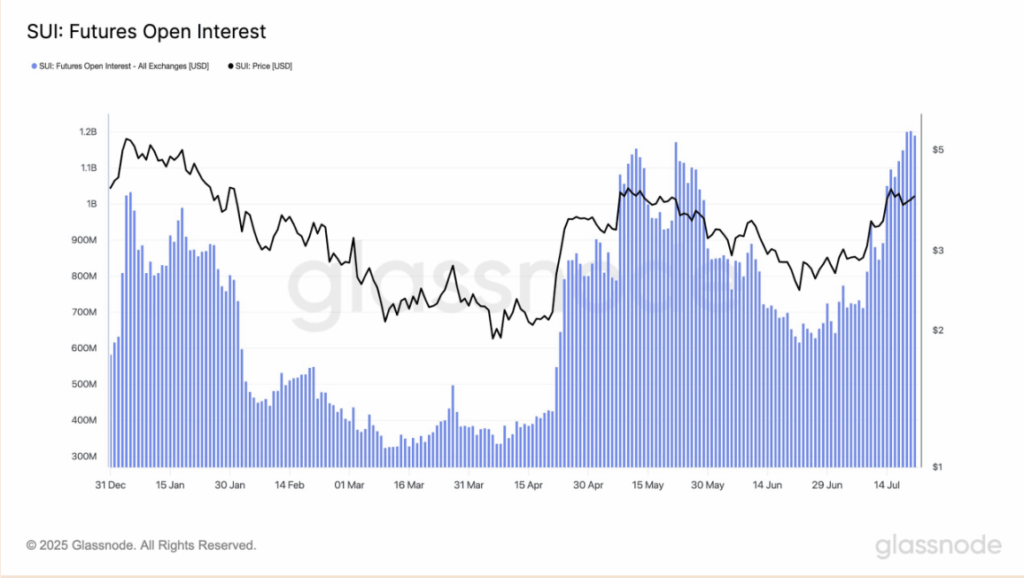

- SUI futures open interest is climbing fast, hitting $1.2B and signaling rising institutional involvement and whale speculation.

- Canary Funds’ SUI ETF has officially entered the SEC approval process, fueling ETF-driven hype similar to BTC and ETH.

- With whales accumulating above $3 and resistance near $4.22, SUI may soon test its $5.39 ATH if momentum holds.

Something’s bubbling under the surface with Sui (SUI), and it’s not just crypto Twitter noise. Futures open interest in SUI just spiked to around $1.2 billion. That’s not small potatoes—it puts it right outside the top five in the entire crypto space for derivatives exposure. You don’t get that kind of number without serious money sniffing opportunity.

What this tells us? Well, folks aren’t just playing around. There’s some serious speculation building, and probably a dose of real conviction that SUI’s gearing up for a move. Institutions and whales aren’t usually early… unless they know something.

That ETF Buzz Is Starting to Matter

Part of the hype is tied to a recent development that didn’t get nearly enough mainstream attention. On July 22, Canary Funds’ SUI ETF officially entered the SEC’s approval process. That came straight from MartyParty, who posted that the ETF filing was given an “Institution of Proceedings” status.

Now, if you’ve been around a while, you know what ETF buzz can do. Just look at what it did for Bitcoin and ETH. SUI’s clearly feeling that same tailwind, and this kind of news usually spreads like wildfire once it gets legs.

Whales Are Stacking—Quietly but Steadily

More interesting? Whales are loading up. On-chain data’s showing a steady uptick in accumulation, especially after SUI punched past the $3 mark. These aren’t retail flips—this is long-game money, and it hasn’t slowed down despite the recent price climb.

When big holders don’t take profits after gains, that’s usually a tell. A tell that they’re expecting much, much more upside. And when accumulation happens on rising volume, that’s often the start of something bigger—not the end.

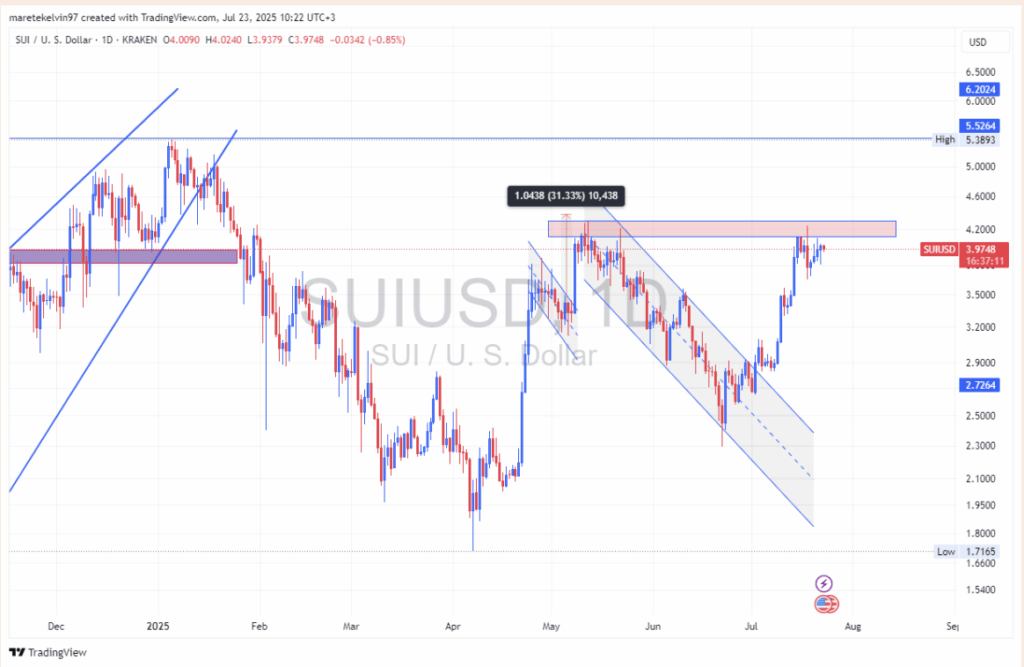

All Eyes on the Final Wall

Technically speaking, SUI’s pushing up against its last real supply wall at $4.22. If it breaks that? There’s not much standing in the way of a retest of its January ATH of $5.39.

Momentum’s there. Volume’s building. And structurally, the chart’s setting up in a pretty clean, bullish fashion. All that’s left now is confirmation—whether the market’s got enough juice to push through and flip resistance into fresh support.