- SUI dropped 7.5% to $3.77, with volume down 26% and bearish sentiment rising after failing to hold $4.20 resistance.

- Traders are heavily shorting, with a long/short ratio of 0.87 and major liquidations stacked near $3.67 and $3.88.

- Despite the dip, over $50M in SUI left exchanges, hinting at quiet accumulation and long-term optimism.

After pumping nearly 34% in just a month, Sui (SUI) might finally be losing a bit of steam. The memecoin-turned-layer-1 darling had a solid breakout past the $4.20 level recently—but now, things are looking… a little shaky.

SUI’s bullish momentum hit the brakes hard. A dip below support has traders wondering—was that it, or is this just a breather before another push higher?

Momentum Stalls, Traders Back Off

At the moment (yep, press time), SUI is floating around $3.77. That’s after a 7.5% drop in the last 24 hours—kinda rough, not gonna lie.

Even more telling? Trading volume has dropped off a cliff—down 26% in the same span. That kind of drop usually screams profit-taking, and honestly, after that 34% pump, who can blame ’em?

It also looks like some capital might be rotating out of SUI into other ecosystem plays like XRP or even AVAX. Gotta chase the next hype wave, right?

Price Action: Danger or Detour?

According to charts from AMBCrypto, SUI’s recent price pattern broke down after struggling to stay steady above $4.20. That was a big resistance zone—and it just didn’t stick.

If the bearish vibes keep rolling, a 10% drop could be on the table. That puts $3.40 as the next major support to watch. And if bulls want to regain control? They need to reclaim $4.20 and close above it. No fakeouts. No wicks. Just a clean, strong daily close.

The RSI is another clue here—it’s cooled down to 61, slipping out of the overbought zone. That doesn’t scream bearish, but it does point toward some sideways chop or a minor pullback.

Traders Betting Short, But Accumulators Aren’t Sleeping

Coinglass data shows the bears are definitely stepping in. The long/short ratio sits at 0.87, which means more folks are stacking short positions expecting further downside.

Big liquidation zones are forming too—$3.67 is key on the low end, and $3.88 above. There’s about $14.4M in long liquidations and over $20M in shorts sitting around those marks. In other words, the next price move might not be quiet.

But here’s where things get interesting…

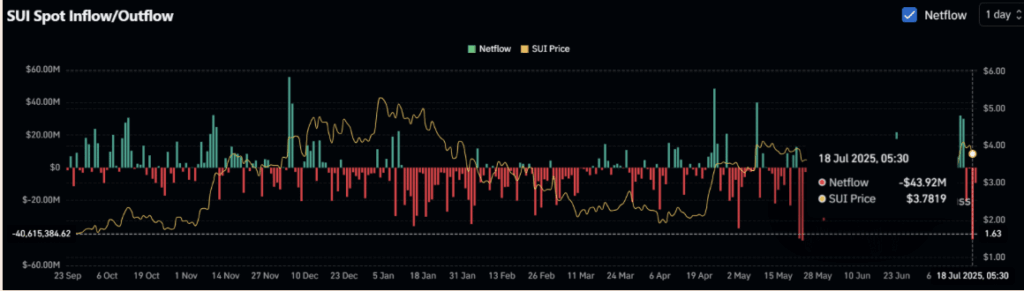

Even as short-term traders hit the brakes, long-term holders seem to be buying the dip. Coinglass shows nearly $50M worth of SUI has left exchanges lately—usually a bullish signal. That sort of movement suggests smart money is accumulating while everyone else panics.