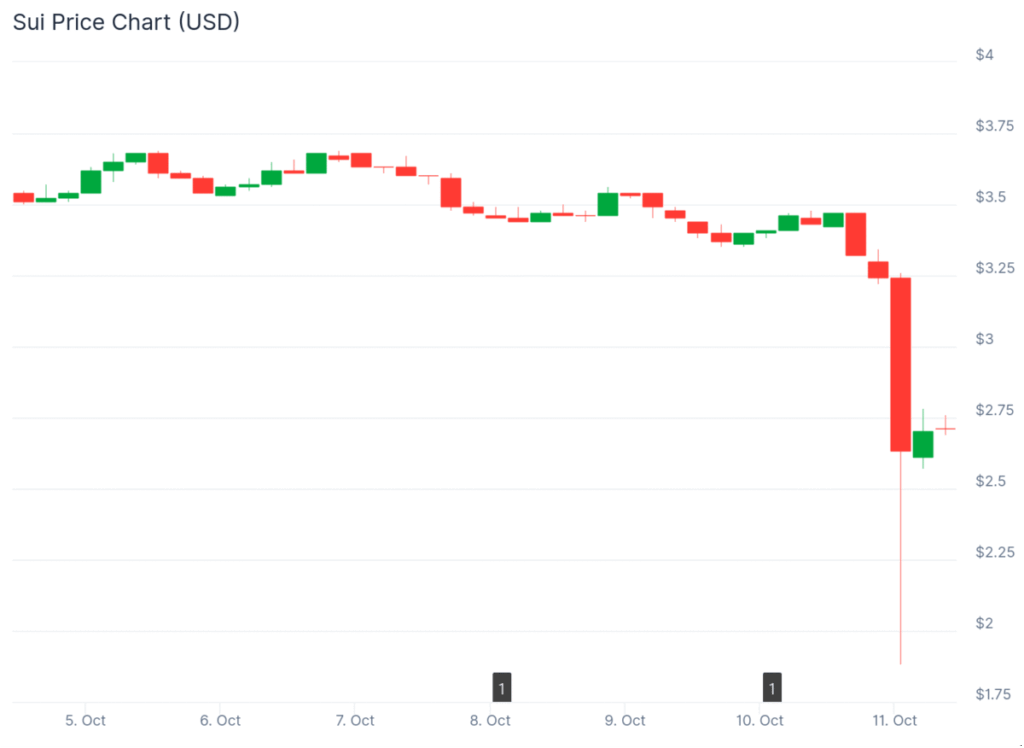

The Sui market just went through absolute chaos. In one of the sharpest crashes seen this year, the token nosedived nearly 87%, tumbling from $3.80 to just $0.50 in minutes. The timing couldn’t have been worse — a massive $144 million token unlock hit the market right as Trump announced new 100% tariffs on China. What followed was a domino effect that liquidated billions across crypto.

By the time the dust settled, over $7 billion in positions were wiped out industry-wide. Bitcoin slipped under $110,000, Ethereum cratered below $3,700, and Sui — well, it took the worst of it.

Token Unlock Sparks Chain Reaction

The main trigger was the unlock of roughly 44 million SUI tokens, worth over $144 million at the time. Those tokens hit exchanges like Binance and Coinbase all at once, flooding thin order books and setting off a chain of panic sales. Once the first stops hit, automated liquidations kicked in, and prices started freefalling faster than anyone could react.

In total, around $500 million in crypto liquidations were tied directly to the Sui crash, with nearly $100 million from SUI futures alone. Trading volumes surged 294%, reflecting traders scrambling to exit before getting caught in the washout.

Sui managed to claw its way back from the $0.50 low to around $2.40, but it still closed the day down more than 20%. At the time of writing, SUI trades near $2.76, with a market cap of roughly $10 billion — down over $2.5 billion from just a day earlier.

The Broader Market Gets Hit Hard

The chaos wasn’t limited to Sui. When Trump’s tariff post went live late Friday, the entire crypto market reacted instantly. Bitcoin dropped $3,000 within minutes, plunging below $110,000. Ethereum sank 16%, while Solana, XRP, and Dogecoin each lost between 20–30%. Cardano, Chainlink, and Aave saw even steeper declines, with some crashing as much as 40%.

The total liquidation count topped $7 billion — a level not seen since the COVID-19 market meltdown back in March 2020. Trader Bob Loukas even described it as “COVID-level nukes,” calling the move a “mother of all shakeouts.”

Technical Breakdown & What’s Next

From a technical angle, the damage was brutal. SUI broke through its 7-day moving average at $3.40, slicing cleanly below Fibonacci support at $3.26. Once that level was gone, algorithmic selling took over, slamming the price down to $2.82 before the eventual bounce.

The RSI now sits around 28 — deep in oversold territory — which could signal a short-term rebound if buyers step back in. That said, if the token fails to hold the $2.82 floor, analysts warn the next strong support lies near $2.11.

To flip bullish again, SUI would need to reclaim $3.26 and hold above it with volume. But right now, open interest in SUI derivatives has dropped 15%, suggesting traders are staying on the sidelines until volatility calms down.

For now, all eyes are on two things — whether buyers can defend current support, and how the market reacts to ongoing U.S.-China tensions. It’s a brutal reminder that even the strongest rallies can unravel in seconds when macro shocks collide with token unlocks.