- SUI trades at $3.45, showing modest gains, but network growth is lopsided—smaller DEXs booming while Cetus stagnates.

- Price action is under pressure, with $3.50 acting as the key level to watch before either a recovery or deeper pullback.

- Derivatives markets remain mixed, with falling volume but rising open interest, hinting at indecision among traders.

Sui managed to post some modest gains today, though a deeper look at its network activity tells a more complicated story. While a handful of smaller decentralized exchanges (DEXs) on the chain are seeing wild growth, the network’s biggest player has been more or less standing still.

At the time of writing, SUI trades at $3.45, with 24-hour trading volume hitting $2.24 billion and a market cap of about $8.06 billion. That’s a 3.25% bump in the last day, but the signals coming in from both technicals and on-chain data suggest things aren’t as straightforward as the price chart shows.

On-Chain Growth Split Between Big and Small Players

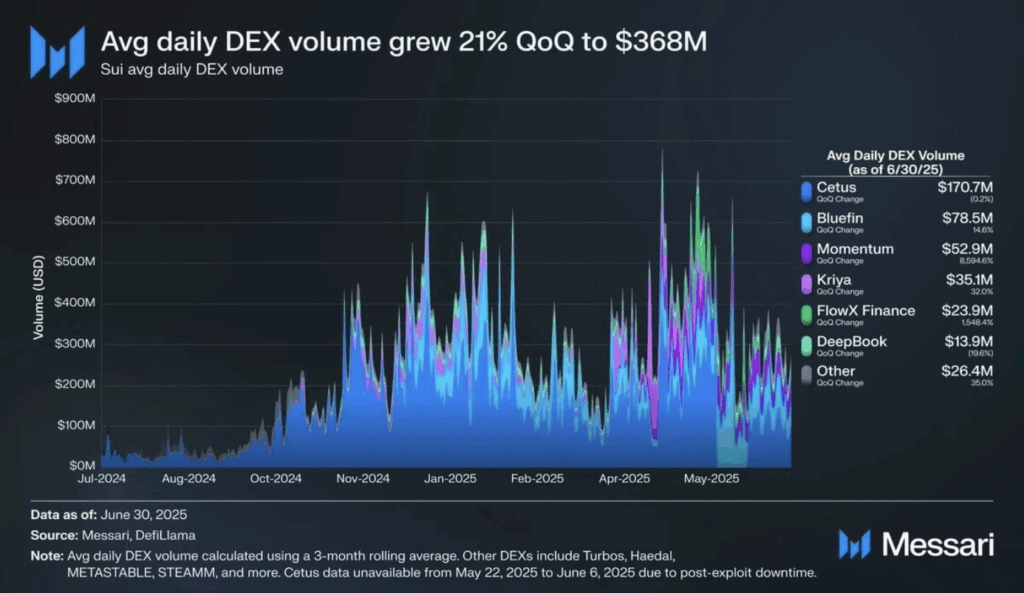

Messari’s data highlights how Sui’s DEX activity has grown 21% quarter-over-quarter, reaching an average daily volume of $368 million. But this growth hasn’t been spread evenly.

Smaller protocols have seen their numbers absolutely explode—Momentum, for example, jumped an insane 8,594%, while FlowX Finance climbed more than 1,500%. In contrast, Cetus, the dominant DEX on the network, barely moved at all, sitting flat with about $170.7 million in daily activity.

The trend seems to show that while new platforms are drawing in curious users, the biggest DEX is consolidating its spot, almost acting like an anchor on the network’s activity.

Technical Pressure Still Lingers

From a trading standpoint, SUI is in a delicate position. The token slipped under its 50-day moving average at $3.69and even dropped below the $3.46 pivot point, signaling caution. The MACD histogram at -0.0293 is still flashing bearish vibes, hinting that downside momentum hasn’t quite faded.

For now, analysts are watching $3.50 as a key short-term level. Reclaiming it convincingly could push SUI back into the $3.70–$4.00 zone, while continued weakness would likely test lower supports around $3.20.

Derivatives Market Sends Mixed Signals

The derivatives side of SUI also paints a split picture. Volume fell 14% to $5.21B, but at the same time, open interest rose 3.66% to $1.88B. That combo usually signals that traders are cooling off on activity while still keeping capital locked in—basically a “wait and see” mode.

Funding rates hover around 0.0089%, suggesting longs still slightly outnumber shorts, though not by much. Overall, the derivatives market feels balanced, with no one side betting too heavily in either direction.