- Massive Stablecoin Inflows: SUI saw the highest stablecoin inflows across all chains in 24 hours — $6.1M — signaling a spike in investor interest and potential buying power waiting on the sidelines.

- Open Interest Jumps 30%: Derivatives market is heating up for SUI, with open interest hitting $785M. The combo of inflows + rising OI points to bullish traders betting on a breakout.

- Cup & Handle Pattern Forms: A bullish chart pattern is developing, with $2.23 acting as the breakout level. If that flips, price could target $2.80 — but confirmation is key before calling it a move.

Sui (SUI) just made a bold move on the blockchain stage — pulling in the largest stablecoin inflows of any network over the last 24 hours. With a net increase of $6.1 million, it stood out while other chains like Ethereum, Solana, and BNB Chain watched capital pour out. That kind of shift? It usually doesn’t go unnoticed.

This kind of fresh liquidity (aka “dry powder”) landing on SUI could be signaling something bigger. When stablecoins flood into a network, it often means buyers are getting ready to make a move — and usually, that means upside pressure on price.

Open Interest Spikes — What Are Traders Betting On?

Open interest on SUI shot up over 30%, landing at a hefty $785.35 million. That’s a big leap. And it didn’t happen in isolation. The bump in open interest alongside stablecoin inflows? That’s usually a bullish combo.

Open interest shows how much money is locked in futures — and when it climbs like this, it’s typically a sign that traders are placing serious bets. Whether they’re hedging or speculating, the momentum’s building. If the stars align, this could be SUI gearing up for a decisive move.

Cup and Handle Pattern Forms — But Resistance Still Stands

Looking at the daily chart, SUI’s price action has been forming what’s known as a cup and handle pattern — a classic bullish setup. As of now, SUI’s trading around $2.16, after rallying nearly 13% in a day.

The “handle” part is shaping up inside a descending wedge, and the breakout line is sitting near $2.23. If bulls can finally close a strong candle above that level, the next big target floats around $2.80. For now, though, it’s all about that breakout confirmation.

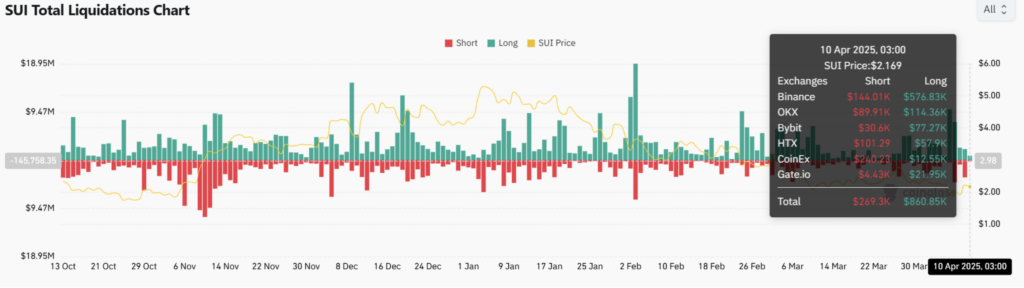

Liquidations + Funding: Bulls Still in the Game?

Over the past 24 hours, long liquidations hit $860k, compared to only $269k in shorts. That shows some overconfident bulls got wiped — but hey, sometimes that kind of shakeout clears the path for a cleaner rally. It’s like hitting reset on leverage.

Also worth noting — funding rates flipped slightly positive, clocking in at 0.0087%. When traders are paying to stay long, that’s usually a sign they still believe upside is coming. If both funding and inflows hold strong, we could be in for another leg higher.

Final Take: Setup Looks Strong, But Patience Matters

All signs are pointing toward a potential breakout — strong inflows, rising open interest, a bullish pattern, and improving funding data. Still, let’s not get ahead of ourselves.

$2.23 remains the key level to watch. A solid breakout and close above that, and this thing could start running. Until then? It’s all about watching and waiting. But yeah, SUI’s looking like one of the more interesting plays on the table right now.